■ The General Election presents an opportunity for policy to become more welcoming to international students. If students are removed from migration targets, growth of overseas students in the UK could exceed worldwide growth of 6% per year.

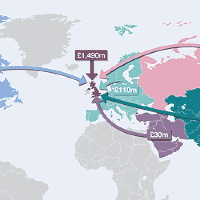

■ Brexit may have intensified appetite for UK student housing. We saw over £2.1bn transacted after the referendum, compared to £1.9bn earlier in the year.

■ Development prospects are stronger this year in prime markets such as Exeter, Guildford and Leeds. They are weaker in cities such as Aberdeen and Liverpool.

.png)