Good schools, a convenient commute and a quality environment are prime’s fundamental pull factors. However, they come at a premium

While housing has been dominated by Brexit, it’s easy to forget the fundamental reasons why buyers are drawn to the prime markets. Here are three…

1. Highly rated schools

For families, or those planning to start a family, the quality of local schools is often the most important factor when deciding where next to move. In the prime country markets, three-quarters of all buyers have children and half of them are upsizing. Indeed, many will pay over the odds to be within walking distance or the catchment area of the country’s highest-regarded schools.

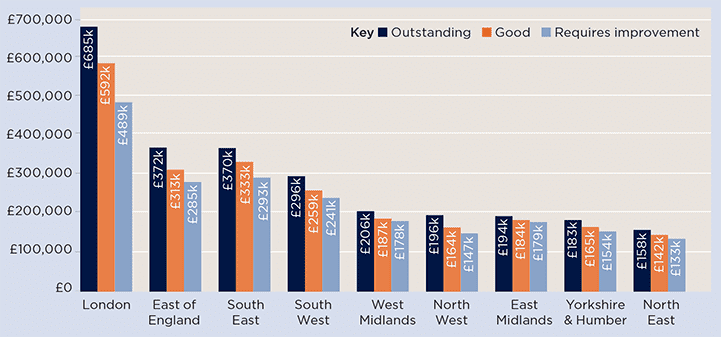

Across England, the average price of a home near a primary school rated ‘outstanding’ by Ofsted is 16%, or £37,000, higher than for one rated ‘good’. That premium rises to 29%, or £61,000, when compared with a home near a school rated as ‘inadequate’ or one that ‘requires improvement’. This price gap is most substantial in London and is at its smallest in the North East.

However, competition for school places is getting fiercer. This means parents need to be more savvy and look to areas with a high concentration of excellent schools, instead of pinning their hopes on just one.

Ofsted rates 19% of primary schools in England as outstanding, but this varies from 28% in London to only 15% in the East Midlands. Hotspots include East Dorset, which not only has the highest proportion of outstanding primary schools (60%), but also the advantage of containing no schools that are considered inadequate or require improvement. Kensington and Chelsea (54%), Epsom and Ewell (53%), and Traff ord (46%) also rank highly.

Property prices near primary schools Average second-hand sale prices for homes near Ofsted-rated primary schools in England

Source: Savills Research, Land Registry

2. Commuting convenience

More than three-quarters of buyers who are relocating from London into the prime suburbs and commuter belt are still working in the capital.

Before making the move, these buyers will generally have a clear idea of several things: how long they’re willing to travel for; the direction out of London they’re happy to move in; and how much they’re prepared to spend – on both housing and travel costs.

Unsurprisingly, the further from London and, therefore, the longer the journey time into the capital, the more affordable house prices are. However, this gap is closing. For commutes of up to 3o minutes, the average house price is £528,000. This represents a saving of £268,000 compared with inner London, down from £287,000 a year earlier. For a journey time of between 30 minutes and one hour, that saving is £351,000, compared with £377,000 previously.

Thanks to a weaker prime London market, the amount of equity generated in the capital has been constrained, so those relocating to the commuter zone may have less spending power. However, the relative value and lifestyle on offer will still drive buyers to make the move.

Of course, it’s also important to factor in the ever-rising costs of season tickets, which can be as high as £9,000 per year for commutes of more than one and a half hours. In most cases, the house price savings will offset these expenses.

.png)

Regional variation Travel costs versus house price savings in the commuter belt

Source: Savills Research using Land Registry and National Rail | Notes: *12 months to October 2018 **Average annual price for 2019

3. Quality environment

For many, an important factor when buying their first or next home is the surrounding environment and the lifestyle it offers.

In larger towns and cities, that may be the availability of both quality housing and retail, alongside architecture and heritage. Prices in the prime markets of historic cities such as Cambridge, Edinburgh, Oxford, Bath and York, for example, have all increased by more than their rural counterparts over the past five years. Similarly, prices in market towns such as Sevenoaks, Beaconsfield and Wetherby are up to 2.5 times higher than the counties in which they sit.

For more rural areas, an idyllic green setting remains in high demand. The UK’s 15 national parks and 46 areas of outstanding natural beauty (AONBs) are a huge draw. Indeed, homes within these spaces can command prices that are 1.5 times higher than areas close by.

Hitting the sweet spot

Where a location combines all three factors, the effect is multiplied. So, locations such as St Albans in Hertfordshire, Winchester in Hampshire and Epsom in Surrey become, and continue to be, magnets for wealthy buyers despite the prevailing political uncertainty.

.png)

Premium locations In-demand cities, national parks and areas of outstanding natural beauty (AONBs) command higher prices

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)