Several of these brands are what really caught the attention of the media with the rise of competitive socialising. Which brands are proving the most innovative?

Concept

These concepts are all about bringing together groups of friends to play a game over a drink. When put like that it doesn’t sound new, but the popularity of socialising that doesn’t just revolve around standing in a bar but instead is based around an activity, is on the increase. Lots of different concepts are emerging and sites tend to be in major city centres where there is a ready supply of young people and office workers.

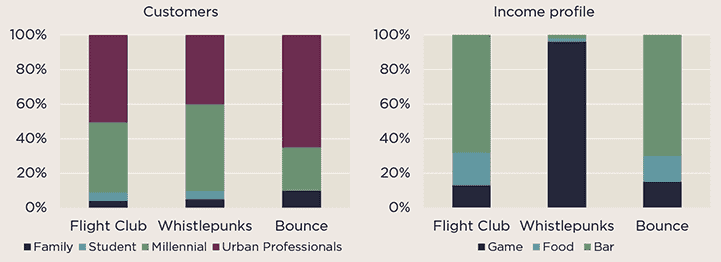

The F&B component (particularly the bar) is really important for most brands in this subsector as it can account for over 85% of income. In turn this naturally skews the demographics to a higher proportion of Millennials and Urban Professionals, with students often being absent due to the cost of participation and only older families typically engaging due to the bar/club environments.

There is a huge increase in activity based social entertainment experiences. It is all about having a fun social experience

Savills Research

Operators

If ever there was a pastime that epitomises a bar game that has been enjoyed for generations it is darts. Flight Club have revolutionised the offer while tapping into nostalgia. The game itself remains uncomplicated, but the modern spin is made through clever use of technology, excellent customer service and a great environment. Fit-out costs are above average by some margin, but their venues appeal to clientele who wouldn’t want to be seen in a gritty pub, but are delighted to play in a trendy bar. Given the investment involved, Flight Club are willing to sign longer leases than many of the operators we have talked, which will appeal to Landlords.

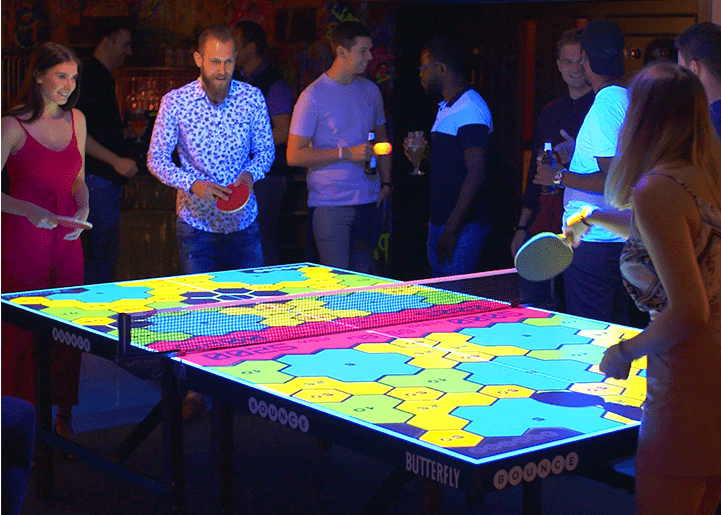

Table Tennis participation is, according to Sports England, up a third in the last decade. Many bars around the country are now choosing table tennis tables over pool and several pop-ups have evolved out of renewed interest in the sport. Bounce have brought the concept up a notch, with their bar/club format, again using technology to track ball movement to add a digital component and range of different formats to the game.

Whistlepunks have axe-throwing sites in London, Birmingham and Manchester, with two more planned for 2019. The game price is above average for the sector because the nature of the sport means that instructors are required to ensure safety and provide a personal experience. In their existing sites peak hours are at capacity and 98% of custom is pre-booked. Venues at present don’t include licences, which is unusual compared to other formats in this sub-sector given that bars can be highly lucrative. However, this is very much on the agenda for future sites including the latest in Bristol.

Shuffleboard is a cross between table top curling and shove-ha’penny, is very playable and becomes extremely competitive. The main brand behind this offer is Liverpool-based SHUFL, who supply over 700 tables across Europe. In the UK, shuffleboard is available in 34 venues across the country, but if you haven’t seen their signage above the door it’s because they franchise the product out to bars and pubs who then rent the tables to customers. Greene King, BrewDog, Stonegate Pub Company and Bierkeller are among the chains who have adopted SHUFL.

There has even been a pop-up croquet bar called Mallet and Hoops and a curling bar at Roof East, a roof top venue, both in London and both with the aim of offering something novel and intriguing to consumers that have an abundance of alternative venues to choose from.

Brand insights: Customer and income profile for Flight Club, Whistlepunks and Bounce

Source: Savills Research

Evolution of offer

Several brands have taken this a step further by incorporating a number of different games under one roof. Roxy Ballroom has six locations, Lane7 has four sites trading, but two new sites in the pipeline for 2019. Roxy has table tennis, shuffleboard, beer pong and pool, with the recent addition of mini golf. Similarly, Lane7 is a bowling operator that has extended its offer to bring together a range of karaoke, table tennis, beer pong, pool, arcades and mini golf. The key benefit for these operators is that multi-activities can provide a full evening’s entertainment, with the potential of capturing more bar spend without the need for a churn in footfall. Both brands have grown their businesses in the North of England and are spreading further north and south with their expansion plans.

New formats will continue to appear in the coming years' as entrepreneurial operators come up with new and novel ideas. Several very popular pop-up bingo operators have inspired the founders of Flight Club, Puttshack and Bounce to plan a new venture, HiJingo Bingo; “bingo for the Millennial generation”. The concept will "infuse technology with the traditional number play to unlock a ground-breaking twist on bingo and shaking up Britain’s socialising scene”. On the back of this vibrant scene, many bar venues across the country are introducing more gaming options within their venues, but will this result in a difference in quality of experience between the specialists and the adopters? Consumers are savvy and increasingly hard to please, returning to those brands that provide the best experience, or seeking the new and latest offer.

LOOK OUT FOR

Bounce

The Ping Pong operator Bounce have two sites in London and another in Chicago. Looking to secure 10 more UK sites c.7,000- 12,000 sqft in a variety of location types where there is a good supply of urban professionals.

Bounce, London

Flight Club

Possibly the go-to venue for Xmas parties last December, with four dart-themed sites already open and plan for a further 15–20 in five years in units 6,000–11,000 sqft in key high street markets.

Flight Club, London

Whistlepunks

Urban axe-throwing is proving a real crowd pleaser, with sites already in London, Birmingham and Manchester and two more in pipeline for 2019. Requirements range 2,500–6,500 sqft.

Whistlepunks, Manchester

Lane7

Very sleek boutique bowling operator with up to six different game concepts under one roof, as well as a strong F&B offer. Four sites already from Birmingham to Aberdeen, with seven more on the way.

HiJingo Bingo

The team who brought Bounce & Puttshack are planning a new venture. The bingo concept will be “something like Who Wants To Be A Millionaire, the X Factor and a rock concert”.

.jpg)