Will price growth return to prime central London? What’s happening in the commuter belt as people return to the office? And how will the lack of supply impact prices in the regional markets? Faisal Choudhry analyses the three prime markets

Domestic buyers keep prime central London afloat

During the past 18 months, activity in the prime central London market has been underpinned by demand from domestic purchasers and London-based non-doms who have focused their attention on homes with outside space.

Returning office workers and overseas buyers remain key

As travel restrictions continue to ease in 2022, we expect to see pent-up demand from international buyers flow back into the market. This will also be supplemented by an increase in demand from bankers, hedge fund managers, tech entrepreneurs and high-earning professionals, as they return to the office with greater regularity.

Optimism and opportunity

With prices currently on average 19.8% below their 2014 peak, we expect to see buyers exploit a window of opportunity leading to projected price growth of 8.0% in 2022. The prospects for global wealth generation – fuelled by growth in the technology and life sciences sectors – gives us confidence for prime central London’s medium and long-term outlook.

Demand for larger homes continues

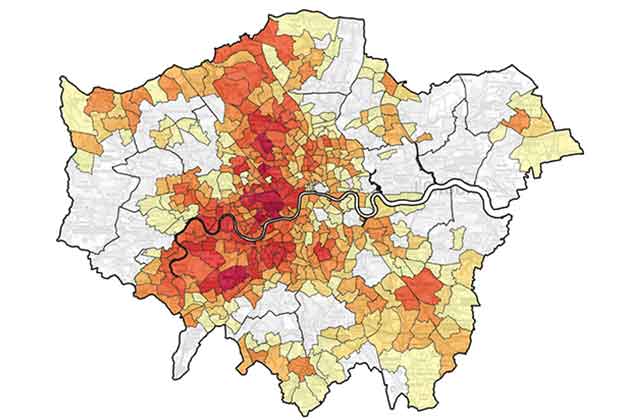

The domestic markets outside central London have been driven by demand for large houses from those with strong ties to the capital. Consequently, the strongest activity has been seen in the established family homes hotspots of Ealing, Wandsworth, Richmond upon Thames and Islington, together with the increasingly fashionable Victoria Park.

A broad-based recovery going forward

Looking ahead, we expect to see increasing demand from a wider range of buyers for a wider range of property types now that social distancing restrictions have been relaxed, the vaccination programme continues and the capital regains its buzz.

Continued growth prospects over the medium term

In a market where price growth has been more steady than startling, there remains capacity for a continuation of similar levels of price growth in the current low interest rate environment, though we expect it to be more evenly distributed between flats and houses from next year onwards.

A long tail of reassessed priorities

According to TwentyCi, agreed sales above £1 million in September this year remained some 121% above the pre-pandemic average for the same months. The results of our recent client survey suggest that even if the flow reduces, we are unlikely to see the tap of demand for regional prime property turned off now that social distancing measures have been relaxed.

Short-term stock shortages and longer-term work patterns

In the short term, we expect the lack of stock to support price growth. Longer-term hybrid working patterns are likely to underpin demand as people are able to take advantage of greater flexibility and widen their traditional search area.

Later in the cycle

Gradually rising interest rates and the prospect of increased taxes are expected to temper longer-term prospects of price growth, as buyers’ spending power is gradually squeezed.

For more information, please contact a Savills office in your area or arrange a market appraisal with one of our local experts.

Read the articles within Prime UK Residential – Autumn/Winter 2021 below

.jpg)