The popular leisure trend of Competitive Socialising has had a lot of press coverage in the last 18 months, but what is it and what brands does it cover?

Benefits & Market Context

Savills has collaborated with the Leisure Property Forum (LPF) on this very issue because we agreed that a comprehensive review was needed of the latest emerging leisure trends.

There are a number of formats and we accepted early in this process that a definition of Competitive Socialising that had full consensus from the market would be hard to reach. In undertaking this review Savills & LPF have assessed four submarkets and identified over 50 mini golf, 90 bar & game, 50 VR, and 145 'Against-the-clock' experiences (escape room) in locations across the country. The reality is that these numbers will be quickly outdated.

The highly fragmented nature of this sector means that operators need only a handful of sites to become a genuine contender as a national brand

Savills Research

In this fast-paced sector we are seeing an increase in venues in prominent leisure schemes and shopping centres. The highly fragmented nature of this sector means that operators need only a handful of sites to become a genuine contender as a national brand.

The growth across all of the competitive socialising market is a good counter narrative to other parts of the market and while some concepts have been around for decades it is clear that the growth we are witnessing now is closely tied to advances in technology and consumer preferences.

.jpg)

Flight Club, London

Benefits of Competitive Socialising

An offer that is good for landlord, tenants and consumers?

.png)

Bounce, London

Market Context

Consumer change and technological development are driving growth

The UK proposition

There has been much discussion around competitive socialising, but what is it? Does it include family leisure, or is just related to a wet-led offer. Arguably it includes any venue or occasion that brings people together to play a game. In order to provide some focus to this report, we have avoided including long established brands and instead focus on concepts that have only emerged relatively recently.

The market is diverse and fragmented, with a large number of independents and operators pushing to become a brand. We have identified 170 operators, 340 locations, and just 3 brands with more than 10 sites. While London tends to lead the UK with new leisure trends, the current suite of emerging brands are truly UK wide. It’s an exciting area and truly entrepreneurial.

Up to 12 months ago expansion had been slow, with operators being reluctant to take on too much debt through over expansion, but this doesn’t mean that brands lack an appetite for growth. 2018 saw the market turn a corner, with several brands looking to expand more aggressively. Immotion VR opened 10 sites, 8 brands opened mini golf courses and 20 escape rooms opened in shopping centres and leisure schemes. Speaking to operators it is clear that this trajectory will continue for at least the next few years.

Drivers for change

So what is driving these brands forward and why now? Consumers are quickly evolving their wants and needs and while this is contributing to challenges in the retail sector, it is seeing a diversion of spend to leisure, now accounting for 14.3% of consumer spend. Millennials are reported to be spending less on products and more on on-demand experiences and the memories they create. In fact, this trend is likely to actually be typical across most demographic groups and there is little doubt from the increase in leisure brands that participation is up across the country.

This increase in demand is being met by a stream of entrepreneurs who have the energy and creativeness to build a brand, and advances in social media and technology that are driving new concepts forward in a way that wasn’t previously possible.

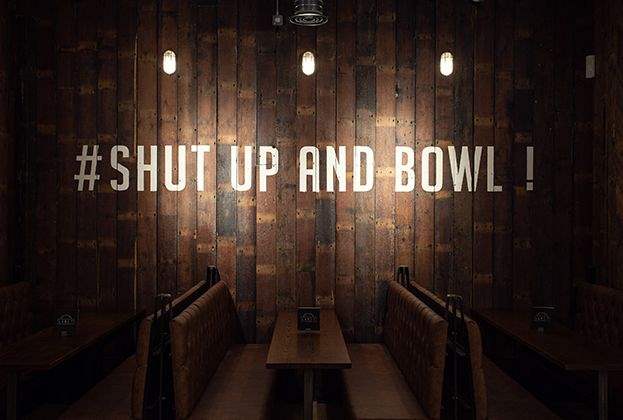

Competitive socialising is on one hand counter-culture to people’s lives going online as it brings people together socially into the real world, but on the other hand it provides exactly the kinds of experiences that people love to share on social media.

There is no doubt that this is an exciting growth area, but is this a temporary phenomenon, will it become saturated and what place does this new offer have in institutional landlord spaces (i.e. off the high street)?

Diversification vs. specialisation

This market is likely to quickly become congested. We’re starting to see growth in specialist operators who look to provide a world class concepts that will keep them ahead of the competition. However, reserving an element of flexibility around formats is important too. Brands and schemes that have the opportunity to diversify their offer, either through F&B, or a range of different games/experiences are likely to enhance their chance of success.

These trends have not gone unnoticed by existing leisure operators. Namco Funscape already have a foothold in various shopping centres and leisure schemes across the country and are able to reconfigure their large units to trial new formats and keep the offer fresh. In several schemes they are now offering an escape room and VR concepts.

In more wet-led locations, brands like Lane 7 and Roxy Ballroom are bringing together different competitive socialising and bar game formats under one roof in order to be able to provide a full evenings’ entertainment and thus extending dwell times.

In the future will we see ‘mega brands’ that can flex the offer and evolve with trends? Grosvenor Casino’s have recently agreed a tie in with Immotion VR and Hollywood Bowl are introducing mini golf to some of their venues.

Read the articles within this publication below