Where will future rental growth come from?

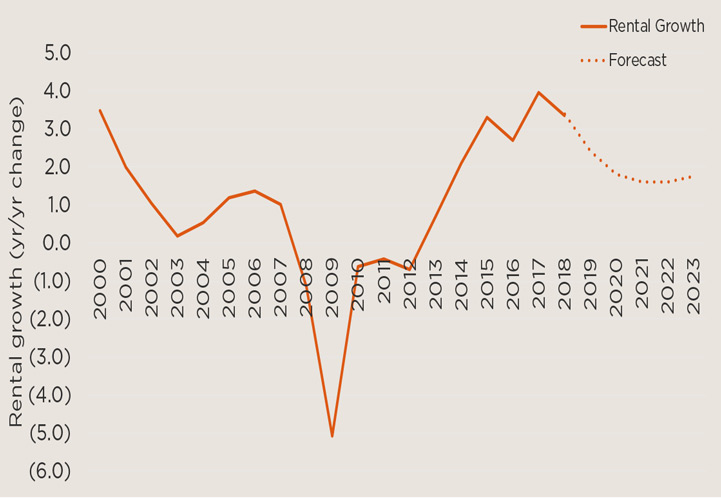

MSCI shows that over the last five years rents have increased for distribution warehouses by 3.9% p.a on average. Whilst take-up remains strong there has been a supply response with speculative development increasing. And with 56% of vacant supply being classified as grade A it is only natural that pressure will be applied to rental growth levels. Indeed market forecast house Realfor are suggesting rental growth will be a more subdued 1.8% p.a until 2023.

Data from MSCI going back to the year 2000 for the wider industrial market shows rents have never increased once vacancy rates have passed 12% and with some markets now hovering around 10% vacancy and set to rise further granular sub market analysis will be key to identifying which markets and indeed size ranges will continue to enjoy strong rental growth.

Rental Growth national average masks sub-markets

Source: MSCI/Realfor

Build cost and programme

The latest indicators from the Savills ProgrammE and Cost Sentiment Survey (S.P.E.C.S) demonstrate that build costs and programme delivery time scales have remained largely static for the first half of 2019.

Continued geopolitical uncertainty does however have the potential to impact two of the key elements of build costs and programme length; the price and availability of steel and the availability of skilled labour.

Continued uncertainty around Brexit will keep overseas contractors away from the UK meaning that existing UK contractors and the supply chain will be working near capacity. If BTS take-up and speculative development continue at the levels they are it is not unreasonable to see upward pressures on costs into 2020 and beyond.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)