Take-up in the region has been dominated by Grade A units

Altitude where Gazeley have leased 574,000 sq ft to Amazon

Strong take-up of the speculatively built space reduces the vacancy rate to 3.8%

Toby Green, Director, Head of London and South East

Supply

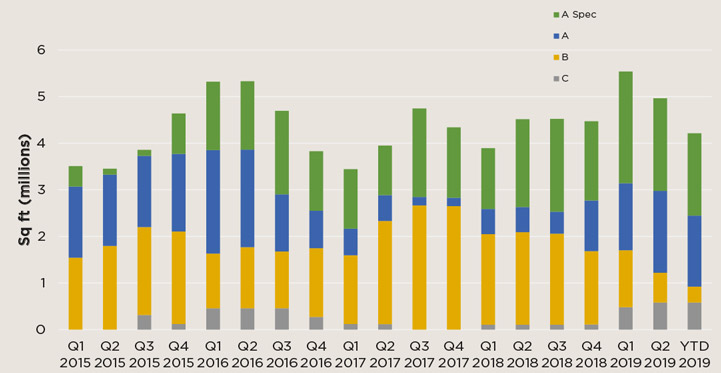

H1 2019 has seen strong transactional activity which reduced supply to 4.2m sq ft across 24 separate units, a 24% fall since the peak of 5.5m sq ft at 2018 year end.

The quality balance of the supply continues to shift as speculatively developed units come to market. Grade A stock now makes up 78% of all space available, of which 53% has been speculatively developed, together totalling 3.29m sq ft across 17 units. H1 2018 saw just 54% of all space available being Grade A quality. The supply in the region continues to be dominated by smaller units with 79% of available units being within the 100,000–200,000 sq ft size category.

Supply Grade A accounts for 73%

Source: Savills Research

Take-up

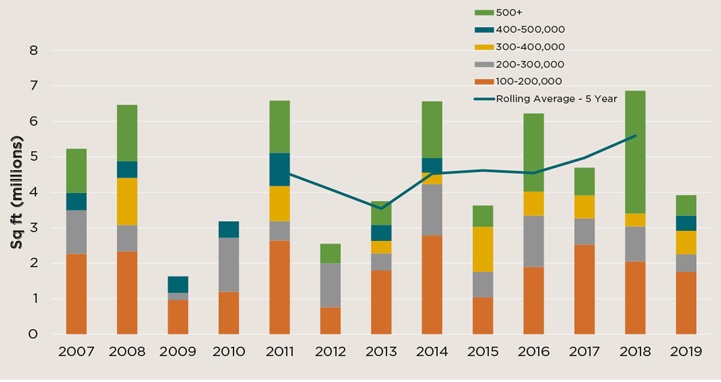

Take-up in the London and the South East totalled 3.92m sq ft for H1, a 60% increase above the long term H1 average for the region and just 4% below H1 2018. The largest unit let in H1 2019 within the region was Altitude at Milton Keynes totalling 574,000 sq ft. However, deal volumes in H1 have centred around the smaller size bands with the average deal size falling 24% from 2018 to stand at 217,659 sq ft. The fall in average deal size is due to the absence of large freehold land deals like those seen in 2018 to Aldi, B&M and Lidl.

There is continued occupier demand for Grade A space in the region with 43% of space let in H1 2019 involving speculatively developed warehouse space and 36% being build-to-suit space.

Take-up rolling average reaches new high

Source: Savills Research

Development pipeline

There are 10 units under construction totalling 1.96m sq ft, only one of which is being developed within the inner M25, two of these units Savills are aware are currently under offer. The largest unit due for delivery in 2019 is Bedford 405 where Goodman are speculatively developing 405,000 sq ft, set to reach practical completion in Q3 2019.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)