Put people in a room, give them a challenge and start the clock. If the essence of competitive socialising is to bring people together to share an experience and create memories, this is it

Concept

Escape rooms dominate this sector. Teams of up to six people are locked in a room and using items they find through a series of clues and puzzles the aim is to escape before the clock runs down. The scenarios are wide ranging, from a detective’s office, nuclear bunker, zombie apocalypse, sinking pirate ship, or the Wild West. The concept is simple, break out within an hour to win. Either way most visitors leave with a smile on their face.

These concepts may have first been derived by problem solving nerds, but make no mistake, these experiences have mass appeal. While females outweigh males in terms of participation and have a better success rate, there is no age, gender or fitness bias. Corporate and urban professional uptake is significant, accounting for more than a third in some cases. As corporate groups tend to look for a higher quality offer, this prices out some people; students typically account for fewer than 10% of customers.

You know a concept has hit a trend when it is embraced by national mainstream leisure operators. Locked In a Room have partnered in Center Parcs and Merlin have introduced an escape room in Warwick Castle. These take a concept usually geared towards adults and provide something that can be enjoyed by the whole family; families now average around 22% of participation in the sector.

With 145+ locations and more than 60 operators it is a very fragmented market. Savills forecast that at the end of 2020 there will be more than 200 locations nationwide. Competition is increasing rapidly, with 24 different escape rooms identified in London, followed by 11 in Manchester and 10 in Edinburgh.

Some operators are concerned that the ease of replicating an escape room, but with low quality experience, fit out and safety, will result in a flooded market. As we are already seeing in the congested trampoline market, local saturation will result in a flight to quality. For landlords considering these concepts in their schemes this will serve to make certain operators more appealing to them and their visitors.

Several escape room brands are exploring IP deals to bring the likes of Sherlock Holmes and Dr Who themed rooms into their venues

Savills Research

Operators

Four brands have emerged so far that by the end of 2019 are expected to account for over 25% of the market.

Clue HQ and Escape Reality are the only brands with more than 10 UK sites; ClueHQ with 18. Both began life in industrial units and railway arches, where space was cheap. Escape Reality recently opened in Printworks Manchester, which is a move to them taking space in higher footfall locations and tapping into the lucrative city centre market. There are a further four schemes in the pipeline as well as franchises in the US, UAE and India.

Escape Hunt have eight UK sites, which are most notable in that they are all located in prominent city centre schemes or high streets. The company has invested significantly in improving the offer and its game design studio has partnered with a production company to ensure the same quality is distributed across its global network.

Locked In A Room have four venues and while there are several regional players with more sites, the brand develop far larger capacity venues compared to any other brand. They adopted an approach to target large corporate groups by having identical rooms that adds competition between different teams and subsequently are able to take groups of up to 78 players. This tactic has helped to increase occupancy levels during the week and subsequently 75% of their market is the high spending corporate or urban professional groups.

.png)

Brand insights: Customer and income profile for Locked In A Room, Escape Hunt and Breakout Rooms

Source: Savills Research

Benefits for landlords

Landlords are realising that with relatively low set up costs and flexible space requirements, escape rooms provide a useful way to increase occupational efficiency of under-utilised space, while providing an additional appeal for the scheme as a whole. In turn, space requirements are evolving; 4,000–7,000 sqft the typical footprint for a brand seeking space in a shopping centre or leisure scheme. Franchising is allowing operators to grow quickly into new markets and with it are building a strong brand and track record that inevitably increases appeal to landlords.

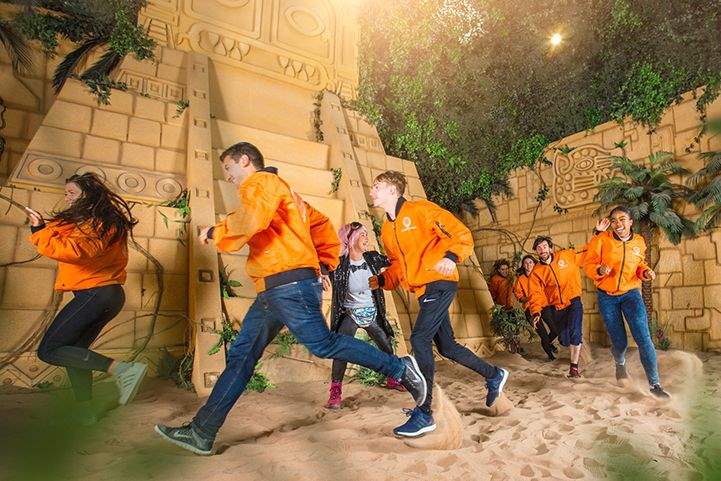

Physical against-the-clock experience concepts tap into our nostalgia. There was a Crystal Maze Live concept during the heyday of the TV series, but these fell out of favour when the programme left our screens. The revitalised offer available in London and Manchester allows you to experience the full game show experience for yourself, is booked up well in advance and the game play doesn’t disappoint. Similarly, there is a Krypton Factor concept rumoured for 2020.

Evolution of offer

IP deals are starting to gain presence in the sector and have the potential to significantly increase the audience and appeal. Coming up in 2019, Escape Hunt are launching a Dr Who experience to various sites and Time Run will open a fully immersive Sherlock Holmes escape experience, both from tie-ins with the BBC.

Food & beverage is not high on the agenda for most operations. Operators are generally of the view that their offer forms part of a wider evening or afternoon’s entertainment and therefore is supported by (and supports) other F&B businesses in the area. However, with the growing group bookings market, bars are starting to feature. These are not intended to significantly increase dwell, but help to complete the overall experience. If there is one thing in common with all “against- the-clock” experiences, the first thing people want to do after the game is talk about it and share it on social media.

LOOK OUT FOR

Escape Reality

With 10 sites nationally, making the transition from industrial units to city centre schemes following opening in The Printworks in 2018. Part of a global network that includes sites in the US, UAE and India.

Escape Reality, Glasgow

Escape Hunt

Developed as a franchise model and has grown to 40 sites in 25 countries globally in five years. Looking to double UK presence in 2019. Arguably the first brand to break the institutional landlord space, with six locations in schemes such as The Light, Cabot Circus and Corn Exchange.

Escape Hunt, Birmingham

Locked In A Room

Has opened in five leisure schemes across the country, including Westquay, Southampton, with several in the pipeline and an eye on 30 sites. One of the largest escape room concepts due to large floorplate and up to 13 rooms. Excellent at serving the corporate market.

Locked In A Room, Bristol

The Crystal Maze

Following the success of the TV show in the 1990s, six venues across the country opened their doors to the public, offering a full live experience. Two decades later nostalgic gamers can visit sites in London and Manchester. The latest in Piccadilly Circus in March 2019.

The Crystal Maze, Manchester

IP Deals

Expect more from big leisure operators like Merlin and Center Parcs, as well as a multitude of IP deals that are linked to popular trends and broaden appeal. Sherlock Holmes and Dr Who in 2019.

Next step Harry Potter, Disney or DreamWorks?

.jpg)