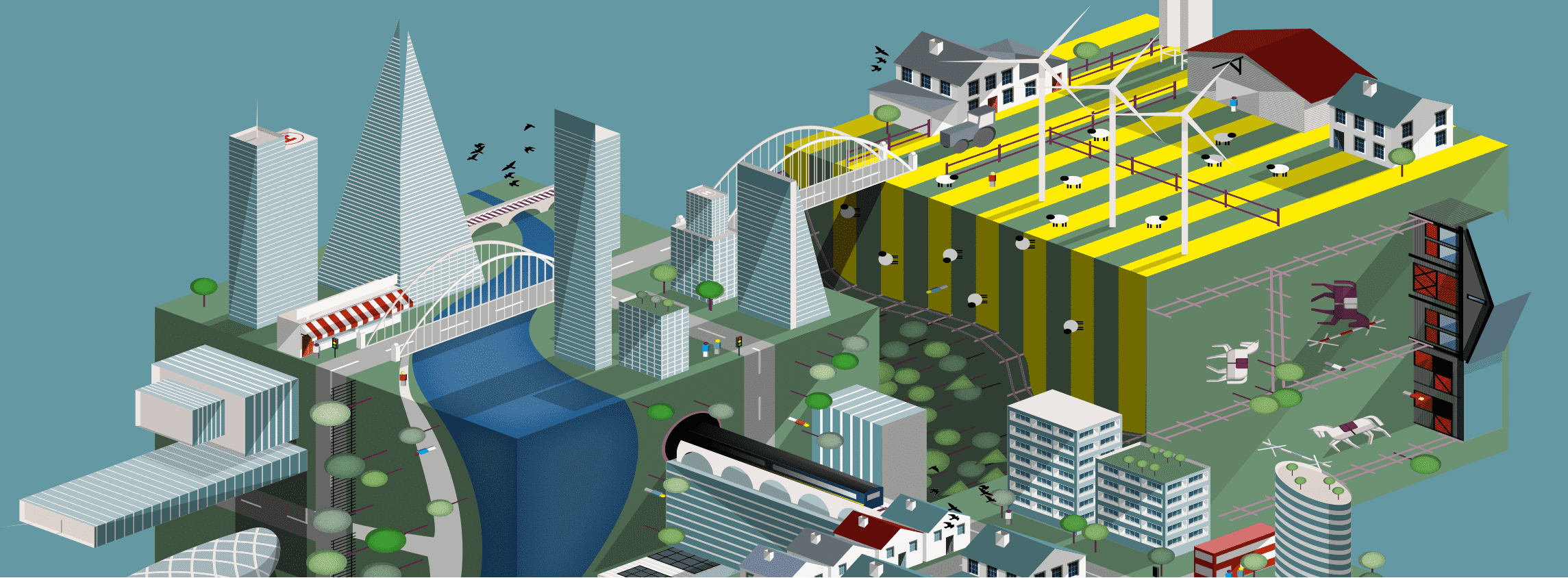

Investment focus

Where to find value across the residential, rural and commercial sectors

Where to find value across the residential, rural and commercial sectors

Development land in demand

The sweet spot in the development-land market appears to be for smaller sites in local authorities with high housing targets who may struggle to meet the housing delivery test. Demand will come from better-financed small and medium sized house builders and Housing Associations.

Urban investment

There is potential for buyers to stretch loan-to-income ratios in second tier cities and towns in the Midlands and the North that are well connected to major regional centres or have a diverse local employment market. They are likely to offer investors a less-crowded marketplace compared with, for example, Manchester and Birmingham.

Diversified income

A key aspect to future-proof rural businesses remains diversification of enterprises. Estates in the South East of England profit from greater residential, commercial and trading enterprise demand than those in other parts of the UK. This reduces their exposure to returns from farming. Analysing the demographic context of an investment is crucial to understanding income growth potential and capital value stability.

Quality shines through

The top-performing farms in the UK have been forecast to thrive under any potential Brexit scenario. Where structural issues, such as soil quality and location, inhibit this performance, values may be affected. However, for good-quality land and certain livestock enterprises, productivity and market alignment mean that performance should be resilient to the evolving policy and trade environment. Structurally sound but poorly managed rural assets could be an attractive pick.

New London developments

The strong occupational trends and falling levels of development activity in the London office market look like they will leave the capital with a severe undersupply of Grade A office space in 2021 and beyond. However, some large new development opportunities will come to the market in 2019, and we expect them to be strongly contested.

Contra-cyclical investment in retail

The unremittingly negative news about retail has led to sharp (and unscientific) repricing of the sector across the UK. Prime assets will remain prime, and opportunistic investors would do well to run a forensic eye over UK retail to identify good assets that could be bought comparatively cheaply.

8 other article(s) in this publication