Prime forecasts

Buyer sentiment across the prime markets is expected to remain sensitive for the next few years, but long-term prospects appear favourable

Buyer sentiment across the prime markets is expected to remain sensitive for the next few years, but long-term prospects appear favourable

The prime central London market is not expected to see further significant falls in value, but we don’t expect a return to growth until there’s greater Brexit clarity. Economic uncertainty means the market will remain discretionary, while international buyers will be reluctant to take advantage of the currency play given the high tax environment.

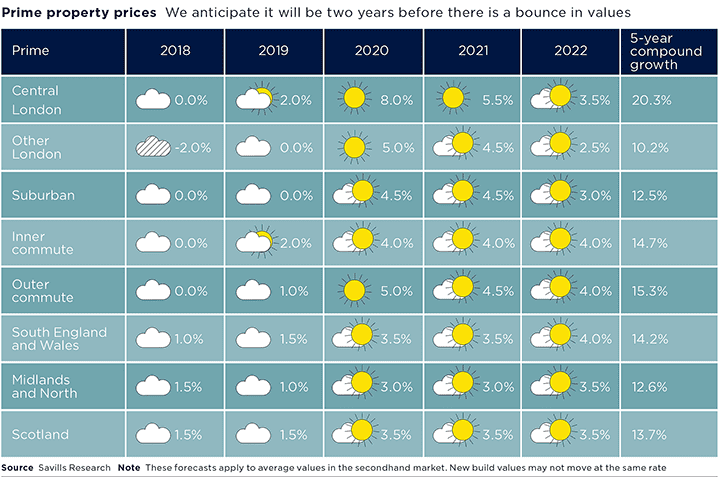

Our forecasts anticipate it will be two years before we see a bounce in values, though this increasingly depends on the political environment.

Continued weakness is expected in other prime London markets that are more dependent on access to domestic wealth generation and borrowing than prime central London. As such, we forecast small falls this year.

Political and economic uncertainty has also translated into buyer caution in the prime country market. This is compounded by the costs of stamp duty, particularly at the top end of the market and for those buying an investment property or second home.

The price gap between London and the rest of the country remains, and committed buyers are likely to take advantage of this. This will drive a flow of wealth into the commuter belt and beyond, so the prospects for house price growth over the next five years remain positive.

4 other article(s) in this publication