Nationwide overview

Strong overall take-up for the UK with varied regional picture

Strong overall take-up for the UK with varied regional picture

2019 so far has been dominated by talk of Brexit, stockpiling, preparations for no deal and much mainstream media attention discussing the availability of warehouse space to assist with these potential outcomes.

Savills has been consistent in the view that Brexit has had limited impact thus far on the demand for warehouse space and far more important drivers are around the structural changes in retailing, the growth of the online retail sector and how UK manufacturing supply chains respond in the long term to leaving the EU.

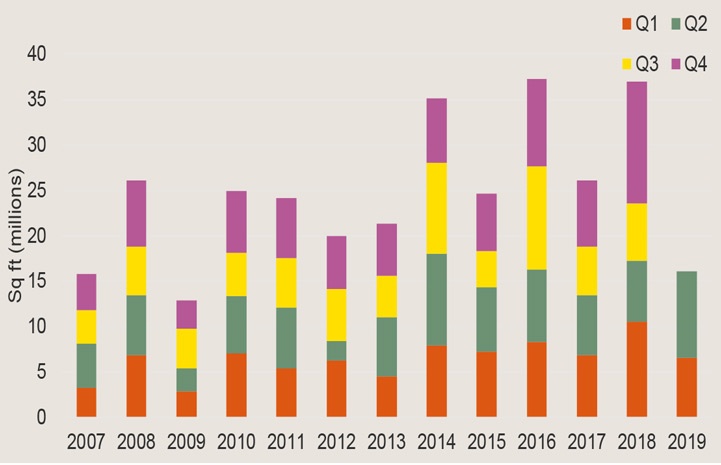

With that in mind it is pleasing to report that UK take-up for the half year has reached 16.07m sq ft, 28% up on the long term average for the first half of a year. Moreover the second quarter in isolation was outstanding with 9.55m sq ft transacted, making it the highest level of Q2 take-up since 2014 and the second best Q2 on record.

Perhaps most encouraging is that fact that take-up is not dominated by one occupier or indeed one sector. This demonstrates that demand is coming from a wide mix of tenants all reacting to wider economic and structural factors to get their supply chains in good order. We expect this pattern to continue for the rest of 2019 and anticipate take-up to breach the 30m sq ft mark.

Mountpark Bardon where VF Corporation have leased 578,000 sq ft

Take-up

Whilst take-up at a national level appears very positive regional market dynamics vary considerably.

Yorkshire and the North East lead the pack with 4.09m sq ft of space transacted almost beating already its annual average of 4.31m sq ft. The North West on the other hand has seen take-up fall by 38% to just over 1m sq ft.

Deal count is also strong with 71 transactions recorded up from 59 in the corresponding period for last year.

Take-up on course to pass 30m sq ft by year end

Source: Savills Research

Supply and Pipeline

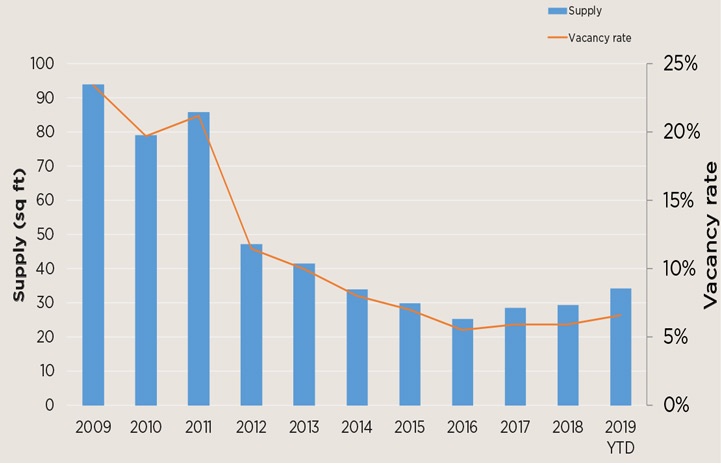

Nationwide supply has risen in 2019 and now stands at 34.14m sq ft, reflecting a vacancy rate of just 6.62%. Of the current supply on the market 56% is classified as Grade A, up from 35% in Q1 2015.

We expect this balance to alter further in favour of Grade A units in 2019 as we track the speculative development market. Currently there are 34 units under construction totalling 7.15m sq ft.

Supply and vacancy continued slight up-tick

Source: Savills Research

Read the articles within Big Shed Briefing below.

10 article(s) in this publication