Brexit, stamp duty, mortgage regulation. Our research team brings much-needed clarity to the key issues

Where are values now?

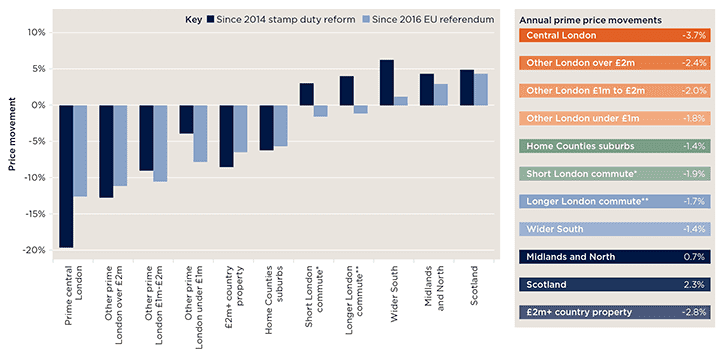

Frances Clacy Across London, prime property prices at the end of March were, on average, 2.5% below where they were a year ago. For a long time, we talked about the peak of the market being 2007. In the capital, we now refer to the peak as 2014. Since then, a combination of tax changes and political uncertainty have caused prime prices to fall by an average of 12%.

Outside of London, the picture varies by region and by type of property. Year-on-year, prices have fallen across the Wider South by an average of 1.4%, while across Scotland and the Midlands and North, they continued to rise slightly. Where they sit relative to 2014 or 2016 tends to reflect the extent to which they have been exposed to the weakness of the London market.

More expensive properties have tended to be the most price sensitive across the board, whether that is in central London, the £2 million-plus market elsewhere in the capital, the private estates of the Home Counties or the country house markets of rural England and Scotland.

Price movements in the prime market Where prices sit relative to 2014 or 2016 tends to reflect the extent to which they have been exposed to the weakness of the London market

Source: Savills Research | Note: *Within a 30-minute commute **Within a one-hour commute

Brexit or stamp duty – what’s having the biggest impact?

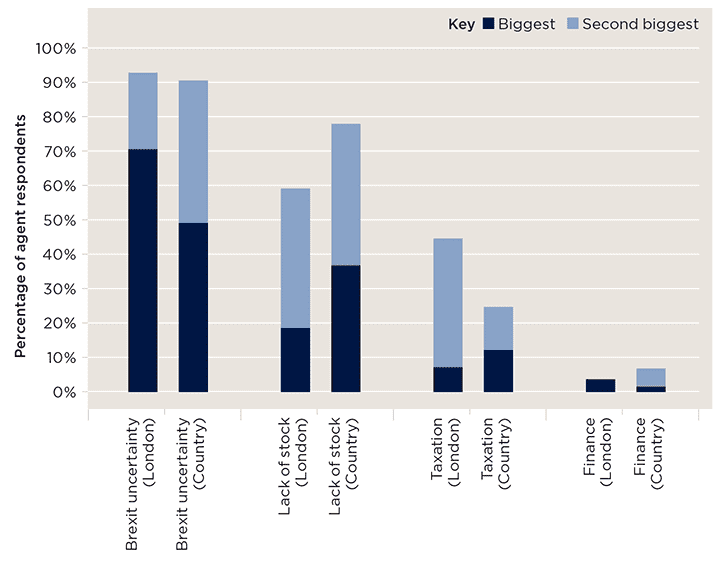

Lucian Cook In the first three months of 2019, we hit new heights of political uncertainty. Not surprisingly, concerns over Brexit were overwhelmingly regarded as the biggest constraint on the prime housing market.

While stamp duty continues to be an emotive issue among buyers, it was largely factored into prices before the EU referendum in mid-2016. And while stamp duty has made the market more sensitive to bouts of weak buyer sentiment, the bulk of the price adjustments in London and its surrounds have occurred since the electorate voted to leave the EU.

By contrast, the cost and availability of mortgage finance is much less of a constraint (below). With lenders limited in their ability to compete on loan-to- incomes and loan-to-values, it has meant interest rates remain highly competitive, with the average five-year fixed rate standing at just 2.04% at the end of April.

With lenders limited in their ability to compete on loan-to-incomes and loan-to-values, it has meant interest rates remain highly competitive, with the average five-year fixed rate standing at just 2.04% at the end of April.

Constraints on the market Concerns over Brexit are regarded as the biggest constraint on the prime housing market

Source: Savills Research

How has that impacted on buyer and seller behaviour?

Kirsty Bennison The uncertainty about what life outside of the EU will mean for the wealth-generating parts of the economy has made discretionary movers cautious about doing so. In turn, that has fed into a relative lack of stock being brought to the market.

In the country, agents report that price expectations between buyers and sellers have widened (below). The result is that chains are now more difficult to put together.

However, in London, we have seen price expectations of committed buyers and sellers brought closer together. In particular, there has been much more realism among sellers who have witnessed values adjust gradually over a period of almost five years.

In London, we have seen price expectations of committed buyers and sellers come closer together

Savills Research

.png)

Buyer and seller expectations In the country, price expectations have widened

Source: Savills Research

Because of the price falls in central London, do buyers think the market is now good value?

LC Prices in the prime central London market are almost 20% below their 2014 peak, with an even greater discount for those buying in other currencies. This has prompted a significant increase in new buyer registrations in all price brackets across prime central London. For properties worth more than £1 million, registrations were 36% higher in the first quarter of 2019 compared with a year earlier. That reflects a healthy latent pool of demand among those who are adopting a wait-and-see approach until the outcome of Brexit is clearer.

What about elsewhere in the UK?

KB The other prime markets have not seen the same level of price adjustment, so it isn’t surprising that they haven’t seen the same increase in buyer enquiries. In the market between £1 million and £2 million outside central London, they have increased by 26%, while beyond the capital the increase in enquiries below £1 million has been 20%.

Whether those indicators of demand fuel more activity largely depends on whether the political and economic outlook becomes more certain over the coming months.

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)