Rural forecast

The importance of natural capital will require farmers and landowners to prioritise sustainability

The importance of natural capital will require farmers and landowners to prioritise sustainability

Natural capital is gaining credence as the future foundation of public investment in land management. The concept offers a broader range of possibilities for landowners than public money alone, with new offerings in private finance for green investments coming to the market with increasing frequency.

The concept of natural capital has gained a foothold in the UK rural economy through the work of influential academics such as Professor Dieter Helm, chair of the Natural Capital Committee, which advises the Government on its environmental performance. The natural capital concept underpins the 25 Year Environment Plan, and the ‘public money for public goods’ elements of the Agriculture Bill.

Natural capital can be defined as the stock of natural assets, including geology, soil, air, water and all living things. From these assets we derive the goods and services that make human life possible, including food, drinking water, building materials, climate regulation, flood defence and pollination. Collectively, these are known as ‘ecosystem services’.

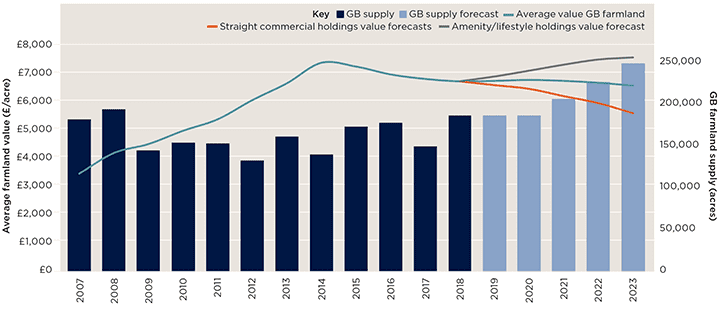

GB farmland forecasts Divergence of potential

Source: Savills Research

The 25 Year Environment Plan is significant. It is expected to be the basis of the forthcoming Environmental Bill and, based on the Government’s ambition, could create an entirely new baseline in environmental regulation for the UK. The Plan sets out three key principles for the future of all land management in the UK: public money for public goods, the ‘polluter pays’ principle, and a net environmental gain on all new developments.

Despite lobbying efforts, it has been made clear that food (or food security) is not considered to be a public good, and there is no mention of income support in the Agriculture Bill, unlike the Common Agricultural Policy (CAP). So, we predict that some farming businesses are likely to receive less in the way of public support in the future. Instead, the proposal in the Agriculture Bill is for public money to be invested in classes of natural services that would not otherwise be supplied privately, such as climate mitigation and biodiversity.

The concept of natural capital has gained a foothold in the UK rural economy

Savills Research

There have been a number of well-publicised partnerships between water companies and land managers that have paid farmers to change their farming practices to avoid causing pollution. However, one concern is that a strict application of the ‘polluter pays’ principle would undermine the viability of this fledgling ‘market in avoided costs’. Certainly, this type of private investment implies a perverse incentive to pollute. Avoiding flooding and mitigating consumer and trade pollution through water filtration services remain areas to consider.

What is clear is that government is looking for ways to attract private investment into ecosystem services, and to blend this with public investment. Carbon credits and the forestry agenda is an obvious case in point. At present, this market is dysfunctional and would benefit from reform to facilitate investment.

The issue is that in many cases nobody really owns the natural capital asset. That is indeed why these assets have been exploited rather than preserved.

What is it going to take for these new assets in natural goods and services to be valued and traded as commodities in their own right? A regulated marketplace is key, but certainty over property rights is more important. Blending public and private sources of investment will then be possible and perhaps crucial to developing valuable multifunctional landscapes and income opportunities for land owners.

For the six key rural trends for 2019, please click here.

8 other article(s) in this publication