Operational real estate in the UK offers exciting growth opportunities for investors and developers

Operational real estate is a broad term, covering a huge range of sectors at different stages of maturity.

On one end of the spectrum, the student accommodation and care home markets are highly liquid. Comparable information and debt finance are both readily available. Some way further along that spectrum we have Build to Rent, which continues to evolve as landmark schemes demonstrate a strong track record. And at the far end, we have institutions taking their first steps in the retirement housing sector.

Common to all these sectors is the recognition that investing in where people live is attractive. The fundamental demographic and economic changes supporting these sectors are difficult for investors to ignore. Institutional interest will continue to grow as these asset classes mature and can increasingly demonstrate their track record.

The student accommodation market is among the most mature of these operational sectors. Worth over £50 billion, we predict the rising student-age population and expansion into new markets will be the main drivers of growth. The sector faces challenges in the form of Brexit and the planning system, but can boast a long history of strong, stable returns in the face of political and economic turmoil.

Build to Rent has come a long way in the last decade, growing from a niche topic at investment conferences to one of UK real estate’s most exciting asset classes

Savills Research

Build to Rent has come a long way in the last decade, growing from a niche topic at investment conferences to one of UK real estate’s most exciting asset classes. Worth a little under £10 billion today, we predict it has capacity to grow to more than £500 billion in value at full maturity, accounting for around 1.7 million households. The volume of funds being raised and invested in this sector, even in the face of political uncertainty, demonstrates the sheer strength of conviction investors have in BTR.

Retirement living is perhaps the most diverse of all these operational real estate sectors, with the nascent retirement housing market on the one hand and the more mature, liquid care home market on the other. The challenges they face are very different: for care homes, restricted local authority funding; for retirement housing, lack of a proven track record. However, both benefit from strong demographic support, with the UK’s 75+ population projected to grow more than a third by 2030. Increasing demand for retirement living will force us to find solutions to these challenges, as the sector grows in value from £162 billion now to £235 billion at full maturity.

In total, the UK’s residential operational real estate is currently worth £223 billion. Growing these sectors to full maturity will require investors to hold their nerve in the face of political headwinds and economic uncertainty. Overcoming those challenges, however, will increase the value of these sectors fourfold to £880 billion. That is an opportunity worth getting excited about.

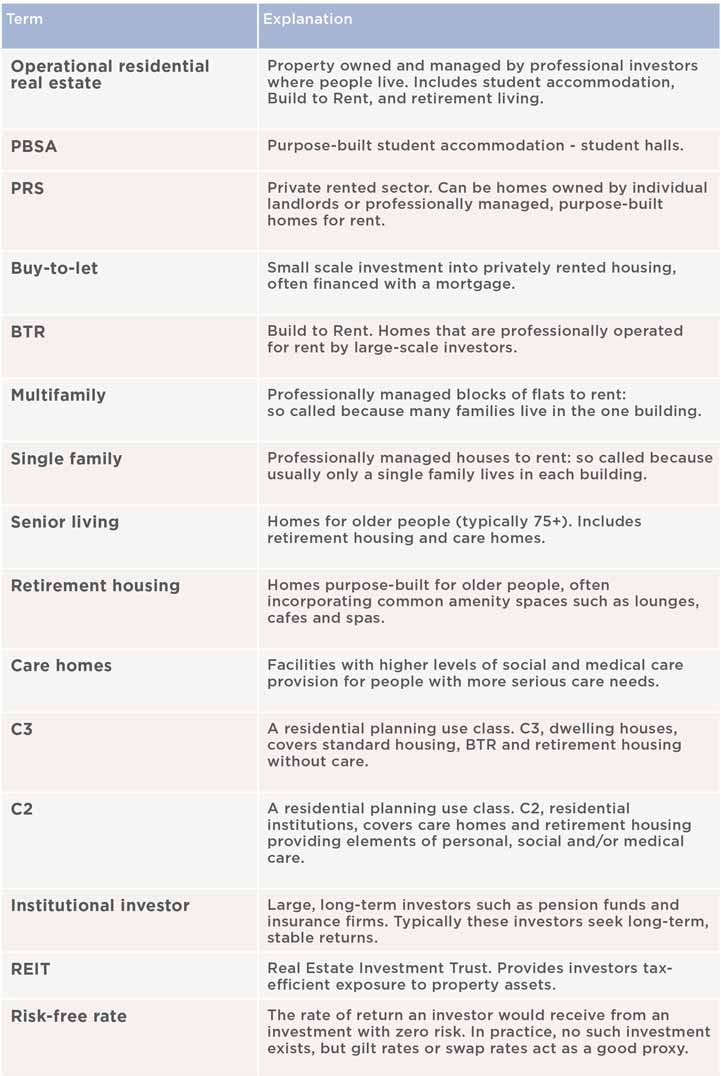

The bluffer’s guide to operational residential real estate

Read the articles within The Sky's The Limit? below.

.jpg)