Cross sector forecast

Despite economic and political unpredictability, attractive investment opportunities are still coming to the market

Despite economic and political unpredictability, attractive investment opportunities are still coming to the market

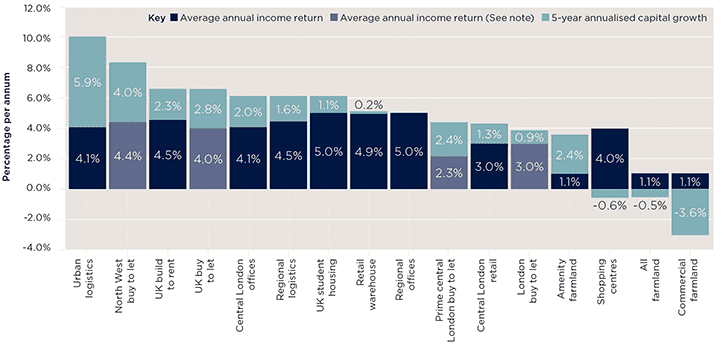

Our projections of five-year investment returns for different asset classes have a similar shape to last year. If anything, there is now even more emphasis on the fundamentals of supply and demand to support secure income streams and greater reliance on rental growth to deliver capital appreciation. This reflects the uncertainty surrounding the economic and political backdrop.

Comparative returns chart The next five years: outlook for annual income and capital growth

Note: In a world of data, it is surprisingly difficult to arrive at comparative income returns for different asset classes. For residential buy to let investments, our model uses a combination of data from the valuation office, the Land Registry and Rightmove. We have then had to take into account that while commercial property income streams will often be underpinned by full repairing and insuring leases, in the residential markets these are the responsibility of the landlord. Agricultural tenancy obligations sit somewhere in the middle. For consistency, we provide figures net of all irrecoverable costs in line with IPD industry standards. No account has been taken of the restricted tax relief available to private buy to let investors using mortgage finance (which would reduce effective income returns for some investors).

Source: Savills Research

To arrive at our numbers we have had to make assumptions as to the outcome of Brexit. First, we have assumed it will occur. Second, we have assumed that whatever the outcome it will not signal the end of uncertainty, which will persist through the first few years of the forecast period. That should mean that interest rates will continue to gradually rise through the forecast period, essentially meaning that we have seen the end of widespread yield compression across the sectors.

Urban logistics sits at the top of the pile, driven by the weight of money attracted to what has become the darling of the commercial property sector on the back of structural change and strong rental growth.

In the residential sector, a continued undersupply of homes for rent underpins our expectation of continued rental growth. Restrictions on the tax relief available to mortgaged buy to let investors make it more difficult to compare returns against other asset classes, or indeed the growing build to rent sector.

This less-attractive investment environment for private investors will limit the stock hitting the rental market, particularly in the lower-yielding markets where it is more difficult for them to make the maths work. This will generally shift investment focus further north where house price growth prospects are greater, now that we have entered the second half of the housing market cycle.

That said, investment levels from wealthy overseas buyers of prime central London property are expected to improve over our forecast period. Assuming the outlook becomes more certain, we expect buyers to increasingly take advantage of the price adjustments seen in this market since 2014, albeit not to the same degree as in previous cycles.

Uncertainty over the shape of future agricultural policy and the impact of prospective trade deals on commodity prices indicate that price growth on rural assets will be confined to more diversified holdings or those where amenity value is a key component of value. While the returns on this asset class look uninspiring, demand is likely to continue to be underpinned by the tax benefits of ownership and the need for those looking to expand their landholding to enter the market as and when a scarcely traded asset comes to the market.

8 other article(s) in this publication