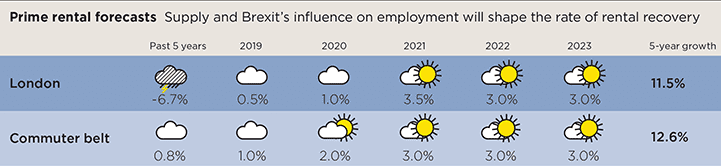

High levels of supply and Brexit’s influence on employment will shape rental recovery in London and its commuter belt over the next five years

The prime rental markets remain active, with demand continuing to be most robust for smaller properties. However, against a backdrop of Brexit uncertainty, the ongoing supply imbalance and changes to taxation have translated into lower rents and greater choice for tenants.

Landlords continue to face challenges. The 3% stamp duty surcharge for additional homes and cuts to tax relief for interest payments mean that mortgaged investors are re-evaluating their portfolios, whether de-leveraging or taking advantage of the current competitive lending market to remortgage.

These market drivers have resulted in the rental value of prime London property falling over the past year, although the rate of annual falls continues to slow. Over the past year to March 2019, rents fell by a further 0.9%, leaving values 7.1% lower than they were five years ago. For the commuter markets within an hour’s travel time into the capital, values fell by 1.3% during the past year. However, over the past five years, these areas have seen falls of 1.1%, much smaller than in the London market.

This five-year average masks variation by property size, with growth of 8.5% for properties of one or two bedrooms compared with larger family homes, of which stock levels have been higher, seeing falls of 6.3%.

Across both the prime rental markets of London and its commuter belt, there are three key trends.

.png)

Prime rental growth Over the past five years, commuter belt areas have seen smaller falls than in the London market. However, in London, the rate of annual falls continues to slow

Source: Savills Research

1. Location

Tenants have become increasingly footloose in their choice of location, prioritising the specification and price of the property over where it is.

In 2018, the main reason tenants across prime London were renting was due to lifestyle relocation, although this is only marginally above employment relocation at 38%.

However, the picture was very different five years ago. Then, tenants moving for employment relocation dominated the market (at 48%) while lifestyle relocation accounted for just under one-third.

This shift points to the changing profile of corporate tenants as the number of those people working in the finance sector contracts. During 2018/2019, one-third of tenants in London worked in financial and insurance activities, down from 36% in 2014 and 46% in 2008. At the same time, there has been a rise in the number of tenants working in tech industries.

In the commuter belt, properties in urban areas have seen stronger rental growth than those in rural locations over the past five years. This has been driven by demand from young professionals or families new to an area looking for easy access to local amenities such as shops, good schools and transport links to the capital.

2. Price

There continues to be high levels of supply across large sections of the market. This sits against rising new build completions in the capital, many of which will be offered on the rental market. As such, existing landlords of prime property will be competing for tenants. Increased choice means tenants are focused on finding value as they continue to be cost-conscious in this economic climate.

As a result, the prime rental market will remain price sensitive with a widening gap between landlord and tenant expectations in a number of locations. Realistic pricing, particularly at renewals or re-lets, is key.

3. Quality

The Penthouse, Mayfair, London

The prime rental markets continue to be driven by quality. Indeed, the standard of property is becoming more important than the location or prestige of a well-known address. Tenants prefer high-specification properties in immaculate condition, with the best new build properties setting the bar in terms of amenities, specification and connectivity.

To remain competitive, landlords are having to invest in the condition of their properties. In central London, the large landowning estates have continued their programme of stock upgrades and public-realm improvements to retain a rental premium and minimise voids.

This has presented further challenges for the private landlord, who often has a shorter-term investment horizon. Faced with potentially significant refurbishment costs and increased regulation, some have chosen to bring their property to the sales market.

Outlook

Supply and Brexit’s influence on employment will shape the rate of rental recovery over the next five years. The status of London as a global commercial centre and the resilience of its economy remains fundamental to the strength of rental demand across the market.

Assuming a no-deal Brexit is avoided, we are forecasting a gradual recovery in rental values across the prime London markets, with rents growing by 11.5% over the next five years. The amount of new build stock brought to the rental market is expected to peak over the next two years. This will likely limit rental growth, but provide more choice for tenants.

Across the prime commuter belt markets, we expect rents to rise by 12.6% over the next five years, marginally outperforming the prime London market. In the short term, rental growth will be curtailed by the continuing imbalance between demand and supply.

During a period of ongoing Brexit uncertainty, we expect stock to continue to be driven by accidental landlords who are unable to sell their homes, particularly at the top end of the market.

Across both markets, landlords will not only need to remain competitive on asking rent but also flexible on terms to ensure they attract tenants, minimise voids and benefit from the best returns.

Source: Savills Research | Note: These forecasts apply to average rents in the second-hand market. New build values may not move at the same rate

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)