Transactions

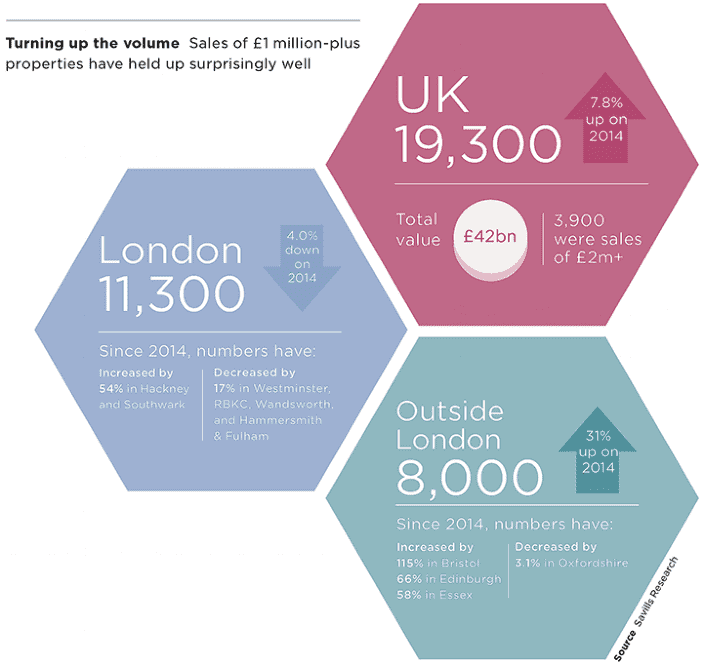

Sales of £1 million-plus properties in the UK rose to 19,300 in 2017, with high-value markets outside London being particularly active

Sales of £1 million-plus properties in the UK rose to 19,300 in 2017, with high-value markets outside London being particularly active

Whereas the prime housing market has been price sensitive during the past three years, the number of sales across the country of more than £1 million has proved surprisingly robust.

The volume of sales is a reflection of the growth in London prices over the past decade rather than the past 12 months.

It particularly reflects the strong growth in the number of sales passing the £1 million barrier in boroughs such as Hackney, Lambeth and Southwark, locations where they would have been thinner on the ground five years ago and regarded as something of an anomaly 10 years ago.

However, in some of the more established high-value locations, numbers have fallen. We estimate they are down by 34% over the past three years in the Royal Borough of Kensington and Chelsea (RBKC), mirroring the period of price falls referred to in 'Taking the pulse of prime'. That compares with a 4% fall over the same period across London as whole.

Across the rest of the country, though the market has hardly been roaring, it has been more fluid. Beyond the capital, the market was slow out of the blocks in the wake of the recession. So, buying in, and beyond, the commuter zone offers a lot more value, particularly when transaction costs are factored in.

Initially, places such as Oxford and Cambridge fed off this momentum, but it has now spread more widely across the Home Counties and into cities such as Bristol and Edinburgh.

In 2017, the high-value markets in the Midlands and the North also picked up, as prices continued to rise modestly.

4 other article(s) in this publication