The number of £1m+ homes outside of London grew by 95,500 in the 18 months to June 2021, while in London, they rose by less than a fifth of that figure. Lucian Cook looks at whether this was a one-off or part of a more permanent rebalancing

By our calculations, across Great Britain, the number of homes worth £1 million or more increased by almost 114,000 in the 18 months to the end of June this year. It took the total number to a new high of 637,500.

However, the composition of that growth tells you as much about how the prime housing market reacted to the pandemic as does the headline six-digit number.

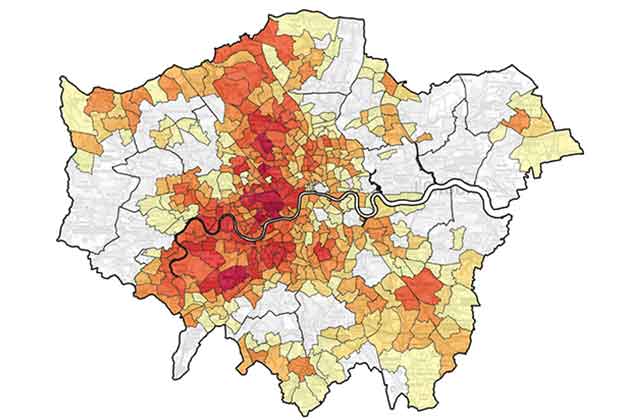

Some 84% of the growth in £1 million+ homes occurred outside of London, as people reassessed both their lifestyles and what they wanted from a home. Meanwhile in the capital, the limited growth that did occur took place away from central London, as constraints on international travel put the brakes on overseas buying activity in that particular part of the market.

Although tax changes and Brexit uncertainty sowed the seeds for a long-awaited recalibration between the values of prime homes in London and the regional market, the pandemic was a potent catalyst for it.

Relative pricing

That rebalancing has been driven by a startling level of demand and, correspondingly, price growth for the most desirable homes beyond the capital. The surge in values started slowly, then ramped up quickly and reached almost feverish levels in the second quarter of the year as a time-limited reprieve from stamp duties came to an end.

Indeed our prime regional house price index suggests that between June 2020 and June 2021, average values rose by 8.2%, with homes in the £2 million+ country house market rising by 13.3%. By contrast, in the same period, prices of prime central London property essentially flatlined, increasing by just 0.5%.

Meanwhile, the value of prime homes across the rest of the capital rose by 2.1%. This was led by homes of six beds or more in the likes of West and South West London, as the search for space also fuelled demand for very large homes in London’s leafy suburbs.

A flash in the pan?

The question is whether these trends are set to continue, and if so, for how long? After all, the stamp duty holidays have finally ended and social distancing restrictions have now been removed on the back of a monumental vaccination effort. That means affluent office workers are progressively returning to the office, bringing back into focus the realities of commuting (whether full or part-time). It should also mean the days of living, working and schooling from home have largely passed.

This has the potential to curb demand from those looking to upsize and refocus domestic demand back to London.

Meanwhile, from a central London perspective, international travel is slowly returning, something which has become widely regarded as a prerequisite for a full recovery in values in that particular market.

Little sign of post-holiday blues

And yet despite all of this, many of the trends we saw in the year to the end of June have continued over the summer and early autumn.

Activity levels have remained robust across the bulk of the prime market, still well above normal market conditions. Encouragingly, a net balance of 16% of the 900+ respondents to our September client survey stated they had become more committed to moving at some point in the next 24 months, despite the loss of the stamp duty holiday. While that has fallen from readings of 22% to 25% over the preceding 12 months, it still indicates a relatively strong core of unmet demand.

Encouragingly, a net balance of 16% of the 900+ respondents to our September client survey stated they had become more committed to moving at some point in the next 24 months

Lucian Cook, Head of Residential Research

Stock shortages to support prices

But that demand sits against the context of a shrinking pool of stock advertised for sale, notably in the prime regional markets.

In these markets in particular, homes have typically received strong interest from an existing pool of unsatisfied demand. As a result, in the three months to the end of September, the prices of prime regional properties rose by a further 2.0%.

This demand/supply dynamic is set to sustain prices in the prime regional and country house markets over the remainder of the year. Both markets are likely to remain seller’s markets in the short term at least.

But with 61% of respondents to our latest client survey saying a lack of stock had significantly inhibited their ability to purchase a property, the relative paucity of property on the market in itself could shift attention to London, where there is greater choice.

Lust for London life

Because the imbalance between supply and demand has been less acute in London since the market reopened in June of last year, the number of £1 million+ homes for sale remained 5% above normal market conditions at the end of September (despite having fallen from much higher levels at the beginning of the year).

In part, this reflects the number of flats worth over £1 million. These properties have proved more difficult to sell when people have placed such a premium on space both inside and outside the home. Again this is a feature of the market that may change over time, as the memory of lockdown fades (though it is unlikely to do so overnight).

For the moment, the price growth in the capital, whether in central London or the more domestic wealth corridors, has remained relatively subdued, with increases of 0.7% and 0.8% in the third quarter of the year respectively.

2022 and beyond

But as we look to next year, we expect to see the balance of demand change. There is already some sign of this occurring. A net balance of 3.3% of respondents to our September survey said that city centre locations are more attractive. It might not indicate a surge in demand, but if you were to rewind to June, that balance was -21%, suggesting an important shift in sentiment.

It is one reason why we expect prices in London to outperform the regions next year, something supported by the prospect of a long-anticipated rebound in central London values as international travel returns. In addition, recent price growth in the prime regional markets is likely to be difficult to sustain, particularly as the changes in buyer preferences we have seen since June of last year start to moderate.

That said, the recent recalibration between prime London and regional housing markets is unlikely to unwind completely. Though aspirations for home working may not live up to the expectations of some, it seems inevitable that some change will become embedded. This is supported by the fact that a net balance of over 40% of survey respondents are still saying rural and village locations have become a more attractive proposition.

Neither should it be forgotten that, while prime homes outside of the capital have become more expensive in the past 15 months, the extent to which prime London prices had pulled away from the rest of the country in the run-up to George Osborne’s stamp duty changes of 2014 means the gap between the two remains relatively wide.

That suggests there will continue to be a pool of buyers lured by the additional space on offer beyond the M25, even if not in the same numbers we have witnessed of late.

For more information, please contact a Savills office in your area or arrange a market appraisal with one of our local experts.

Read the articles within Prime UK Residential – Autumn/Winter 2021 below

.jpg)