uk forecasts

We highlight the main drivers behind UK mainstream price movements. Plus, our five-year forecasts for the UK and its regions

We highlight the main drivers behind UK mainstream price movements. Plus, our five-year forecasts for the UK and its regions

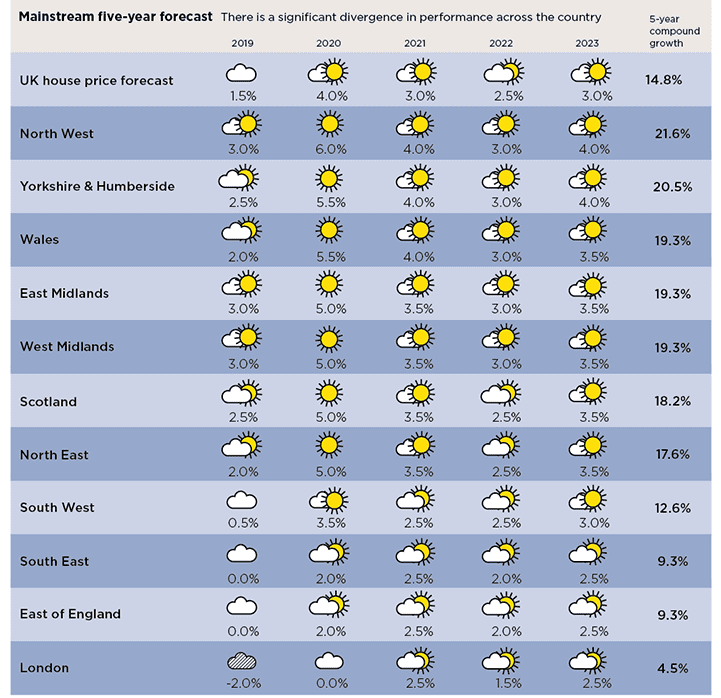

At this point in the property cycle, growth in London typically slows as price rises ripple out to the regions. This time, the divergence appears even more marked. With Brexit uncertainty in the short term, a general election on the horizon and rising interest rates, stretched affordability will limit growth in London and the South. Conversely, we expect growth in the North West and Yorkshire to be over 20% by 2023.

.png)

Source: Savills Research, Oxford Economics

Two new housing ministers. Two Bank of England base rate hikes. Continued disagreement on what flavour of Brexit the public voted for back in 2016. A lot has changed since our property forecasts from a year ago.

Although we have become accustomed to a merry-go-round of ministers responsible for housing, the likely trajectory of interest rates and underlying Brexit uncertainty have been at the heart of a slowing in levels of UK annual house price growth. At the end of September, Nationwide put it at 2%.

The main impact of these factors has been to weaken confidence. Indeed, the RICS housing market survey has given a positive reading for new buyer enquiries in only two of the past 18 months.

Sentiment running low

In the short term, sentiment will remain the primary driver of house price movements. The economic implications of Brexit, and what this might mean for household finances, lies at the heart of this.

Last year, we based our forecasts on the assumption that the UK would begin a transition agreement with the EU in March 2019, followed by a free-trade agreement.

The progress that is made in Brexit negotiations, both in the run up to March next year and what happens afterwards, will be key to sentiment among buyers.

The sooner a deal is struck, the more certainty it will bring to the market. The more prolonged this period of uncertainty, the greater the chance that current market malaise will spread beyond London and the South East. This would slow house price growth more widely, at least until we get a clearer picture on the economic implications of leaving the EU.

More particularly, a lot depends on what Brexit means for interest rates and income growth.

There is some interplay between the two. Assuming that – as most economic forecasters are suggesting – we avoid a full-blown recession, then interest rates are probably the bigger of the two variables.

.png)

Affordability issues

For now, affordability, measured by mortgage payments as a percentage of income, remains pretty benign. The base rate is still only 0.75% – far lower than at any point in the 20 years before the global financial crisis. According to the Bank of England, the average interest rate for a two-year fixed mortgage in September was still only 1.7%.

The base rate hike in August was more about putting buyers on notice of what may occur in the future. The expectation is that base rates will rise gradually. This will put a squeeze on the amount people can borrow, particularly as mortgaged buyers factor in the additional cost of the capital repayments that have now become the norm. This is likely to amplify the effects of the stricter 2014 mortgage regulations over the second half of our five-year forecasting period.

From 2021, we expect the Bank of England base rate to rise from 1.5% to 2.75% by the end of our forecast period. This is unlikely to be a problem for those households already paying their mortgage. But, assuming it remains unchanged, a 3% affordability stress test for new buyers will start to impinge on the amount people can borrow relative to their earnings.

In turn, the rate of house price growth will be constrained. This is likely to have a much greater impact in London and the South East, where buyers are already operating on higher loan-to-income ratios than elsewhere in the UK.

In combination with restricted tax relief, this will also continue to hit mortgaged buy to let investors. Already, these investors have become much less active in the market, especially where high house prices and low yields make it more difficult for them to make the sums add up.

That adds to the regional dimension of our property forecasts. So, in revisiting them, we have looked again at where we are in the cycle and concluded that the divergence in performance across the country is likely to be greater than we have previously predicted.

You can see how that divergence works region by region below, and in our regional forecasts.

Source: Savills Research

Note: These forecasts apply to average prices in the secondhand market. New build values may not move at the same rate

5 other article(s) in this publication