The diversity of branded residential schemes, in terms of location, type, brand, and design, continues to be a strong selling point for this unique property type.

In the coming years, as the global economy continues to produce increasing numbers of high-net-worth individuals with international lifestyles, there will be an ever-growing demand for branded residences around the world. New brands will enter the space and existing brands will reinforce their residential offerings.

Brands with debut schemes in the pipeline that will enter the market before 2030 include Dolce & Gabbana, De Grisogono, Mama Shelter, and Rare Finds. Each of the brands entering the sector will introduce their own design and service offering and will attract new and existing buyers to their schemes.

In the coming years, we expect demand for the branded residence product to remain strong in global cities, which are business and education hubs that offer the lifestyle, cultural attractions and unique experiences that are significant drivers for prospective buyers and their families.

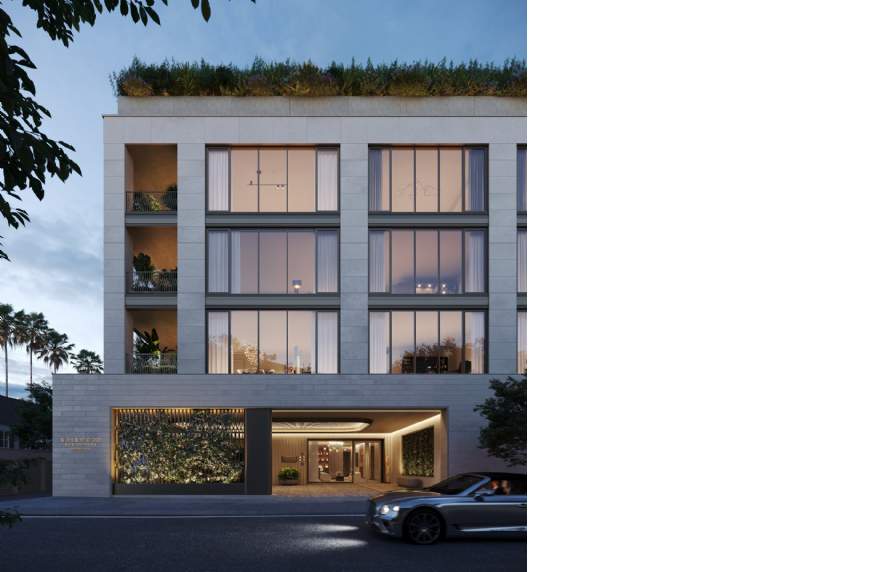

Rosewood Residences Beverly Hills

One of the most important benefits of a rental program to a buyer is the fact that the programmes enable the homeowner to seamlessly and effortlessly transition from periods of personal use to periods in which the property is rented, as the details are typically attended by the operator.

The decision to purchase a branded residence is often accompanied with deciding how to furnish the residence. Residence owners may be provided the option to purchase a developer furniture package, or they can purchase an unfurnished unit, allowing for customization. However, if a residence owner intends to participate in the rental programme, they must conform to the brand’s furniture package, aligning with the brand’s aesthetic and ensuring it is furnished in an operationally viable manner. This ensures a consistent experience for guests and delivers the brand standard.

Incidentally, some high-net-worth individuals (HNWIs) prefer developments that impose restrictions on rental programmes. These restrictions aim to maintain a sense of security, privacy and exclusivity by limiting short-term rentals. Such measures curtail short-term guest traffic from outside sources, bolstering privacy within the community. This level of control over the rental programme enhances the allure of branded residences for HNWIs who seek luxury and seclusion.

Hotel brands play the pivotal role in the success of these rental programmes. Buyers who acquire brand approved furniture, fixture, and equipment (FF&E) packages are subsequently granted the opportunity to participate in the rental programme. Notwithstanding this, the brand may retain the authority to determine the number of units that may be included in the programme based on market demand and careful management and coordination of hotel rooms and residences. Management of the units in the rental programme, as well as their marketing, is exclusively managed by the hotel operator with thoughtful regard for their hotel inventory.

Mandarin Oriental Residences, Fifth Avenue

Revenue generated by branded residences through the rental programme may be recorded on a separate profit & loss statement (P&L) or may be accounted for within the hotel’s P&L. The implications of both options require careful consideration as well as the decision to distribute a topline revenue split, or a bottom-line revenue split to participating residence owners. For the avoidance of doubt, any ancillary revenues, such as those from food and beverage, from spa & wellness amenities, or from other operated departments are accounted for exclusively on the hotel’s P&L, and not included in rental revenues. Regardless how rental programme revenues are recorded, rental programmes possess the ability to improve the bottom line performance of the hotel, demonstrating an uplift on hotel gross operating profit, through cost allocation and operational synergies. Generally, owners of branded residences participating in rental programmes receive a distribution of the rental revenue. This share typically ranges from 40% to 60% of gross revenue, after which the residence owners must account for fixed property expenses including, but not limited to, their service charge obligations.

Structuring rental programmes within mixed-use developments requires careful planning and thoughtful consideration including clear definitions of contracting parties, limitations and restrictions imposed through the associated rental agreements, as well as budgeting and distribution of revenues in accordance with an optimized index. When it is done successfully, performance indicators suggest that average daily rates throughout the year can range from several hundred US dollars to several thousand US dollars with occupancies often 20 percentage points behind their co located hotels and not unusually between 30% and 35%.

For many, rental programmes are a vital component of the branded residential value proposition, and contribute tangibly to the marketability of branded residences. With the allure of luxury living, personalized experiences, and potential financial offsets, the rental programmes in branded residences exemplify a harmonious collaboration between property owners, residence owners, and prestigious hotel brands.

SLS Palm Jumeirah Dubai Residences

Read the articles within Spotlight: Branded Residences below.

Further information

Global Residential Development Consultancy

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)