We take a look at the challenges of developing a unique offer in the leisure market

- Demographic change People are drinking less, buying less and want more experiences. This sector is all about creating a different and lasting memory. Customer journey key.

- Social interaction Drives this sector, with the most enjoyable and satisfying experiences often being associated with group participation.

- Food & Beverage offer can significantly enhance income and plays an important role in being able to locate in more prestigious locations. But both add complexities. Food requires kitchen, extraction and staff, while a bar may require street access if the scheme it is in is not open late.

- Which customers are more valuable? An offer with a bar attracts Millennials and Urban Professionals. A family offer has wide appeal, but tends to be more of a day time activity. Both targets may restrict locations a brand can go in to.

- Technology Has a significant role in enabling the offer, but social media presence important too and how Instagramable the offer is is an important consideration.

- Optimising space Leisure uses provide a fantastic opportunity for landlords in filling under-utilised space, or repositioning units that have come back to market following structural change in the retail market.

- Flexibility Does a paradox exist where a high quality environment is more appealing, but is not flexible when trends move on. Yet a cheap and flexible fit-out can be adapted, but lacks the same level of experience?

- Differentiation How do you stand out from the crowd with a unique offer? Crucial for both operators and landlords who need to avoid a situation where in a few years every scheme has a golf, VR and escape room.

- Diversification How can brands flex the offer to meet changing needs? Are there advantages to having more than one concept under one roof and being able to entertain for an entire evening?

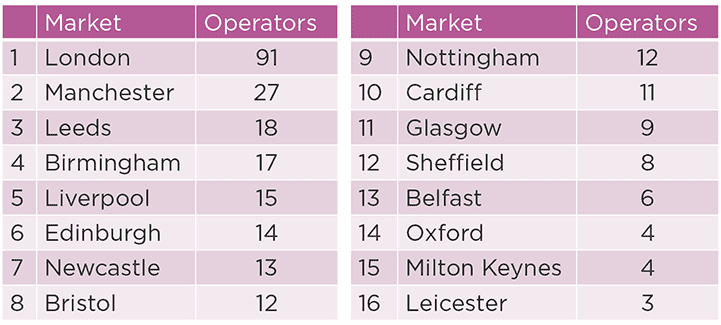

Top 16 Cities

Provision is heavily weighted to the top UK cities

Source: Savills Research

.png)

Source: Savills Research

.jpg)

Don't forget bowling

Bowling was around long before D2 space was even thought up, has always been on the fringes and is making something of a comeback with an increased quality of experience, more F&B and supplemented with a broader offer.

It still anchors 50% of leisure parks and 16% of in-town leisure schemes, so shouldn't this market narrative also include bowling?

Arguably there is no better example of competitive socialising and with 160 existing bowling lanes in the UK it remains the most mature leisure offer in the UK after cinemas. However, the traditional out of town bowling operation was grown out of the need for large cheap sites, but requiring a drive-to audience.

There is a clear advantage for operators with a smaller format to being able to take their offer into city centres where more Millennials go out with no need for a car. These boutique formats, spearheaded by All Star Lanes and Lane7 are redefining the bowling experience with a wet-led focus.

These disruptors are forcing the big players to up their game, and several of these are using the end of their leases to renegotiate deals with their landlords and often getting further capital contributions. This enables them to reinvigorate their offer with a refit and diversify to include other formats of competitive socialising, such as the addition of mini golf in some Hollywood Bowl venues.

The upshot is that we will see a higher quality of experience across the country as a consequence.

.jpg)