2016’s performance was slightly lower than the record set in 2015, which saw over £6bn worth of student housing change hands. However, the volume traded in 2016 was still 54% higher than the average for the last five years.

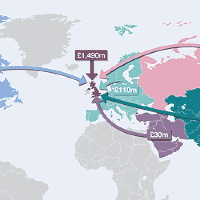

Many more of these deals took place in the second half of the year, as investors opted to wait for any market movement following the outcome of the EU referendum. The UK’s decision to leave the EU does not seem to have affected investment appetite – in fact, it may have intensified it. With sterling now worth less relative to many other international currencies, deals are highly attractive to overseas investors.

The appetite for student housing assets has outgrown the supply of available stock. Of the £4.5bn traded in 2016, £1.1bn (25%) involved forward funding developments while £223m (5%) were development sites. Existing stock made up 69% of trades, the lowest proportion on record. We expect this higher level of investment in development to continue this year.

The trend towards consolidation has continued. This has had a striking effect on our rankings of student housing investors. Two of our Top Ten investors by number of beds are new entrants to the list, having not invested in the UK student market at all until last year. This shows how student housing has established itself as an attractive asset class worldwide, even in the face of political risk.

.png)

.png)

.png)