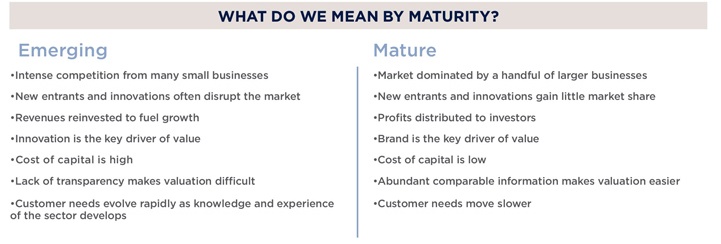

The sub-sectors of the UK’s operational real estate are at different stages of maturity

This paper covers residential operational real estate. By this we mean places owned and operated by professional, large-scale investors where people live, whether those people are full-time students, young professionals, working families, or retirees.

Operational real estate offers attractive opportunities for investors and developers. It’s supported by strong fundamental demographic and economic drivers. Already, investors have made significant inroads into many of these property sectors. However, many aspects of operational real estate are still emerging, and there are challenges still to face. In this document, we identify many of those challenges and explain how they might be addressed. Of the UK operational real estate markets that we examine in this report, purpose-built student accommodation (PBSA) is the most mature, followed by Build to Rent (BTR) and then retirement living (RL).

As a more mature sector, opportunities for growth in PBSA will likely be by outperforming the competition on brand differentiation, rather than through innovation. Organic growth will largely be limited to growth in the full-time student population, rather than increasing penetration.

Capacity for new entrants is limited, with firms such as Unite, UPP and GCP REIT maintaining their hold on the majority of the market. We estimate the UK’s PBSA sector is worth just over £50 billion.

The UK’s operational real estate will grow from £223 billion today to £880 billion at full maturity

Savills Research

BTR is still evolving. There is plenty of space for new entrants, and the competitive landscape is likely to look very different in ten years’ time. Opportunities for growth in BTR will be driven by developing new stock and delivering innovative new products and tenure structures. While the BTR stock completed to date is worth less than £10 billion, at full maturity, we estimate that the BTR sector could grow to £550 billion in today's values.

Institutions have invested in UK care homes for many years, but the scale of that activity is growing rapidly. By contrast, retirement housing has been a slower burn, with institutions only recently entering the sector. Retirement living (care home and retirement housing) is, therefore, an emerging sector where many of the rules are still being written. We expect to see competition intensify as new entrants compete to develop new product and build sufficient brand awareness to attract their target end-users. We calculate the total value of retirement living today is £120 billion: at full maturity, we predict the sector will be worth £266 billion in today's values.

The scale of investment in these asset classes is growing. Whether it’s the recapitalisation of the Chapter student housing portfolio, Goldman Sachs’ £2 billion investment in retirement housing developer Riverstone, or Greystar’s recently launched £2 billion BTR fund, investors are increasingly confident pouring large amounts of capital into operational real estate, often across multiple asset classes.

Summary of UK operational real estate asset classes

Source: Savills Research using ONS, RCA, EAC

Read the articles within The Sky's The Limit? below.

.jpg)