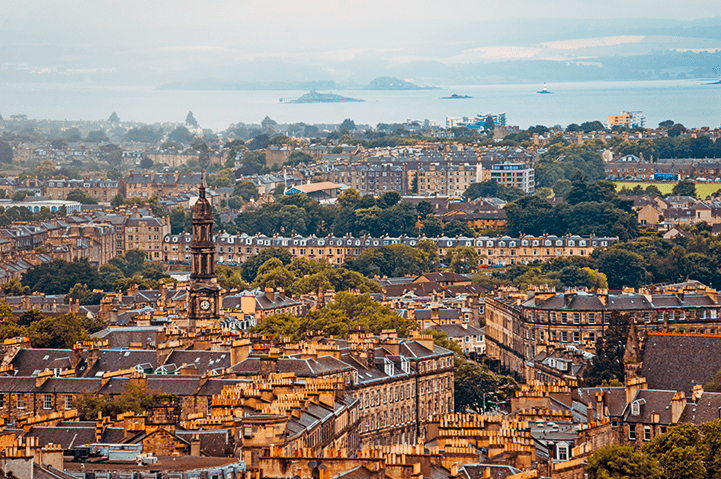

While prime residential property markets slow in other regions of the UK, Scotland is bucking the trend with positive price growth

Having experienced its own referendum and taxation challenges, Scotland’s residential property market appears unaffected by the political uncertainty impacting London and the South East.

The official UK House Price Index for Scotland has shown positive annual growth for 34 consecutive months, while annual price growth of 2.3% in the prime market was the highest of any UK region. Last year, the prime market above £400,000 recorded its highest-ever number of transactions, and the £1 million-plus market its highest since 2008.

.png)

Edinburgh accounts for a third of Scotland’s prime market activity

Urban attraction

The Scottish market is structured across three main city hubs – Edinburgh, Glasgow and Aberdeen – with the remainder comprising commuter and country locations. Edinburgh remains the jewel in Scotland’s crown, making up 34% of prime and 61% of £1 million-plus activity. At 7.4%, annual price growth in the capital’s prime market at the beginning of this year was the highest of anywhere in the country. A recovery in prime supply has enabled growth in transactions. Despite an increase in the number of sellers, there remains a surplus of motivated buyers.

In the west, housing supply remains intermittent across Glasgow, despite growing demand. Current availability is 8% lower than last year, which explains the lack of movement in transaction numbers between 2017 and 2018. Meanwhile, the Savills Prime Regional Index for the city area of Glasgow showed an annual increase in values of 3.5% at the beginning of this year. As we enter summer, we anticipate more stock coming on to the market, but a significant spike in registered buyers and viewing activity will continue to put upward pressure on values.

In the north east, Aberdeen’s oil- and gas-dependent economy is beginning to stabilise, which is being reflected in the local residential property market. Residential activity recovered during the second half of 2018, led by the prime market. Average prices have continued to remain steady in recent months.

Despite stock levels reducing recently, the number of homes for sale in Aberdeen remains high, which is a key barrier to the city’s long-term market recovery. House prices in the area ended 2018 approximately 4% lower than 2017. We expect price drops to ease in 2019, subject to a further reduction in stock, which will enable a recovery from 2020.

Country life

Outside the three city hubs, Scotland’s prime country market continues to grow, thanks to realistic pricing and good value compared with urban properties. Scotland’s heartland of Fife, Perthshire and Stirlingshire is now the third-largest prime market outside Edinburgh and Glasgow. Argyll and Bute was the top-performing country location in 2018 in terms of prime transactional growth, attracting lifestyle buyers, many of whom came from outside Scotland.

In the south of the country, improved activity in Peebles and Melrose boosted the prime market in the Scottish Borders.

Increased prosperity in Dundee has led to prime growth in Angus. Meanwhile, Dumfries and Galloway was one of a few parts of Scotland that witnessed a rise in transactions during 2018 as a whole.

Looking ahead, we expect a more considered prime market in 2019, driven by realistic pricing. Despite the wider uncertainty, Scotland still has room for growth, particularly in popular, well-connected neighbourhoods. In many of these markets, supply falls well short of demand, so competition will drive up values.

Five stars of the Scottish property market

Standout performers and ones to watch

1. Strong foundations

The housing markets in Edinburgh and Glasgow are underpinned by strong economies. Edinburgh’s economy has grown more over the past five years than most UK cities, with a large proportion of workers in highly-skilled occupations. Glasgow’s economy is being bolstered by a young and growing population, and business growth in high-tech and service sectors.

2. Edinburgh’s inner suburbs

Ravelston was Edinburgh’s standout inner suburb in 2018, with an annual increase in prime transactions of 44%. Other star performers in the Scottish capital are The Grange, Morningside and Merchiston areas, south of the city centre, where a record level of prime activity took place in 2018.

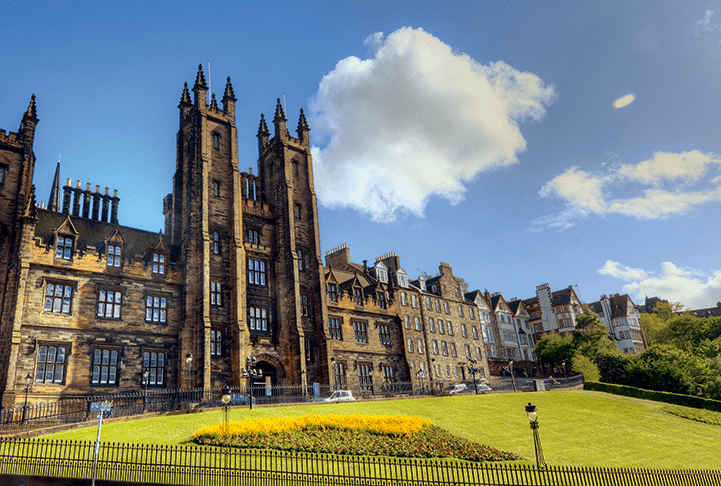

3. University challenge

Despite recent growth, prime values in Edinburgh are only 4% above the 2008 peak. In Glasgow, values are 6% below the peak. In comparison, values in Cambridge are currently 43% higher than the peak of the market. This suggests there is room for further growth in Edinburgh and Glasgow’s markets, given the value gap compared with other university cities.

4. The £1 million market

With 128 of a total 211 transactions in 2018, Edinburgh dominates Scotland’s £1 million market. Interestingly, only 26 of the 211 transactions can be classified as country houses. With an average of 64 acres per country house, privacy is one of the main drivers of demand, especially for buyers from outside Scotland.

5. Small town, big name

Over the past 10 years, the small seaside town of St Andrews has established itself as the most expensive location for homes in Scotland. While prices per square foot in Edinburgh are close to £800, 18 transactions in St Andrews exceeded this level in recent years, including 12 at £1,000 per sq ft and above.

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)