■ We forecast there will be £5.3bn traded in 2017, or 75,000 beds.

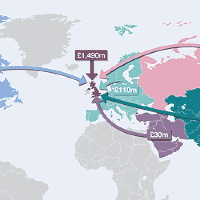

■ Brexit will drive international investment because of currency discount due to fall in value of sterling.

■ Investors are becoming pickier. Yields in prime locations will sharpen this year. In the weakest markets they will soften.

■ This year’s development league table has more fallers than risers. Developers will have to be careful when selecting sites.

■ There will be more sites switching from PBSA to Build to Rent. There are opportunities for investors that can adopt a flexible delivery approach in over supplied markets.

■ If the Government removes students from its immigration targets, we expect international student numbers to grow 6% per annum.

■ There is an even greater opportunity for diversification, with the same investor providing rented housing for students, young professionals, families and older people.