There is continued strong demand for build-to-suit units

Prologis RFI DIRFT where Prologis are speculatively developing 535,000 sq ft

Increased levels of take-up leave just eight months worth of supply in the market. Take-up for H1 19 is already 53% above the long term average with more deals in the pipeline

Charles Spicer, Director , Industrial & Logistics Birmingham

Supply

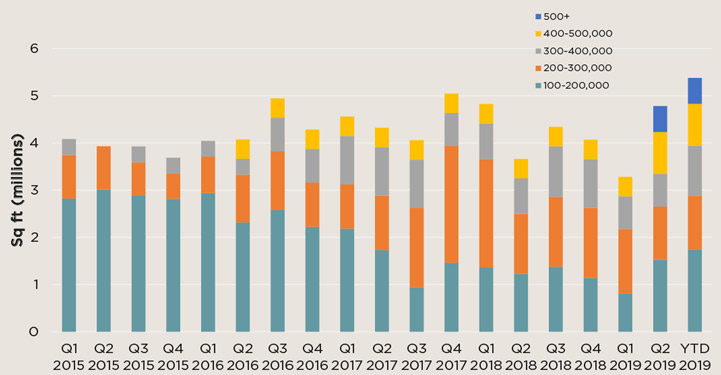

An increase in speculative development completions, paired with large units returning to the market has led current supply to total 5.37m sq ft representing a rise of 64% from 2018 yet still maintains a low vacancy rate of 5.4%. The proportion of supply has altered dramatically, 2015 saw 19.44% of space available on the market classified as Grade A yet recent speculative development has shifted the proportion of Grade A units to 57.80%.

Using the five-year average of Grade A take-up in the market there is just 0.68 years left of Grade A quality supply within the region. The largest available unit on the market is Nottingham 550 having reached practical completion in March 2019 totalling 550,000 sq ft, speculatively developed by Panattoni. The current supply is skewed towards smaller sized units with 75% being below 300,000 sq ft, of these units just 33% are of Grade A speculatively developed quality.

Supply speculative development increases supply

Source: Savills Research

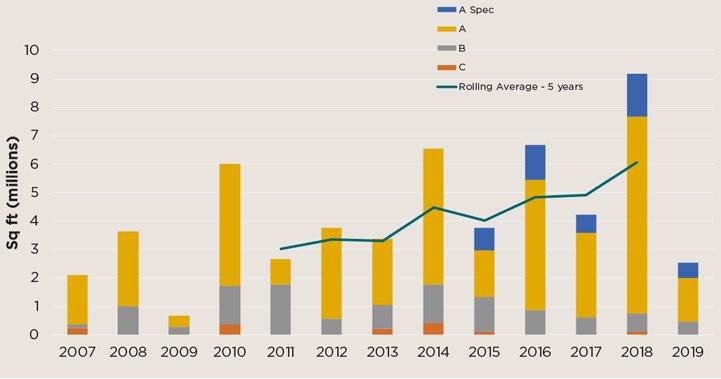

Take-up

Take-up in H1 2019 has reached 3.02m sq ft, 53% above the H1 long-term average take-up evidencing continued strength in the East Midlands market. Interestingly, H1 2019 has seen 85% of space transacted involve Grade A quality units with Grade B space accounting for the other 15%, it seems occupier demand in the region revolves around better quality units.

Build-to-suit transactions continue to dominate the market with the largest deal being at Mountpark Bardon where VF Corporation has leased 578,620 sq ft.

Take-up dominated by Grade A units

Source: Savills Research

Development pipeline

There are currently eight units under construction which total 2.34m sq ft, adhering to the regional trends these are primarily located in Northamptonshire where five units are being developed. The largest unit is DIRFT in Daventry where Prologis are developing 535,000 sq ft which is due to reach practical completion in Q4 2019.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)