A volatile year is expected for the North West's industrial and logistics market

525 Haydock where Bericote have delivered 523,500 sq ft

A subdued start to the year with take-up expected to pick up in second half

Jon Atherton, Director, Industrial & Logistics North West

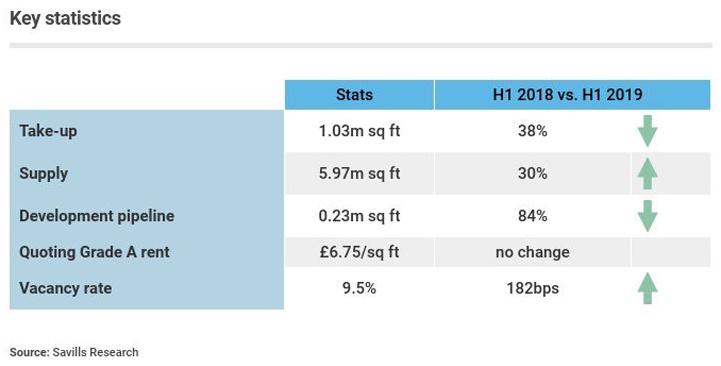

Supply

The region continues to have the second largest amount of supply within the UK, currently sitting at 7.26 million sq ft across 38 units, representing a 22% rise from 2018.

The grade balance of the available stock has shifted as Grade A speculatively developed space reaches practical completion, grade A stock now accounts for 52% of all available space up from 42% in 2018. However, despite the increase in the proportion of Grade A quality space, through using the five-year average take-up of Grade A space in the region there is just 1.45 years left of supply in the North West.

There are just five units in the region over 300,000 sq ft, of which just two are of Grade A speculatively developed quality which have both reached practical completion in the last six months.

Supply Grade A supply continues to increase

Source: Savills Research

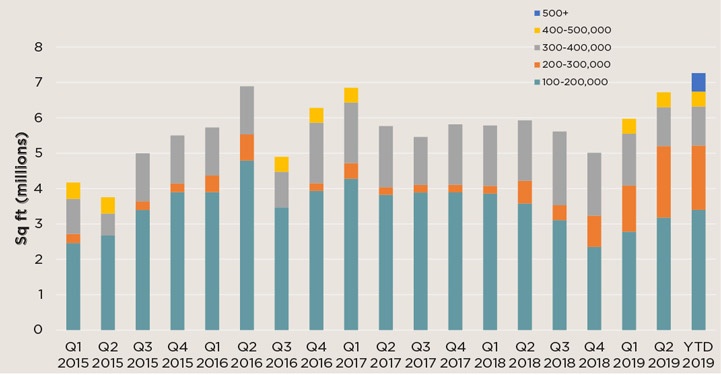

Take-up

Following the record year seen in 2018, transactional activity for H1 2019 has been relatively subdued reaching 1.03m sq ft through six transactions representing a 39% decrease below the long term H1 average.

The largest deal of the year so far has been Kammac acquiring 365,000 sq ft at M58 Skelmersdale. Additionally, Savills are aware of four units currently under offer in the region due to complete next quarter totalling 1.02m sq ft and highlighting continued occupier demand in the region.

Take-up dominated by second hand units

Source: Savills Research

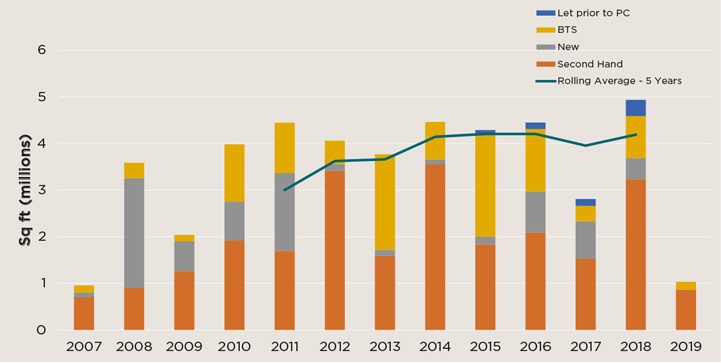

Development pipeline

There are currently just two units being developed totalling 232,210 sq ft. The largest being Unit B at Aviator Business Park totalling 125,000 sq ft. This limited development pipeline could see average rents increase as continued demand limits the supply of smaller good quality units.

Read the articles within Big Shed Briefing below.

.jpg)

.jpg)