The growth potential of UK Build to Rent is huge. The volume of funds being raised to target the sector is testament to the scale of investor demand

Private renting is not a new concept in the UK, but it's only in the last few years that large-scale, institutional investors have made their mark on the sector. 2013 was the year things changed, whether you consider the watershed moment to be M&G’s acquisition of a Berkeley residential portfolio or Delancey funding the Athlete’s Village in Stratford.

The sector has expanded rapidly in the years since, with over 30,000 homes complete and a further 110,000 in the pipeline that will be built, let, and managed by professional investors as homes for rent.

Looking to the student accommodation sector as our benchmark, there’s at least a decade to go before institutional private rent reaches maturity. This means there is still scope for seismic shifts in the sector. There is also plenty of opportunity for new and innovative entrants to disrupt the market, as customer awareness and understanding of this tenure increases.

The year in review

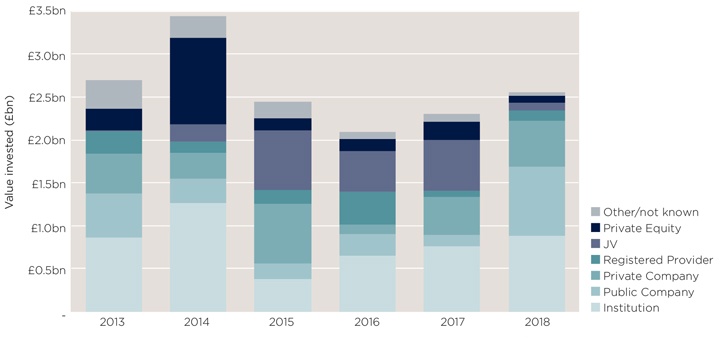

Build to Rent investment totalled £2.6 billion in 2018, 11% higher than in 2017 and the highest level of investment since 2014.

Institutions, such as Legal & General and M&G, continued to grow, increasing their share of investment from £382 million in 2015 to £880 million in 2018, over a third of the total. Public companies made up a further third of the market, largely due to Grainger buying partner APG’s 75% share of GRIP for £396 million.

Last year’s investment volumes would have been somewhat higher had Lone Star’s proposed sale of Quintain gone ahead. Even though the sale didn’t go through, the scale of interest in acquiring one of London’s largest BTR developments bodes well for the market in general.

Despite similarities between PBSA and BTR, relatively few investors are active across both sectors. Goldman Sachs, Legal & General, M&G, Greystar, and Aberdeen Standard are among the few to have invested in both. Goldman Sachs and Legal & General are the only two investors with commitments across all of PBSA, BTR and retirement housing.

Given the similar challenges in development and management, we would expect to see more investors expanding their capabilities to cover the full spectrum of operational residential assets. In particular, there are opportunities for firms to capitalise on brand awareness to encourage graduates leaving PBSA to move into the same investor’s BTR schemes, and for those in later life leaving BTR for retirement housing.

Build to Rent investment by type of investor

Source: Savills Operational Capital Markets

The years ahead

Five years have now passed since 2014, when private equity firms invested over £1 billion into the BTR sector. With a typical 4-6 year investment horizon, we would expect to see those firms attempt to refinance or exit in the near future: as we saw with Lone Star’s marketing of Quintain last year. Given comparatively poor sentiment in some parts of the residential sales market at present, we predict many will sell to institutions rather than breaking up blocks for sale to individuals, driving a spike in investment activity.

In addition to these investors, housebuilders are paying more attention to the demand from institutional investors to forward fund stock. This gives those developers an opportunity to reduce their risk exposure and helps generate returns more quickly, allowing them to move onto the next site faster.

Finance

Availability of development finance for BTR development is generally similar to that for student accommodation, despite the relative youth of the sector. In fact, banks and other debt providers are arguably more comfortable with the demographic drivers for BTR. The clear story of housing undersupply and stretched affordability as the premise for BTR investment is easy to understand, and perhaps provides more comfort for a lender than the more discretionary international student demand that helps underpin the UK PBSA proposition.

Nevertheless, the cost of finance for BTR development currently tends to be the same or higher than for similar PBSA schemes, simply because BTR developers haven’t yet had the chance to build such a strong track record in what is still a new sector. We expect to see the cost of finance for BTR decrease as the sector matures, potentially becoming even cheaper than finance for PBSA.

The PRS debt guarantee scheme is a helpful statement of Government’s support for the BTR sector, but take-up to date has been slow simply because not much stock has completed yet. Refinancing demand for stabilised assets will grow substantially over the next five years as the pipeline of BTR stock completes and begins to let up.

Evolution

As of March 2019, there were just over 30,000 complete BTR homes in the UK, according to Savills/British Property Federation data. There were a further 37,500 homes under construction and 72,200 in planning, bringing the total pipeline to 140,100 homes.

We estimate that the 30,000 completed BTR homes have a total value of approximately £9.6 billion

Savills Research

We estimate that the 30,000 completed BTR homes have a total value of approximately £9.6 billion, based on average values for standing PRS portfolio transactions. This is just under 1% of the total value of privately rented housing in the UK, at £1.5 trillion. The vast majority of the remaining stock is owned by individual landlords: 1.9 million homes are owned with a buy-to-let mortgage.

Recent changes to tax and regulations have made buy-to-let much less attractive for individual landlords. Our analysis of UK Finance figures suggests that landlords have redeemed over 120,000 buy-to-let mortgages in the last two years, as they sell properties. There is an opportunity for larger scale, professional investors to aggregate portfolios of rental homes.

There are parallels here with how institutional and professional investment grew to 47% of rental stock in the US. In the aftermath of the subprime mortgage crisis in 2007, large-scale investors were able to acquire portfolios of scale from distressed mortgagees. While there is no crisis of such scale on the horizon in the UK, there is an opportunity emerging for investors to aggregate portfolios from individual landlords struggling to service buy-to-let mortgages.

.jpg)

In the more mature student accommodation market, 35% of full-time students live in purpose-built housing. Assuming a similar level of penetration in the private rented sector (and accounting for cross-over between the PRS and student accommodation for the younger age bands), we estimate that the UK Built to Rent sector could comprise over 1.7 million households at full maturity, with a total value of almost £550 billion.

We expect purpose-designed and built homes to make up the majority of this supply. Portfolios aggregated from buy-to-let property sales will comprise a significant minority.

Reaching this potential will require a serious step up from current delivery levels. With buy-to-let looking less attractive, housebuilders will have to consider routes to market other than sales to buy-to-let landlords. Block sales to professional investors will undoubtedly be one of those alternatives.

Risks and mitigation

While Brexit dominates the foreign policy agenda, housing sits at the top of parliament’s domestic policy priorities. That’s been reflected in the policy announcements made since the tail end of 2018.

Since 2013, Government has supported households buying new build homes through Help to Buy. That changes from April 2021, when Government plans to restrict the scheme, and in March 2023, when the scheme is set to end entirely. Without this source of Government support, demand for rental homes will rise as fewer households are able to access home ownership.

One of the key recommendations of the Letwin Review was to encourage a greater diversity of tenures on large residential developments, including BTR

Savills Research

Last year also saw the publication of the Letwin Review, which reported on housing delivery rates on large residential sites in England. One of the key recommendations of that report was to encourage a greater diversity of tenures on large residential developments, including BTR.

More recently, Government announced that it would end no-fault evictions. While Build to Rent landlords are unlikely to want to evict residents without good reason, losing this option makes BTR look riskier as a long-term investment. It could seriously delay redevelopment if a landlord needed to go through a lengthy Section 8 court hearing for every home on a scheme, for example. Much depends on the detail of the proposed changes, which will not become clear until later this year.

We have more clarity on Labour plans for rent control. Reassuringly, these resemble rent stabilisation measures, as seen in New York City, for example, rather than rent caps. Shadow Housing Minister John Healey has clarified that Labour plans would be to cap rental growth within tenancies to CPI plus a small premium.

Capital complications

Uncertainty regarding the possibility of rent controls and the Draft New London Plan may be why regional schemes now make up a majority of BTR homes under construction.

There is a caveat to John Healey’s comments on Labour’s rent control plans to consider. The Shadow Housing Minister has said that their policy would support introducing more assertive rent control measures in areas where rental affordability is most stretched, such as London. For now, the detail behind this policy aspiration remains unclear. Should Labour reveal plans to introduce rent caps, however, this could make London look far less appealing for BTR investors.

The Draft New London Plan, currently still in examination, could also make it much more difficult to deliver BTR schemes.

In particular, some of the Mayor of London's Further Suggested Changes to the plan include allowing boroughs to set affordable housing requirements on BTR schemes that include social rent homes, where the homes are managed by a registered provider. Since most BTR investors are not registered providers, this would make it impossible for single BTR blocks to remain in single management. Where this is a requirement, the likelihood of securing investment is poor at best, potentially making some BTR development in London much less attractive.

Learning from student

The Collective, Old Oak The management of The Collective bought the firm’s scheme at Old Oak Common in October 2018 for £115m. It is the only stabilised co-living scheme in the UK, and comprises 546 residential units with associated amenity space and commercial units

There are a few things the BTR sector can learn from the more established PBSA market to help make the most of schemes.

Firstly, it’s important to consider location at a micro level. Cities are not homogenous: they have areas of high and low value, stronger and weaker amenity offering, and better and worse access to public transport. In the case of PBSA, developers must also consider proximity to universities, as there is often a steep downward gradient in the rent you can charge as you move further away from campus. BTR schemes must consider these factors, taking heed of proximity to the prime localities in their wider area and setting rent expectations accordingly.

When providing amenities on schemes, BTR developers need to think about what provides actual value to residents as opposed to headline-grabbing novelty. PBSA operators often help their residents with setting up events, providing space and logistical guidance. We’ve seen a similar approach at The Collective’s co-living space at Old Oak Common (above), where staff support residents running yoga classes, business coaching and cooking courses.

These events can help foster a sense of community, encouraging residents to stay in the scheme longer and decreasing voids. Even without events, there are ways to promote communities in schemes: in PBSA, shared study and recreation spaces bring people together organically.

Finally, it’s vital to consider how a scheme interacts with its surroundings. Plans for PBSA schemes often meet objections that they will “studentify” the surrounding area, which means they have to work even harder to get local communities on side. Ensuring that a scheme engages and interacts with its surroundings, regardless of tenure, will be key in securing public support.

London and the regions

Carmen Street, Poplar

While London remains the most popular location for BTR investors, competition, planning policy, and higher costs will push more development to the regions. Many investors have already bought into Manchester’s investment and rental growth story, and there are still considerable opportunities for expansion at the lower end of the market and in other regional cities across the UK such as Bristol, Leeds and Glasgow.

In March 2019, London developer Telford Homes plc entered an agreement with Invesco and M&G, giving those investors first refusal on funding any new Telford developments. While these deals will result in lower profit margins for Telford in the short term, this funding model allows them to recycle capital and deliver sites more quickly, while also reducing their risk exposure.

Key Build to Rent deals

In January 2019 Legal & General forward funded Buchanan Wharf, a 324 apartment scheme on the south bank of the River Clyde in Glasgow. This was the first forward funded BTR deal in Glasgow and Scotland’s first transaction involving a purpose-designed rental scheme.

Transport for London’s (TfL) recent agreement with Grainger is a prominent example of a trend that Savills expects to see much more of in the coming years: public/private partnerships. The TfL and Grainger partnership combines the two entities’ expertise, capital, and land to unlock delivery of 3,000 BTR homes across London.

With mounting pressure on government departments to release more land and reduce reliance on central government funding, we expect to see more deals like this over the remainder of this parliament. In addition to urban apartment schemes, we expect to see an increase in activity from investors developing house-led schemes in suburban locations. This type of housing appeals to a different part of the market from flats, which comprise most Build to Rent development to date. PRS REIT has been notable in investing in houses to rent so far, but firms such as Grainger, Legal & General and M&G all have BTR houses in their pipelines.

Read the articles within The Sky's The Limit? below.

.jpg)

.jpg)