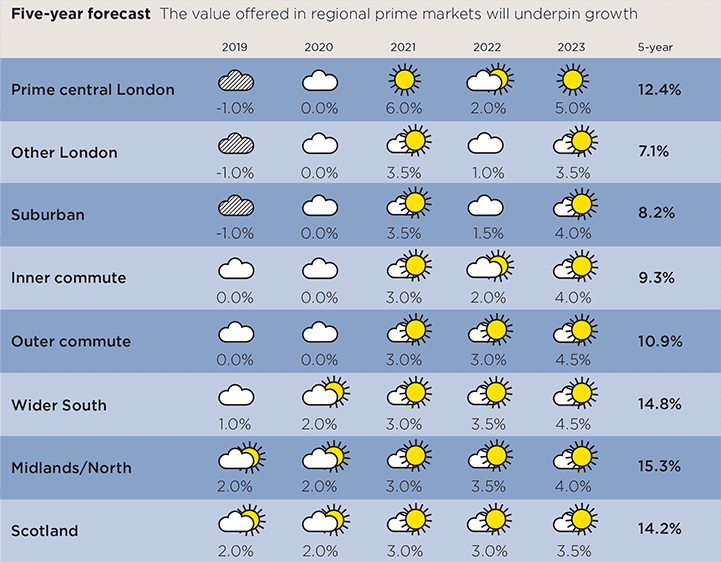

The regional prime markets will underpin growth in the short term before clarity over the UK’s position post-Brexit feeds consumer confidence

Even in periods of relative political and economic certainty, forecasting is a difficult exercise. Given the current climate, it is essential to understand the assumptions on which our forecasts have been based.

2019 A deal to leave the EU is struck within the extension period, which brings an improvement in sentiment in the latter part of the year. This partially offsets the muted market conditions through the spring market.

2020 During the transition, uncertainty over the precise impact of an agreed deal continues to hold back activity among discretionary buyers and sellers, as the complexity of the remaining negotiations becomes apparent. The market continues to be price sensitive, although Scotland and the North have the best of the market conditions.

2021 There is a return to more widespread house price growth as greater clarity emerges over the UK’s position post-Brexit. This feeds into improved consumer confidence. Price growth is strongest in central London, given the value on offer to overseas buyers who are now prepared to exploit a currency advantage.

2022 A general election interrupts the recovery. In the absence of evidence to the contrary, post-election forecasts are based on the assumption that there continues to be a minority Conservative government.

2023 A return to more normal market conditions supported by underlying economic drivers, including wealth creation and costs of borrowing.

Source: Savills Research | Note: These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)