Prime Rents

High supply may be limiting growth, but the rental market provides opportunities for a variety of investors

High supply may be limiting growth, but the rental market provides opportunities for a variety of investors

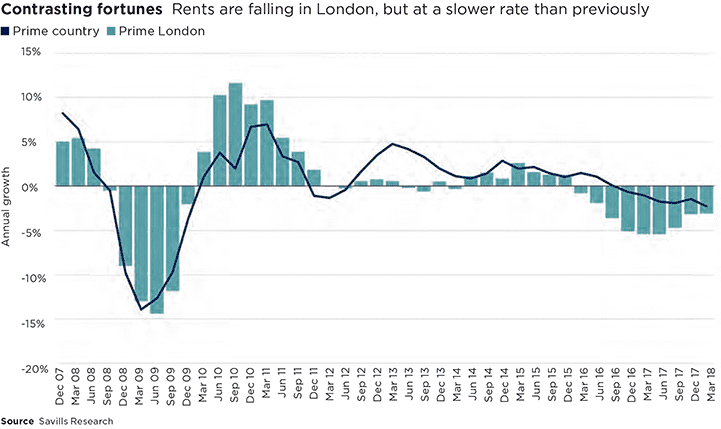

Over the year to March 2018, prime rents across London fell by 3.1%, with a fall of 2.3% across markets in its commuter belt. High stock levels are continuing to provide more choice for tenants, limiting rental growth.

Yet, rents are falling at a slower rate than in previous quarters, which suggests the market is finding a balance, and despite these falls the levels of new tenancies and re-lets remains strong.

With stock still working its way through the market, pricing is absolutely key to retaining demand.

Demand remains stronger for properties of the best condition, especially in central markets. Properties in prime central London classed as immaculate saw rents fall by 4.8% over the past year, compared with a fall of 6.0% for properties in poorer condition.

With immaculate new build stock coming to the market, investing in condition is a way to retain an edge. Here, we assess three other strategies for landlords to stay competitive.

Subdued buyer sentiment has resulted in properties taking longer to sell. Across prime London, we have seen this rise from 5.7 months at the peak of the market in 2014, to 8.1 months in 2017.

Unable to sell their property, there has been an increase in the number of accidental landlords who rent it out instead. But being in this position is not necessarily a bad thing. It’s often much quicker to let a property than to sell, and a successful tenancy can sometimes lead to a sale.

As owners tend to invest more into their own properties, stock from accidental landlords is often of higher specification. And in a market driven by quality, these properties can often command higher rents.

.jpg)

▲ Bayswater, London

Across the prime markets, the levels of buying for investment are decreasing as a result of pressure on the buy to let sector, especially in London. The number of new buy to let mortgages has fallen by 36% since 2015, as landlords start to rationalise their portfolios.

However, the proportion of investors buying with cash has been steadily growing – from 59% of buyers in 2014 up to 67% in 2017. They are not impacted by mortgage regulation or the cut in interest tax relief.

Instead, these landlords are seeing current conditions as an opportunity to invest. This is particularly the case for international investors who can still make a currency play. International landlords have increased their share of the prime London market from 22% in 2014 to 28% in 2017.

We have seen in the past how estate landlords leading on the regeneration of an area can fuel demand in the capital – with examples such as Cadogan’s work on the King’s Road and Sloane Street, Howard de Walden and Marylebone High Street and Grosvenor’s regeneration of Mount Street.

Adapting to a market where tenants are able to be picky, placemaking and investing in the condition of both the property and its surrounding area can be a lucrative way to attract tenants.

Just under one-third of tenants across the prime London market rent because they are relocating for lifestyle reasons. This proportion is even higher for those areas of London that retain a village-like feel, such as Fulham, Marylebone and Notting Hill.

▲ Richmond, Surrey

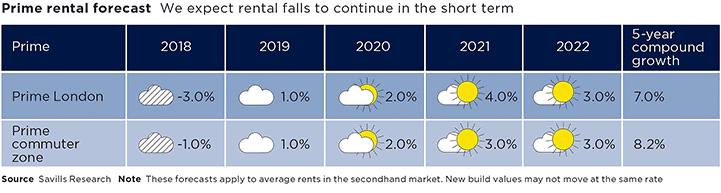

Though rental falls are slowing, there is still a high supply of stock, which is limiting growth. Prime rents are likely to continue to fall during 2018 – by 3.0% in prime London and 1.0% across the prime commuter belt.

By 2019, we expect an increase in confidence across the market as our position over leaving the EU becomes clearer.

This is when rents are likely to stabilise, but there is also a new build pipeline coming forward, some of which will become rental stock. The completion of some schemes was delayed by the uncertainty following Brexit, and we believe the level of completed units across London is likely to peak in 2019. This will limit huge rental growth as more stock is added to the market.

Over the next five-year period, we are forecasting prime rents will grow by 7% in prime London, and 8.2% in the commuter belt. Recovery is expected to be stronger here as there is less of a new build pipeline and the rental falls to date have been lower.

Landlords will need to price their stock appropriately and ensure their property is of the best possible condition to remain competitive with new build stock.

The next few years should be viewed as an opportunity for asset wealth generation.

4 other article(s) in this publication