prime markets

Despite pockets of modest growth in the regions, expect Britain’s prime markets to remain price sensitive and driven by needs-based purchases until Brexit negotiations are complete, say Lucian Cook and Frances Clacy

.png)

Despite pockets of modest growth in the regions, expect Britain’s prime markets to remain price sensitive and driven by needs-based purchases until Brexit negotiations are complete, say Lucian Cook and Frances Clacy

What have been the key drivers in the prime housing market over the past four years?

Much like the mainstream market, the uncertain political and economic outlook has made buyers more cautious and price sensitive. The outlook for jobs and earnings in the City has been a particular concern for prime purchasers in London and the South East, though the risk of wholesale relocation of jobs in the banking industry has receded.

This has coincided with higher stamp duty costs and greater exposure to inheritance and capital gains tax for overseas buyers. The impact of this has been most noticeable in prime central London.

Although the prime markets tend to be much more equity-driven than the mainstream, mortgage regulation has also played a part in limiting the amount some buyers can borrow as they look to trade up – both in London’s established wealth corridors and beyond.

Political events and changes to the tax regime have led to values falling more gradually than in other downturns

Savills Research

What has this done to property prices in the prime London markets?

Even before the stamp duty overhaul in 2014, price growth had started to slow in prime central London as it started to look fully priced. That left it exposed to those stamp duty changes and marked a turning point in the market.

Subsequent political events and changes to the tax regime have led to values falling more gradually than in other downturns, but over a much longer period. At the end of September 2018, prices in this market had fallen by 18.4% since 2014 – a comparable level to other significant downturns in the early 1990s and after the credit crunch.

Other prime London markets, such as South West London, reached their peak a little later, in September 2015. The price adjustment there has been less severe than in central London, down 7.6% since 2014. However, annual price movements stand at -3.1%, similar to the most exclusive London neighbourhoods.

.png)

Cyril Mansions, Chelsea, London

And the markets beyond London?

With less impetus from the capital, annual price movements have gradually moved into modest negative territory across the high-value suburbs in the home counties, prime properties in the uber-towns of southern England and their village and rural counterparts. In these markets, there was noticeably weaker price growth in the run up to the slowdown.

Further north and into Scotland, markets have been more robust. Lower values and slower price growth in the past 10 years have meant less exposure to stamp duty and left them less sensitive to weakened sentiment. Here, modest annual price growth remains, with Edinburgh city the strongest market during the past year.

.png)

Hermitage Gardens, Morningside, Edinburgh

Historically, any recovery in the prime markets has been sparked in central London, with a strong bounce in values

Savills Research

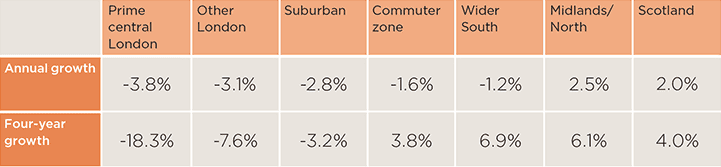

Prime variation Price growth in the past year and since 2014 (to September 2018)

Source: Savills Research

What are the prospects of a cut in stamp duty at the top end of the market?

The latest comprehensive data we have on stamp duty receipts relates to the 2017/18 tax year. It suggests that transaction levels in London’s two central boroughs of Kensington and Chelsea and Westminster have fallen by 35% in the past four years, but that the stamp duty take is still 19% higher than in 2013/14.

Furthermore, sales of properties of more than £1 million across the country as a whole were 25% higher in 2017/18 than four years previously. With a relatively high proportion of purchases bearing the 3% stamp duty surcharge as well as a higher underlying rate of tax, they raised an additional £1 billion in tax revenues over the same period.

In April, the Treasury calculated that cutting each of the marginal 10% and 12% rates of stamp duty by 1% would result in a loss in tax revenues of more than £100 million which made a cut look unlikely. Instead, we have seen proposals for an additional surcharge on non-UK resident buyers of between 1% and 3% that is expected to increase tax revenues by up to £120 million.

.png)

What does history tell us about the prospects for a recovery in the prime housing markets?

Historically, any recovery in the prime markets has been sparked in central London, with a strong bounce in values. Often, the catalyst has been a currency advantage, though it requires this property to look identifiably good value and for some of the uncertainty afflicting the market to clear.

As a result, until Brexit negotiations are complete, we expect the market to remain price sensitive and driven by needs-based purchases.

The experience of the past underpins our central London forecasts from 2021 onwards. However, the prospect of increasing interest rates, higher investment returns on competing assets and a general election in 2022 suggest a less exuberant recovery than in previous cycles, especially given the higher tax environment.

We expect the other, more domestic, prime markets of London to benefit from a flow of wealth out of central London during that recovery phase. But they are more likely to be held back by weak sentiment feeding up from the mainstream housing market. The impact of rising interest rates will also be felt more strongly, given the much greater use of mortgage debt in these markets.

That is likely to weaken any ripple effect into the commuter zone. It is more likely that the relative value afforded by other prime regional housing markets will be a greater driver, meaning higher expected price growth across the prime housing stock across the rest of the UK.

.png)

Source: Savills Research

Note: These forecasts apply to average prices in the secondhand market. New build values may not move at the same rate

5 other article(s) in this publication