As we move into the autumn from a busy summer, so too are we seeing a transition in the prime rental market, says Jessica Tomlinson

Throughout much of 2020 and the first half of 2021, the prime commuter belt took centre stage, with average rental growth of 6.8% in the year to September 2021. However rental values here now appear to be stabilising slightly, while in London rental demand has turned a corner. Over the three months to September 2021, prime rents in these locations increased by 1.4%. More subdued than the previous quarterly growth of above 2% seen in Q1 and Q2. This indicates that the strong performance in the commuter belt isn’t necessarily coming to an end, but that prime London will quickly move into the limelight over the coming months.

Positivity for prime London

Back in May this year, we suggested a recovery for prime London was on the horizon. At that time, the specific timings were difficult to predict given the lasting challenges of the pandemic. But the biggest development over the past months is the pace at which the market has rebounded and how much further along the timeline prime London has moved.

During the second quarter of this year, there were the first signs of a recovery in prime London as it recorded the first positive quarterly rental growth since before the pandemic. That continued during Q3, with growth of 2.9% in the three months to September this year.

Tenant demand rebounds

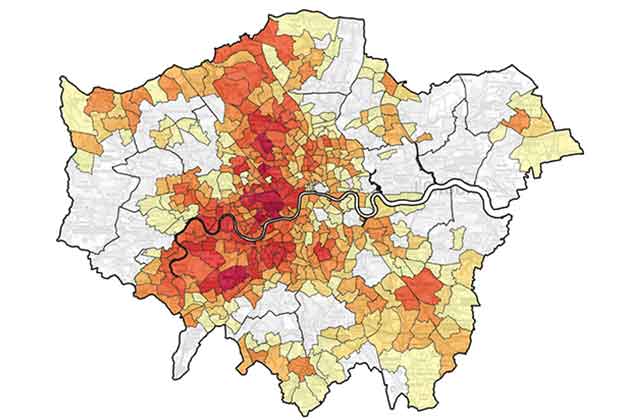

This reaffirms the view that the much-anticipated recovery has begun for prime London. Hotspots in North and East London – particularly Shoreditch and Clerkenwell – are seeing the highest quarterly growth. In part, this is due to renewed demand from some key tenant groups.

With many firms beginning the transition of ‘back to the office’, in some capacity at least, there has been an uptick in demand from young professionals and sharers across the capital

Jessica Tomlinson, Analyst, Residential Research

In the capital, the number of new applicants registering with Savills offices hit a record in August this year, beating the previous ones set in June and July respectively. And internet registrations remain at record high levels as tenants set their focus back on the capital.

With many firms beginning the transition of ‘back to the office’, in some capacity at least, there has been an uptick in demand from young professionals and sharers across the capital. And given the loosening of restrictions, many corporate relocations (which had been put on hold during the pandemic) have returned in full force. The Savills corporate relocation division has reported demand to be at least 10% above the average pre-pandemic levels over August and September.

Back to the lecture theatre

But it is not only the professional sector returning. 82% of our London agents also reported an uptick in demand from students, both international and domestic, over the past three months. As many of the in-person teaching restrictions begin to ease, students are looking to return to campus and experience student life in the capital. Despite some constraints on international travel, we have seen the first green shoots of recovery in this part of the market returning over the coming weeks and months. This is particularly important for the very central locations of prime London.

From surfeit to shortage

The increase in demand is only part of the story in London. Stock levels have seen a dramatic U-turn over the course of this year. At the beginning of 2021, supply levels across much of London were still high, as a result of the influx of stock over lockdown. Over the third quarter of this year, 94% of our agents in London reported a reduction in stock levels. For much of prime London, stock is now in short supply not only for larger family houses but across multiple price points and property types. This supply and demand imbalance will help support rental growth across the capital.

Back to the commuter belt

The prime commuter belt benefitted substantially from the shifts in tenant preferences as a result of the pandemic, with applicant levels rising sharply once the housing market reopened in May 2020. These high levels of demand have been sustained into 2021, driven by the ‘try-before-you-buy’ brigade often coming out of London. But this has also been supplemented by the needs of accidental tenants who have been unable to secure a property to purchase in the busy sales market.

Strong rental growth in the commuter belt is likely to be tempered in 2022, but there are already signs of a resurgent rental market in London

Jessica Tomlinson, Analyst, Residential Research

Given that many restrictions have eased, amenities and transport links have again become more important for tenants. As a result, we expect to see the rebalancing in demand between the urban and more rural locations continue over the coming months.

Stock remains at very low levels right across the commuter belt, which we anticipate will continue to put upward pressure on rents over the short term. However, while levels of demand continue to be higher than average, they are not quite at the record highs seen in the summer of last year, suggesting that pressure may ease later this year and into next.

The next stage

In the short term, we anticipate that strong demand will continue in the commuter belt and for larger family homes in London. But as we see the continued return of key tenant groups, we expect the pattern of growth to develop over the coming months, with a recovery in rents across the board in London accelerated by a shortage of stock available to rent. We are forecasting 2021 to be the standout year for growth in the market outside the capital, with the rate of growth easing back in 2022. In contrast, given the evidence that the recovery in London has begun, we expect the strongest pick-up in rents across the capital to take hold from the end of this year and into 2022.

For more information, please contact a Savills office in your area or arrange a market appraisal with one of our local experts.

Read the articles within Prime UK Residential – Autumn/Winter 2021 below

.jpg)