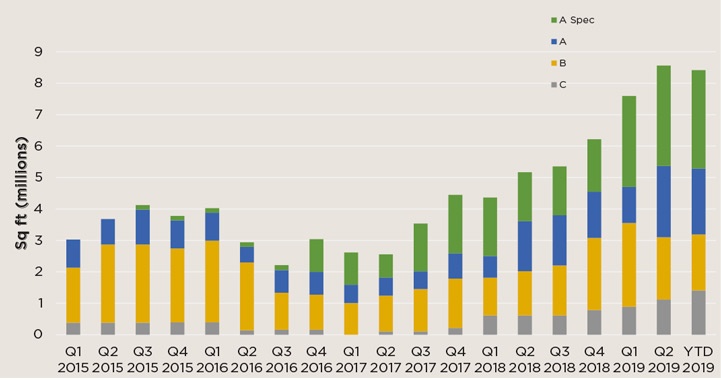

Supply in the West Midlands is still less than 2017 levels despite a recent rise

.jpg)

Wolverhampton 450, the largest Grade A unit on the market

Understandably Brexit has dampened demand in certain sectors such manufacturing but others remain active and we expect a pick up once the uncertainty is lifted

Ranjit Gill, Director, Industrial Birmingham

Supply

Supply within the region currently stands at 8.53m sq ft, falling 1.7% from the peak in Q1 2019. Of the vacant space on the market 37% is considered to be of Grade B & C quality which given the fact take-up is dominated by Grade A units could suggest this stock is not suitable for modern requirements.

The high levels of take-up and occupier demand seen in recent years has stimulated speculative development, since the beginning of 2018 2.44m sq ft of speculatively developed warehouse space has been added to the West Midlands. However, despite the recent rise in supply in the region, using the five-year rolling average yearly take-up there is just 1.6 years left of supply within the market.

Supply first fall in six quarters

Source: Savills Research

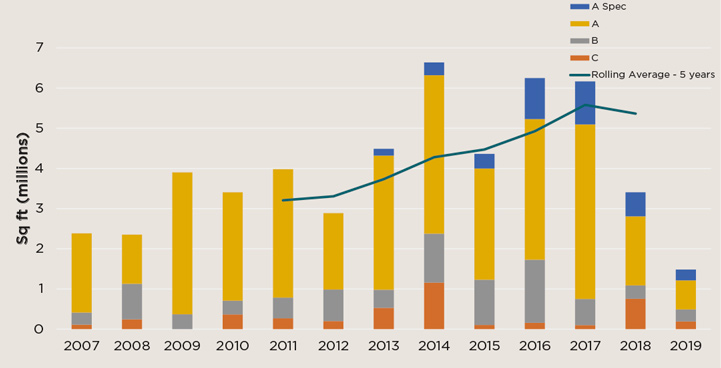

Take-up

Take-up in H1 2019 reached 1.48m sq ft through eight transactions, representing a 6% decrease on H1 2018. There has been a slight decline in larger requirements within the region which is unsurprising given the ongoing economic and political uncertainty. However, the smaller size bands continue to attract occupier interest with 63% of all space leased in H1 being within the 100,000–200,000 sq ft size band. Grade A quality space continues to see the strongest demand with 67% of all space leased in H1 2019 being of Grade A quality.

Whilst take-up in H1 2019 has been subdued, Savills are aware of multiple deals in the pipeline over 250,000 sq ft which should complete in H2 2019. More specifically, there is 485,000 sq ft currently under offer set to exchange in Q3 2019. Furthermore, with strong demand from developers, investors and occupiers land values in the West Midlands continue to rise which will further impact rental growth in the region.

Take-up balanced across all grades

Source: Savills Research

Development pipeline

Nine units are currently under construction within the West Midlands totalling 1.71m sq ft. The largest unit currently under construction is the recently announced Fradley 432 where Evans Property Group are speculatively developing 431,500 sq ft set to reach practical completion Q1 2020.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)