There are 53 venues across the country, with many more in the pipeline. Who are the key operators and where are they locating?

Concept

Mini Golf has traditionally been a stalwart of the holiday seaside destination, where families brave the British weather and knock balls around concrete courses with increasing frustration, before reconciling the inevitable family disputes by heading for a 99 flake.

This stereotype is being turned on its head as a revolution is seeing the concept head indoors and increase its appeal through the use of innovative design, imaginatively themed layouts, neon lighting, technology and often banging tunes. The only ice-creams on show may well be those seen floating in a cocktail.

For this report we have coined this growing subsector Urban Mini Golf to distinguish from the traditional outdoor crazy golf that has been around for decades. The sector is split between family entertainment and bar/night club venues. In both cases operators are bringing a fresh approach to the concept and locating in high footfall shopping and leisure destinations in the major towns and cities across the country. Game play is excellent, with wide appeal due to previous experience not being critical.

In today’s rapidly changing consumer market Urban Mini Golf provides landlords with an opportunity to diversify and freshen the offer

Savills Research

Operators

In the family sector, Mr Mulligans are the largest operator with 12 locations nationally, having first opened sites adjacent to golf courses in a bid to increase take up of the sport by young people. In 2014, they opened a venue in Stevenage Leisure Park. The brand now have seven shopping and leisure scheme locations, with six more pipelined for 2019/2020 and plans to reach 25 sites in five years.

Similarly, Paradise Island Adventure Golf have seven shopping centre and leisure scheme locations. In total there are 11 operators with multiple locations that focus on the family entertainment market, predominantly from high footfall locations and with a close affinity with retail.

Several brands are pushing in a different direction, aiming to capitalise on the lucrative bar market by attracting Millennials and Urban Professionals on a night out. Junkyard Golf launched their first night club style site in a temporary unit in Manchester in 2015 and now have four venues, with a fifth opening in Liverpool One in March 2019. Their high profile move to Westgate Oxford in 2017 has helped to improve their covenant and perception to landlords, which is paving the way for more opportunities. At present Junkyard Golf believe there is potential for 40 locations across the country.

In London, Swingers and Puttshack have developed premium concepts. Their fit-out costs are high and require significant landlord contributions, but they are creating world class venues with excellent playability and environments that ooze sophistication. Swingers are located in the City and have recently opened in the West End.

Puttshack arrived with acclaim to Westfield London in 2018 with has sites in London Bank and Lakeside Shopping Centre in the pipeline, with a plan for 25 sites within five years. The brand are developing their own technology and building their courses in-house to manage the supply chain and reduce their costs to market.

Swingers, has received backing from private investment firm Cain International. The deal will provide substantial capital for expansion with a number of openings targeted for Swingers in North America and the launch of a second Competitive Socialising concept in the UK.

.png)

Brand insights: Customer and income profile for Mr Mulligans, Puttshack and Junkyard Golf

Source: Savills Research

Benefits for landlords

Typical requirements are 15,000–25,000 sqft across the operators. This may have meant limited opportunities available in the past because many landlords simply wouldn’t have had this amount of available space at the appropriate rent. However, landlords are seeing the advantages of bringing mini golf into their schemes to increase the variety of offer whether for family entertainment in the case of Paradise Island and Mr Mulligans, or drawing a young adult crowd and enhancing the evening economy in the case of Junkyard Golf and Puttshack.

There are also several examples of landlords bringing in golf to large units that have become vacant from CVA or administration. Swingers have taken a floor in the BHS unit on Oxford Street and Mr Mulligans are taking space in the House of Fraser unit in High Cross Shopping Centre, Leicester. A few years ago a D2 operator taking such prominent space either on the high street or in a shopping centre would have been unthinkable. In today’s rapidly changing consumer market it provides landlords with an opportunity to diversify and freshen the offer.

Landlords have brought these into schemes to provide diversity and supplement a wider offer. However, for standalone operators the question over which customers are the target market and what is the main source of income, is an important consideration.

For the family market the mini golf game itself represents the biggest source of income for operators, but F&B is becoming increasingly important as it provides greater revenues that in turn can support paying higher rents and access markets that would otherwise be unviable. For Junkyard Golf and Puttshack F&B income accounts for 45–50% of income.

LOOK OUT FOR

Puttshack

The impressive site in Westfield London has a casino theme and utilises the same tracking technology used by Flight Club and Bounce. Now developing licence to roll out the concept & tech globally.

Puttshack, London

Junkyard Golf

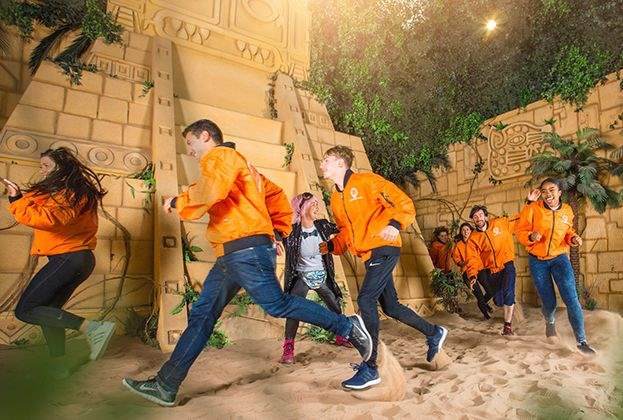

Vibrant bar-orientated locations moving into prime city centre schemes following launch of Westgate Oxford in 2017. Four venues and growing with Liverpool One open from March 2019.

Junkyard Golf, Leeds

Mr Mulligans

Has 12 venues across the country. The offer has evolved from outdoor to indoor where F&B are a more significant part of the offer. The latest has just opened in Broadway Plaza, with the 13th opening in Basildon in March.

Mr Mulligans, Cheltenham

Swingers

Two sites in central London. A premium experience for Millennials and Urban Professionals, with bar and street food. Plans to expand offer into UK and to North America.

Swingers, London

Paradise Island

Family offer located in seven distinguished shopping centre and leisure parks across the country, with the latest opening in Rushden Lakes in 2019.

.jpg)