rentals

Recognising the perfect tenant and what they’re looking for enables landlords to capitalise on demand and maximise premiums

.png)

Recognising the perfect tenant and what they’re looking for enables landlords to capitalise on demand and maximise premiums

Landlords of prime properties have had their challenges over the past few years. Rents across the prime London market have been in gradual decline. Over the third quarter of 2018, rents remained flat in central London, leaving them down 3.8% over the past year. Across the commuter belt, they have fallen by 2.0% over the past year.

The 3% stamp duty surcharge for additional homes, together with limited tax relief on mortgaged payments, has already caused some landlords to rationalise their portfolios. Yet overall, there continues to be high levels of supply across large sections of the market. And this sits against rising new build completions in the capital, many of which will hit the rental market.

That means existing landlords of prime property are competing for tenants. And they are doing so in an environment where renting appears to be becoming much more of a lifestyle choice.

That begs the question as to whether the profile of a new build tenant differs from someone looking for a secondhand property? And should that impact on what a landlord looks to offer to remain competitive?

.jpg)

Younger renters are attracted to the amenities associated with new build, such as concierge services, on-site gyms and residents’ areas

Common drivers

There are a number of areas where the profile of prime tenants shows precious little difference. In both the new build and secondhand prime lettings markets there are high proportions of international tenants, particularly in the central London market.

Similarly, lifestyle relocation is now the primary reason for renting among about one-third of tenants across the prime London market as a whole. This suggests that the fundamentals of what attracts people to live in London – the strong educational offering, the language and the cultural experience – remain strong.

New build properties have attracted more renters moving because of employment relocations

Savills Research

In the recent past, the secondhand market has seen a prominent uptick in the proportion of these lifestyle-motivated renters – growing from 26% of that market in 2015 to 41% in the first half of 2018.

At the same time, new build properties have attracted more renters moving because of employment relocation. Some 40% of tenants of these properties have stated this as their major reason for renting since 2016. The largest proportion of these tenants work in the finance and insurance sector – and with those coming to London more inclined to rent – this share of the market has steadily increased since the EU referendum, growing from 33% in 2016 to 37% in the first half of 2018.

How are tenants changing?

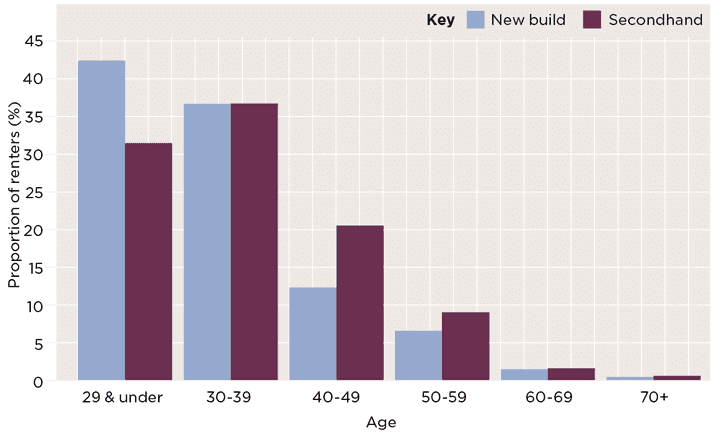

Where tenants across the prime new build and secondhand market differ most significantly is in age. The new build rental market tends to attract younger renters, as well as students – 42% of tenants since 2016 have been aged under 30.

Because of this, new build tenants are more likely to be established and experienced renters. The proportion moving from the owner-occupier sector has been decreasing steadily since 2015 (where they accounted for 30% of tenants) to just 14% of tenants in the first half of this year.

Such tenants are often drawn to the ease of new build, as well as the amenities that are often associated with them, such as on-site gyms and concierge services. New build schemes in areas such as Wandsworth, Camden and Ealing that can offer these have been particularly attractive to this demographic.

By contrast, secondhand property tends to be favoured by slightly older tenants, with a third aged over 40. They are more likely to be renting with children, and favour more central markets such as in Kensington and Chelsea.

Age profile New build appeals to younger renters

Source: Savills Research

Outlook

Against the context of these tenant profiles, it is important to consider what is expected to happen to supply in these different parts of the market.

Ongoing pressure on buy to let means we will probably see landlords continue to re-evaluate their portfolios. This should limit the amount of secondhand stock coming to the market. In particular, the search for yield could impact the availability of larger family homes to rent.

Considering the demographic of these renters, the properties located close to the best schools and areas of culture will see the strongest demand.

In the prime new build market, levels of completions are likely to peak over the next two years and, though much of this stock will have been sold off -plan, there will be units coming into the rental market. This is likely to limit rental growth and provide more choice for tenants drawn to new build. Therefore, to stand out, it will be important to off er something new or different in terms of amenities, specification or connectivity.

We are forecasting that rental value returns are likely to be lower than capital value returns for prime London landlords over the next five years. That means landlords will generally need to be flexible in their terms and realistic on their asking rent. But by understanding what tenants are looking for, they will give themselves the best opportunity to find that elusive gap in the market.

8 other article(s) in this publication