new development

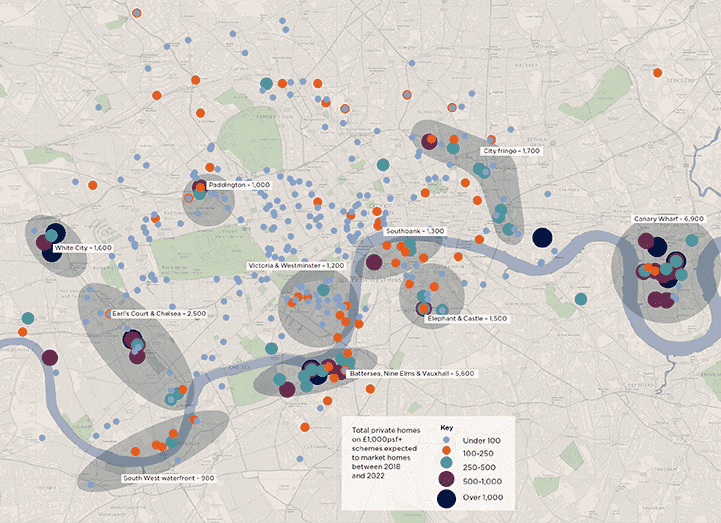

Of the new prime London homes expected to market over the next five years, 70% are concentrated within 10 clusters. Here’s how the market is evolving

.png)

Of the new prime London homes expected to market over the next five years, 70% are concentrated within 10 clusters. Here’s how the market is evolving

How is the prime London new build market changing?

Sales of new build homes continue to take a larger share of the market. In the 12 months to June 2018, 18% of £1 million-plus sales were new build, up from 5% a decade ago, according to Land Registry.

What’s driving this change?

More completions mean more choice, with most units selling off-plan. During the 12 months to Q2 2018, there were just over 5,500 prime completions – almost three times as many as in 2014. We’ve also seen buyers looking for properties of the highest specification and offering the best amenities. New build is often best placed to satisfy this demand.

Significant progress has been made in these clusters to create a sense of place

Savills Research

Is the market at risk of oversupply?

Although there has been an increase in completions, we’ve also seen prime sales hold steady. Importantly, the number of prime developments starting construction has begun to slow. So, while there were two prime starts for every sale in 2015 (fuelled by starts of tower schemes that cannot be phased), in the 12 months to Q2 2018, the level of sales exceeded the number of starts on site; a sign of a more stable market. Likewise, many of those units which are now completing have already been sold off-plan, hence why sales are remaining steady.

Are buyers still buying off-plan?

Yes, but there’s a trend for buyers purchasing closer to completion. In 2015, the average prime buyer was purchasing a home (more than £1,000 psf) around 2.5 years before practical completion. By the first half of 2018, that was down to just over one year. This trend is particularly prominent for domestic buyers and those purchasing their main residence rather than an investment or second home.

Looking ahead, what do developers need to consider?

Over the next two years, we expect the level of completions to peak, with an annual average of 8,500 prime completions in 2019 and 2020. While we expect the proportion of these units that are unsold upon completion to remain at around 10%, the actual number of units will, of course, be higher. To remain competitive with high-quality secondhand stock, developers must be pragmatic in their pricing and offer a diverse range of product to appeal to a variety of buyers.

What does the prime London supply pipeline look like over the next five years?

Of the total number of private homes over £1,000psf expected to market over the next five years, 70% are concentrated within our 10 clusters (see map). These range from bespoke schemes of fewer than 100 units to towers of more than 1,000 units, such as in Canary Wharf and Nine Elms.

New build numbers London’s new prime homes range from bespoke schemes of fewer than 100 units to towers of more than 1,000 units, such as in Canary Wharf and Nine Elms. These 10 clusters will deliver 70% of the stock

Source: Savills Research

Significant progress has been made in some of these locations in terms of creating a sense of place. Previously known as a transport hub and office location, Victoria has emerged as a true mixed-use destination. Meanwhile, White City is back on the map thanks to sales successes at Television Centre, the new Soho House and the Westfield extension. And Nine Elms is finally coming to fruition – securing major commercial tenants and introducing a thriving cultural programme at Battersea Power Station, and a flourishing rental community at Embassy Gardens. It is these kind of successes which underscore how new developments are transforming London.

8 other article(s) in this publication