The most mature of the UK's operational real estate sectors, investors will face stiff competition to increase their market share

Purpose-built student accommodation (PBSA) is the most mature and liquid of the operational property markets in the UK. Investors had access to the sector as far back as 1998, when Unite Students listed on the Alternative Investment Market (AIM), a submarket of the London Stock Exchange. Its transfer to the London Stock Exchange itself in 2000 marked the beginning of PBSA’s evolution into a mature, mainstream investment class.

In the following years, a host of new investors entered the market, with REITs GCP and Empiric Student Property offering retail investors access to the PBSA market. 2015 and 2016 saw the latest new entrants, CPPIB and Brookfield. Since then, new entrants have played a less significant role in aggregating stock at scale. Now the market is dominated by a tight group of large-scale investors, with only small movements in market share of late.

The year in review

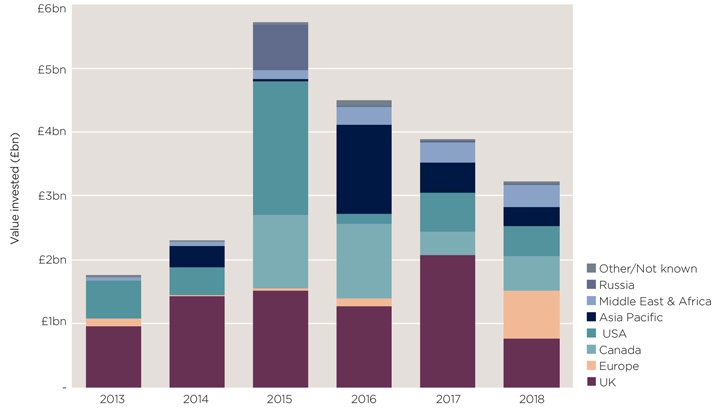

Investors placed £3.1 billion in UK PBSA in 2018, 19% less than in 2017 and 45% less than in 2015. Price per student bed remains high, at £90,000, in line with the average for the previous four years.

Just four deals accounted for more than half the PBSA investment market last year, down from five deals in 2017 and 12 in 2014. Institutional investors such as Allianz, Brookfield, and Aberdeen Standard dominated the PBSA market in 2018, accounting for 61% of the value invested and 56% of the beds.

Student accommodation investment by source of capital

Source: Savills Operational Capital Markets

North American investors had the greatest share of investment into UK student housing for the first time since 2015: 31%. Investment from mainland Europe and the UK was roughly equal, with each accounting for just over 23% of the year’s total. Investment from mainland Europe and the Middle East last year was higher than the three-year average. The disproportionate fall in domestic investment since 2016 reflects both a particularly strong year in 2017, when UK investors made up 53% of investment volume, and a shift in focus to development, with UK PBSA developers building the stock for international investors to acquire later.

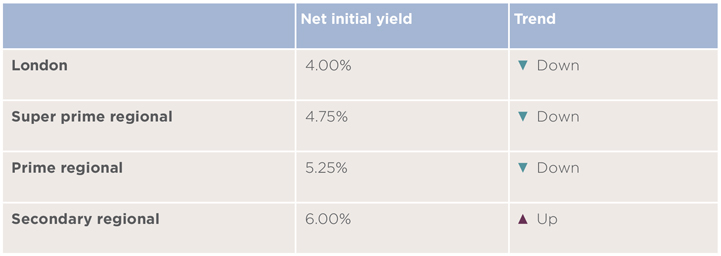

Direct let net initial yields for student accommodation

Source: Savills Operational Capital Markets

The years ahead

The first quarter of 2019 has been relatively quiet, with just over £600 million of investment. That’s 44% less than Q1 2018 and 38% less than Q1 2017, reflecting the uncertainty leading up to the UK’s original March 29th deadline for leaving the EU.

More than half the investment in Q1 came from just two deals: iQ agreed to forward fund almost 2,000 student homes in Leeds and Coventry, and Chapter acquired Paul Street East near Old Street, London.

We predict that 35,000 PBSA beds will trade in 2019, with a total value of £3.5 billion. Based on the pipeline of portfolios either on or approaching the market, we would expect to see a flurry of activity in the second half of this year. In particular, we expect to see activity accelerate once there is further clarity regarding Brexit, whether this arises from securing a withdrawal agreement, a further, longer extension to Article 50, or a hard Brexit on 31st October 2019.

Finance

Debt finance for development or stabilised PBSA assets is widely available through a range of lenders, including clearing banks, other banks and also non-bank debt providers. This is the case for major developments right through to small schemes, due to the relative maturity of the market: lenders feel they understand the UK PBSA proposition. The strength of some student housing developers’ track records even means that their lending costs can be cheaper than for most Build to Rent developments.

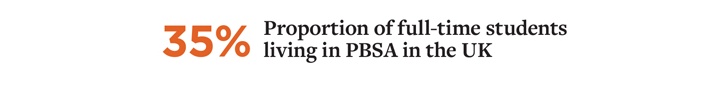

Evolution

A little over a third (35%) of full-time students in the UK live in purpose-built student accommodation. We see little scope for PBSA to increase its penetration of this target market. The sector will still be able to expand in line with growing full-time student numbers, and there will be a natural churn of development as older schemes become obsolete and are redeveloped.

Universities operating their own student housing will become more active in the market as their current schemes age: for example, Reading University has closed some of its older blocks in order to redevelop. Other universities could choose to partner with private PBSA developers to help reinvigorate their stock.

Operators trying to increase their market share will have to do so at the expense of their competitors, or in new markets. With parts of the UK PBSA market looking fully supplied, we expect to see larger investors turn their attention to less mature PBSA markets across mainland Europe, such as Italy, Spain and Portugal. Attitudes towards full-time study in these countries are changing, with more students choosing to live away from home during their time at university. This will fuel increased demand for PBSA, driving investor appetite in these markets.

Accelerated two-year degree courses will only have a limited impact on student numbers at established universities

Savills Research

In November 2018, the UK Government gave the green light for universities to offer accelerated two-year undergraduate courses. This will allow students to remain at university studying for two 45-week years, rather than the current standard of 36 weeks for three years.

We believe that this change will have only a limited impact at established universities with a strong focus on research. One of the selling points of Russell Group universities has always been that they attract leading lecturers and professors, who are working at the cutting edge of their fields.

Offering accelerated degree courses would require these professors to spend a greater proportion of their time teaching, rather than working on new research, which they are unlikely to want to do.

At newer, teaching-focused universities, demand for these intensified courses is likely to be greater. This will have a mixed effect on demand for PBSA. On the one hand, the total number of students at these universities will fall unless they can dramatically increase recruitment, as some students will be on campus for two years rather than three.

On the other hand, having a greater number of students on 51-week leases will increase net operating income for those schemes that are let.

Risks and mitigation

There are two categories of risk facing the student housing sector. The first and most pressing is political, with Brexit a persistent theme and immigration, education, and planning policy all high on the agenda. The second, more fundamental set of risks are demographic considerations stemming from the UK’s ageing population.

The most apparent risk facing the UK PBSA market in 2019 is Brexit. Specifically, the uncertain future for international students following the UK’s departure from the EU poses challenges for student housing investors.

While EU students make up just 7% of full-time undergraduate students in the UK, they’re more likely to live in PBSA than domestic students according to HESA data. Currently, EU students pay the same fees as UK students. Government has yet to clarify what fees EU students will face after Brexit, but the prospect of levying substantially higher international student fees on EU students remains on the table. This would mean EU students could see their fees double or more. Those students would also lose access to finance from the Student Loan Company, meaning they would have to find a way to pay those higher fees up front. A large number of EU students might well look elsewhere for a university education should fees increase in this way.

If acceptance rates for non-EU students were to align with students from EU countries, international student numbers could increase by over 7,000 per year

Savills Research

However, changes to immigration policy could mitigate any potential falls in EU student demand. As of March 2019, graduates from overseas can now remain in the UK for six months after graduating from a bachelors or masters course, up from four months. This is some way off the post-study work visa system scrapped in 2012, which allowed graduates to remain for 12 months, and countries such as the US and Australia which allow graduates to remain for up to 18 months.

However, it marks a positive shift in rhetoric. This change, and the potential exclusion of international students from immigration caps, could help UK universities recruit more students from outside the EU and further bolster PBSA demand.

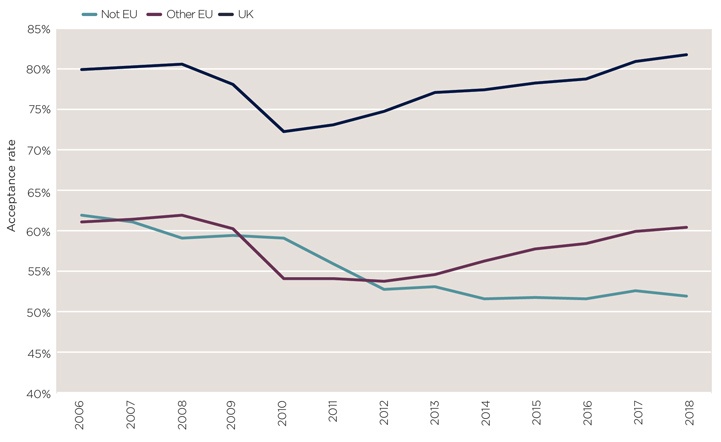

Acceptance rates for non-EU students have fallen over the past decade as universities have felt increasing pressure from immigration policy. The immigration white paper suggests Government is taking a less hard-line approach with regards to overseas students, however. After the UK leaves the EU and seeks free trade agreements with countries such as China and India, student visas are likely to be a valuable part of the UK’s wider trade offer.

If non-EU student acceptance rates rose in line with rates for EU students, the number of international students could increase by more than 7,000 per year. Given that international students are more likely to live in PBSA, this could have a significant effect on student accommodation demand.

Acceptance rates for undergraduate students by domicile

Source: UCAS

Planning still presents a risk to student housing development, especially in London. The Mayor of London’s Draft New London Plan suggests imposing affordable student housing requirements on PBSA schemes and requiring developers to have a nominations agreement with a university in place to secure planning permission. For now, PBSA consents are still being granted, but unless the Mayor is forced to back down, these proposals could make new PBSA development all but impossible anywhere in Greater London.

Last year we reported that the sector faces a demographic challenge (Investing in Private Rent, 2018), with the student age population approaching a trough. We're now one year closer to a return to growth. From 2020 onwards, population projections show rising numbers of people at university age, suggesting we’ll see increasing demand for student places and for accommodation.

Old dog, new tricks

While PBSA may be the most mature of the operational property asset classes, there are still lessons it can learn from other, more emerging sectors.

With brand awareness and loyalty increasingly important for student housing operators in a highly competitive landscape, co-living and co-working offer interesting parallels and lessons to be learned. Amenities such as lounges, study/work areas and games rooms are common to all these spaces. Yet where co-living and co-working go beyond this is in the curation of these spaces. Through running events, or enabling residents to run their own events, these spaces can help create a positive sense of community that builds loyalty and encourages residents to renew their leases time after time.

Flexible space

The Project, Hoxton

The Project in Hoxton, East London, is a good example of how PBSA developers can create flexible amenity areas to support their residents and make best use of the space through the day.

Depending on what students want, the space can be configured for quiet study, workshops, yoga classes, film screenings, and DJ nights.

Expect to see more community creation initiatives in the next generation of UK PBSA schemes.

Read the articles within The Sky's The Limit? below.

.jpg)

.jpg)