As the prime London market shows signs of stabilising, new areas of value are emerging while traditional enclaves retain their premiums

During the first quarter of 2019, the prime London market recorded its 14th consecutive quarter of price falls, albeit with a marginal drop of 0.3%. Over the past year, prices have fallen by 2.5%, the smallest annual fall since the EU referendum. This suggests the market is beginning to find its level, despite the ongoing uncertainty.

In prime central London, the 19th consecutive quarter of price falls signals the market’s longest-running downturn. Since the June 2014 peak, prices in the capital’s most expensive markets have fallen by 19.4%. For the £10 million-plus market, prices are down by 21.3%. This points to a different environment than that experienced in the early 1990s recession and the global financial crisis. Both saw greater price falls, but over a shorter period of time.

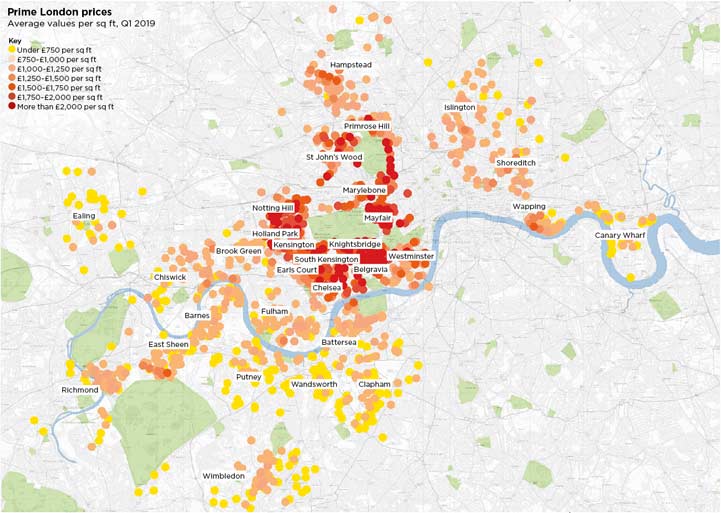

While previous downturns have predominantly had a single trigger, the combination of tax changes and Brexit has provided a significant opportunity for buyers. A US dollar buyer purchasing a £5 million property in central London in June 2014 would pay 38% less today. We’ve highlighted where, on a £ per sq ft basis, areas of value in prime London are becoming apparent.

Source: Savills Research

Areas of value

Across prime central London, the stalwarts of Mayfair and Knightsbridge still command the highest premiums. Here, the best properties average more than £2,000 per sq ft, with super-prime new-build schemes well in excess of this given their high quality and associated amenities. Make the short journey across Oxford Street into Marylebone, however, and the average value drops to £1,600 per sq ft. Although Marylebone has benefited from significant investment in placemaking over the past few years, this has yet to be reflected in the value of second-hand residential property.

The same goes for Westminster. Here, the average property is £1,400 per sq ft, compared with £2,100 per sq ft in Belgravia. Nearby Pimlico is £1,100 per sq ft. The regeneration around Victoria has transformed the area. It is now far more than just a destination for work, but the residential market still provides significant value for its central location.

Transport improvements are also likely to have an impact on values in Ealing with the arrival of the Elizabeth line. The average value of £670 per sq ft is 22% lower than the rest of the prime West London market.

In the prime South West market, Fulham hit its peak much earlier than other areas, influenced by mortgage restrictions in a market that had previously seen exceptionally strong growth. Prices have fallen by 15.4% since its peak in March 2014, leaving the average value at £880 per sq ft. This provides a stark contrast with neighbouring Chelsea, which averages £1,600 per sq ft.

Premium locations

It is apparent that people will still pay a large premium for certain locations. Regent’s Park commands a premium that is 24% above the average for prime North West London at £1,600 per sq ft. Yet the market around Primrose Hill offers value at £1,300 per sq ft. Likewise, a property on Hyde Park will cost 28% above the average for prime central London.

This is also reflected throughout the south-west corridor.

Properties close to Richmond Park have a premium of 11% above the average £ per sq ft for the region. And a property on the Thames throughout South West London will cost 15% above the average at more than £900 per sq ft.

There is also a clear link to town centres and retail, with properties commanding a higher price in hotspots such as Upper Street in Angel and Old Street in Shoreditch.

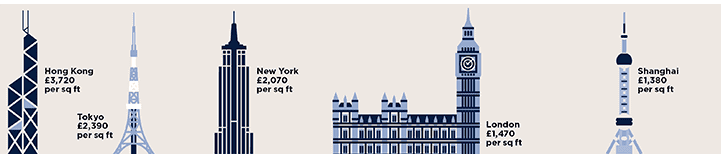

Global appeal

On a global scale, the difficulties London has faced again provide an opportunity for buyers looking at multiple markets around the world.

New York, London’s traditional competitor, has an average prime value 41% above London, at £2,070 per sq ft. And with New York’s mansion tax for $2 million-plus properties increasing incrementally from April this year, the relative cost of buying, holding and selling is higher as well.

But global wealth is changing, with new competitors emerging. Hong Kong now has the highest average £ per sq ft value at £3,720 per sq ft, 153% above London, with Tokyo 63% higher at £2,390 per sq ft.

Source: Savills Research

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)