Grade A supply to drive take-up forward in the South West market

Panattoni Park Swindon where a unit over 500,000 sq ft will be brought forward speculatively

We expect the future delivery and availability of Grade A space will drive take-up in the second half of the year

Rob Cleeves, Director, Industrial & Logistics Bristol

Supply

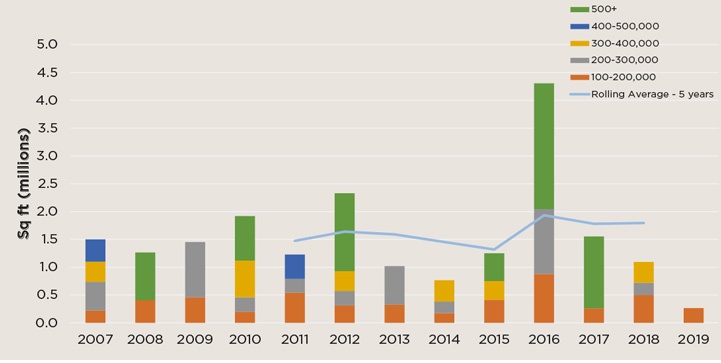

In recent years supply levels have hovered at around 2m sq ft and have recently dropped to stand at 1.95m sq ft representing a 4% decrease from 2018 year end.

Current supply in the South West is skewed towards smaller size units with no vacant units above 400,000 sq ft. As speculatively developed units have come to the market the proportion of Grade A stock has increased to stand at 52%. The largest unit on the market is the Former Morrison’s at Cribbs Causeway Distribution Centre totalling 384,786 sq ft. Currently, there are just two Grade A speculatively developed units on the market equating to 22% of the total supply, the rest is considered second hand.

Supply slight fall on 2019 levels

Source: Savills Research

Take-up

Following strong years of take-up, transactional activity in H1 2019 has fallen to the lowest levels ever recorded in the region by Savills. Take-up reached 266,173 sq ft through two separate deals, representing a 29% fall from H1 2018 and a 76% decrease below the long-term H1 average. Interestingly, second hand space accounted for 56% of the total space transacted with 44% being built-to-suit space.

Despite the fall in take-up, given the five-year yearly average take-up of 1.8m sq ft and the current supply there is still just 1.09 years of supply left in the South West market. The largest deal of H1 2019 was Oak Furniture Land acquiring 149,173 sq ft at Groundwell Distribution Centre in Swindon.

Take-up lack of large deals sees take-up fall

Source: Savills Research

Development pipeline

There is a total of 249,315 sq ft being speculatively developed in the region across three separate units. The largest unit being Junction One where Barwood Capital are speculatively developing 137,315 sq ft, set to reach practical completion in Q3 2019.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)