Buyer focus

The prime market may lack urgency, but premiums are out there. You just need to know where to look

.png)

The prime market may lack urgency, but premiums are out there. You just need to know where to look

A consequence of the current market conditions is that buyers are becoming ever more selective. This is enabling a number of factors to attract a premium.

One is quality. There’s a gap between best-in-class properties and the rest. Buyers who have sufficient equity to make the move are looking to get the best location for their money, avoiding fringe areas and concentrating on established prime locations. Low levels of stock have fuelled the flight to quality in the Midlands, the North and Scotland, in particular.

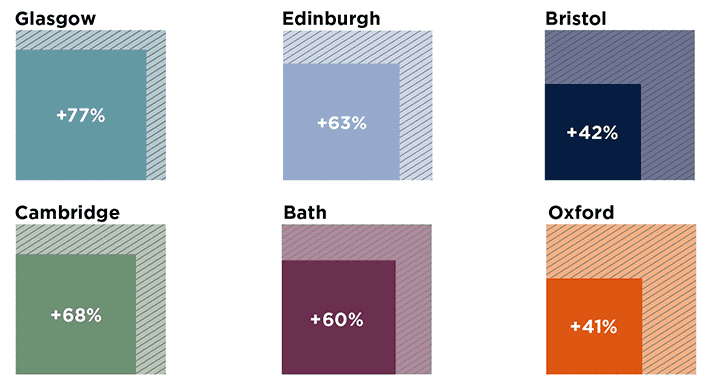

Prime markets in Edinburgh and Glasgow are having their best market conditions for 10 years. Transaction levels have also increased. In the year to June 2018, there were just over 5,000 transactions above £400,000 across Scotland, the highest ever annual number at this price point. In the pockets of stronger activity, there are instances of competitive bidding for the best properties in the best locations.

.png)

The prime market in Edinburgh is at a 10-year high

Traditional stock has always attracted high demand, whether in urban or rural areas. For many, access to transport, amenities and good schools are essential. As such, the prices of prime properties in cities and towns have risen by 13.4% over the past five years. Prime period homes across the country have sustained growth of 9.4% over the period.

At the top end of the market, the ongoing appeal of trophy homes in central London’s most exclusive locations has held up transaction levels. Although the value of these properties has fallen 18.4% since the peak of the market in 2014, it continues to attract significant investment. More than £500 million was spent on secondhand properties above £20 million in the first half of 2018 with recent sales in the most desirable and established locations attracting significant investment.

It is not just in central London where demand for high-value properties remains. Country estates form a unique set of assets for a buyer, which are attractive for investment or lifestyle reasons.

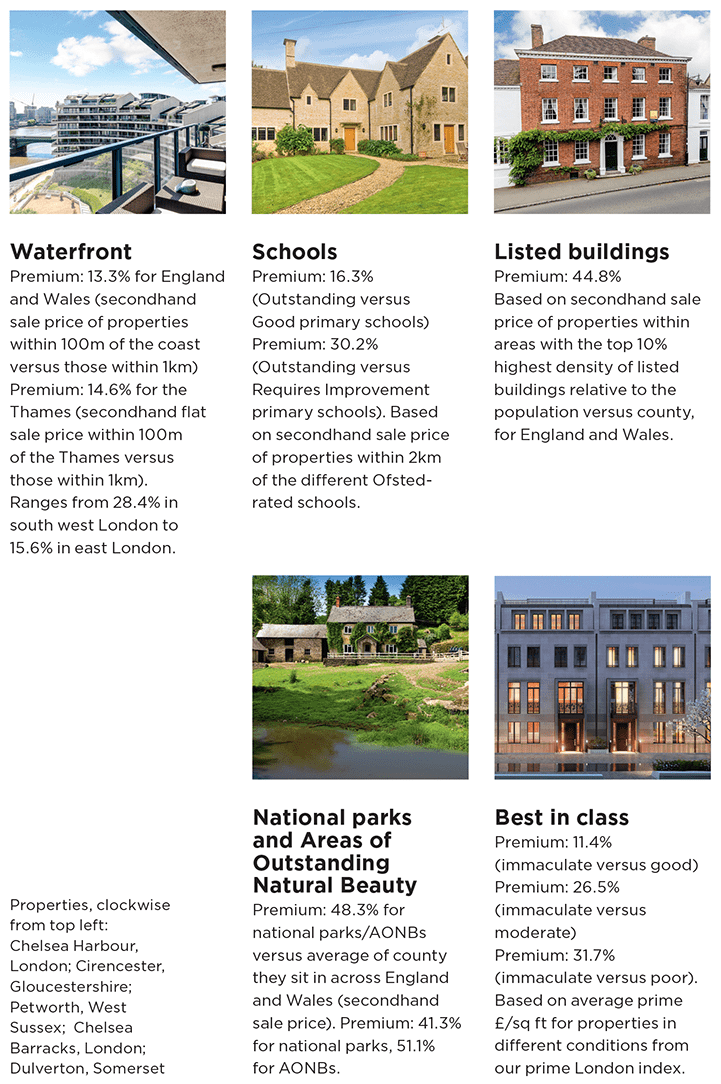

Return on investment Five property attributes that attract a premium

For the best-in-class estates, the total value is usually more than the sum of its parts which creates a profitable marriage value. In 2017, there were 47 £5 million-plus estate sales where the land area was at least 200 acres. Together, those assets had an aggregate value of £406,445,000.

Attracting a substantial premium can also come down to other appealing features. A waterfront setting, for example, can add almost 15% to a Thames-side property. We look at this and other factors above, while our research into the premiums of urban over rural living is illustrated below.

Urban uplift The difference in average price (£/sq ft) for city properties compared with those in the surrounding area

Source: Savills Research

8 other article(s) in this publication