Overview

Although the prime market remains subdued, there are interesting trends across the UK, not least with the shifting pattern at the top end of the market

.png)

Although the prime market remains subdued, there are interesting trends across the UK, not least with the shifting pattern at the top end of the market

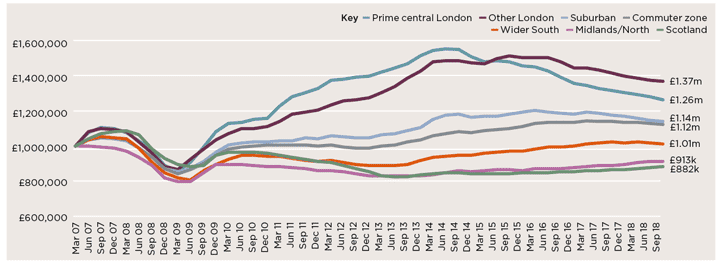

It’s almost four years since the then chancellor George Osborne introduced new rates of stamp duty, which increased the tax burden for buyers of property worth £937,500 or more. The move caused a correction in prices at the top end of the residential markets – over the past four years, prices have fallen by 18.3% in prime central London. Subsequent political events (see boxout, below) have caused further disruption and uncertainty. There have, however, been some nuances within the market that can sometimes be overlooked when discussing headline averages.

A LONG TIME IN POLITICS

2015: Following the Conservatives’ majority win, a degree of confidence returns to the market. Price falls in prime central London begin to ease while low levels of growth are seen in outer prime London.

2016: The UK votes to leave the EU. Uncertainty over the political and economic climate means prime London prices begin to fall at a sharper pace.

2017: Further disruption is caused by the snap election, which results in a minority government.

2018: As the UK continues its negotiations for leaving the EU, uncertainty leads to a more muted market.

Starting at the top

In prime central London, higher-value properties have experienced more substantial price falls since 2014 than those of lower value – those worth more than £10 million have fallen by more than 20% over the period. But in the past year, this pattern has shifted. Price falls are beginning to ease at the top end of the market – a signal that the most expensive property has begun to find its level and values may be bottoming out.

Into the regions

The story is slightly different for the prime regional markets. As they are generally of lower value, stamp duty changes have had less of an effect. Indeed, around 60% of Savills sales in the regions now incur lower levels of stamp duty than they would have done before the changes. This has meant that transaction levels have been much more robust than in London, although in the past two years there have been more subdued headline levels of house price growth.

The prime regional markets generally have a higher proportion of mortgaged buyers so are more sensitive to the availability and cost of borrowing. Increases to regulation and tighter lending criteria have curtailed buyers’ spending power. That is likely to be squeezed a bit further by gradual increases to interest rates.

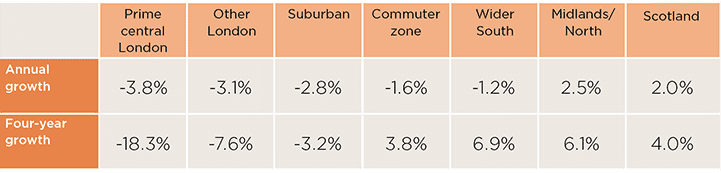

Regional variation Price movements of prime residential property in the past year and since 2014 (to September 2018)

Source: Savills Research

Contrasting fortunes

The prime markets furthest from the capital have held up more strongly, particularly over the past year. In the Midlands and North, prime prices are up by 2.5%, while they have increased by 2.0% in Scotland.

But London’s prime suburbs and immediate commuter zone have been impacted by lower levels of wealth leaving the capital. As such, prices in these markets have fallen by between -2.8% and -1.2% during the past 12 months. The value gap between London and its surrounds has, however, maintained a source of demand from those looking for space and value. Similarly, while the prime regional city markets have performed well over the past five years, levels of growth have begun to ease as neighbouring village and rural markets begin to look like good value.

Prime performers Price movements by region for a property worth £1 million in March 2007

Source: Savills Research

Maintaining a sense of realism

Importantly, transactions continue to take place when stock is priced correctly and vendors are realistic about what they’re likely to achieve in a more difficult market. Likewise, the acknowledgement that the market is likely to remain subdued – at least in the short term – should bring buyers’ and sellers’ expectations more in line.

8 other article(s) in this publication