A snapshot of the market in the Golden Triangle, which is heading towards a record year in 2023

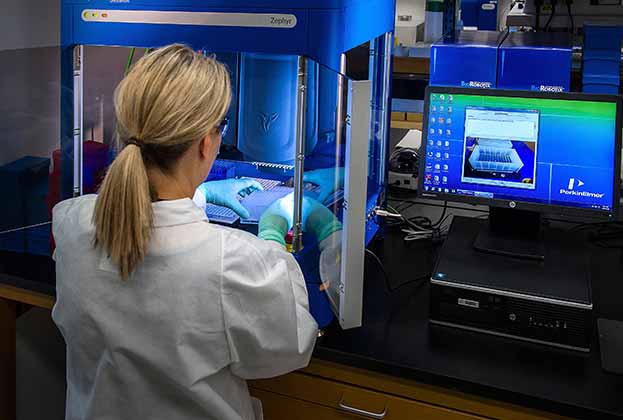

The expansion of the science and innovation sectors across the Golden Triangle has resulted in an increased demand for real estate which has been evident when analysing the take-up levels across this market area. Across London, Oxford and Cambridge, there was 982,000 sq ft transacted at the end of the first three quarters which was 4% above the same time period last year.

Notably, laboratory take-up in Oxford and Cambridge is set to be the highest annual total ever recorded in 2023, demonstrating the continued growth of these sectors. At the end of Q3 2023, there was 269,000 sq ft and 189,000 sq ft of laboratory take-up recorded in Oxford and Cambridge, respectively. These figures were boosted by Building 960 Babraham Research Campus, Cambridge being fully let ahead of practical completion with Mosaic, Adrestia and Xap leasing a combined 38,000 sq ft. The UK has the largest biotechnology cluster in Europe which is set to be further enhanced by a leading occupier from the sector under offer to lease 85,000 sq ft of shell and core laboratory space at 1000 Discovery Drive, Cambridge Biomedical Campus. They will join Cambridge University Hospitals NHS Foundation Trust which has acquired the remaining available space at the scheme totalling 23,000 sq ft.

Oxford has also experienced strong demand for laboratory space with Moderna pre-letting a 145,000 sq ft R&D facility at Harwell Campus. Other transactions have included Oxford Gene Technologies letting 12,000 sq ft at two recently completed buildings at Life Science REIT’s Oxford Technology Park and Milvus Advanced acquiring 6,900 sq ft at Swailes SuperLab, which was the first purpose-built laboratory letting in Oxford city centre in the last five years.

Laboratory take-up in Oxford and Cambridge is set to be the highest annual total ever recorded in 2023

Simon Preece, Associate Director, Commercial Research

Take-up in London has been more subdued with 175,000 sq ft of science-related space transacted which can be predominantly attributed to the relatively nascent nature of the market in comparison to Oxford and Cambridge and the lack of available purpose-built laboratory stock. Developers are responding to the lack of supply in the capital with 116,000 sq ft of laboratory space completed this year and a further 2.9 million sq ft of purpose-built or laboratory-enabled space either being under construction or being granted planning permission. Canary Wharf’s science and innovation cluster continues to expand with 38,000 sq ft of incubator space being delivered at 20 Water Street and Kadans securing planning consent to deliver an 823,000 sq ft health and life sciences laboratory building at North Quay. This development will be the largest scheme of its kind across Europe. The submarket has secured the two largest laboratory lettings this year with AviadoBio leasing 15,000 sq ft at 20 Water Street and hVIVO acquiring 39,000 sq ft at 40 Bank Street.

The supply constraints of immediately available laboratory stock in both Oxford and Cambridge has resulted in strong developer appetite to provide this type of space. There is currently 228,000 sq ft of laboratory space under construction in Oxford that is set to complete by the end of the year. The largest scheme being The Iversen Building, Oxford Science Park, comprising 110,000 sq ft. Cambridge is also experiencing development activity with 326,000 sq ft of laboratory space set to complete by the end-2024. There will be a time lag before the Golden Triangle experiences a significant increase in laboratory stock levels with 73% of the pipeline schedule to complete after 2025.

New rental tones have been set on laboratory space with rental levels of over £70 per sq ft consistently being achieved on fitted space in both Oxford and Cambridge. Further rental growth is expected with newly fitted laboratory space delivered in the city centre expected to achieve rents in excess of £90 per sq ft from 2025 onwards. London is also experiencing rental growth with quoting rents for fitted laboratory schemes being in excess of £120 per sq ft.

The consistent delivery of real estate will be critical to enable the acceleration of the UK’s life science growth ambitions. The combined stock of laboratory space across the Golden Triangle is estimated to be 5.4 million sq ft. This is significantly below US markets which have large life science ecosystems. Notably, Boston is estimated to have nearly ten times the existing laboratory provision with an estimated stock level of 52.7 million sq ft.

Demand continues to outweigh the current supply and despite the reduction in venture capital raising due to the current economic conditions, there are currently an estimated 2.1 million sq ft of requirements. This volume bodes well for take-up next year as well as the ongoing development of the life science cluster across the Golden Triangle.

Read the articles within Spotlight: Life Sciences – Trends & Outlook below.

.jpg)

.jpg)