A key and mature life science market in the US

San Francisco Bay Area is the Global Epicentre for Life Sciences

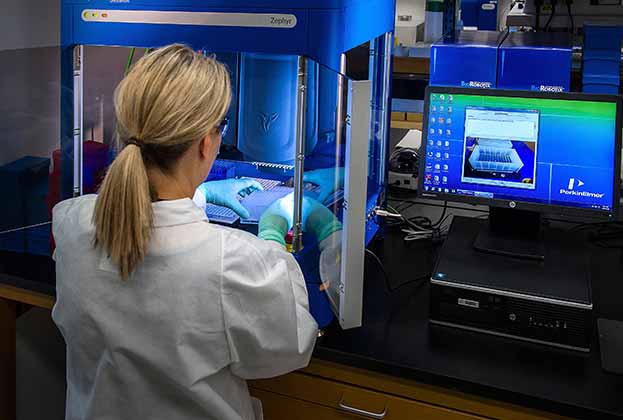

The San Francisco Bay Area is the largest life science ecosystem in the world with over 43m sq ft of space. Nicknamed ’Biotech Bay’, the Bay Area hosts industry leaders such as Moderna, Amgen, AbbVie, Gilead Life Sciences, and many others. Companies in the area have access to a top tier talent pool coming from reputable institutions like Stanford University, two University of California campuses – Berkeley and Davis, San Jose State University, and more. Life sciences employment growth in the San Francisco Bay Area remains strong and elevated demand for these specialized employees has created some of the highest salaries in life sciences across the nation.

Life sciences demand slows, but pent-up demand for high-quality R&D space keeps the development pipeline robust

Uncertain economic conditions, rising interest rates and the decline in VC funding from recent record highs have pushed many life sciences companies into cost-cutting mode in 2023. However, this change in dynamics brings with it an era of opportunity. Moderating lease activity has resulted in an uptick in available space and created a tenant-favourable market. Despite the pullback in demand, millions of square feet of new life science developments are underway and they continue to attract active tenants in the market as flight to quality prevails. One of these new projects includes Southline, a state-of-the-art development currently under construction that will encompass 2.8m sq ft of R&D and office space across six different buildings.

The San Francisco Bay Area’s life sciences market is the global epicentre for the sector and is poised to benefit from the growing need for innovation

Brianna Friedman, Senior Research Analyst, Savills Research

Additionally, San Francisco Mayor London Breed is preparing to propose legislation to help convert obsolete and unoccupied office inventory into lab space by changing zoning regulations and accelerating the approval process for permits. As the tech sector returns millions of square feet to the market and office vacancy surges, there is hope that these conversions to life sciences use can help revitalize areas like the Financial District and downtown.

Life sciences VC funding in the San Francisco Bay Area

2021 represented a record-breaking year for life sciences companies headquartered in the San Francisco metro region as they raised a staggering $19.1bn across 898 VC fundraising transactions. As the economy shifted in 2022, funding levels began to decline, and by 2023, it became clear that the pandemic-induced funding frenzy was at an end. By the third quarter of 2023, the San Francisco Bay Area raised $6.6bn from 359 deals closed. As funding levels in San Francisco temper, life sciences companies are shifting their expectations regarding how long fundraising may take and are trying to make their capital last longer.

In 2023, Kriya Therapeutics, a Bay Area biopharmaceutical company that develops gene therapies to treat numerous diseases, raised a total of $430m to clinically support the company's pipeline of gene therapies. Also in the Bay Area, Elon Musk’s company, Neuralink, raised over $280m and plans to start the recruitment process for the first human trial to surgically place a brain-computer interface (BCI) in patients with paralysis. Funding remains available for exciting science and unmet needs.

Looking forward

Although the entire country has felt the impact of recent economic headwinds, the life sciences industry is better prepared to withstand the ongoing volatility. On top of the National Institute of Health (NIH) and other U.S. agency funding for the sector, the White House signed an executive order at the end of 2022 for an additional $2bn to advance biomanufacturing and biopharma innovation, which will spur growth in life sciences. Funding from biopharmaceutical companies is on the rise as a large number of patents for ’blockbuster’ drugs are set to expire over the next decade, which will elevate R&D spending in the subsector. Lastly, as the Boomer generation ages, there is a growing need for life sciences development to cure and prevent disease. The San Francisco Bay Area’s life sciences market is the global epicentre for the sector and is poised to benefit from the growing need for innovation.

Read the articles within Spotlight: Life Sciences – Trends & Outlook below.

.jpg)

.jpg)

.jpg)