How much has the “race for space” boosted transaction levels?

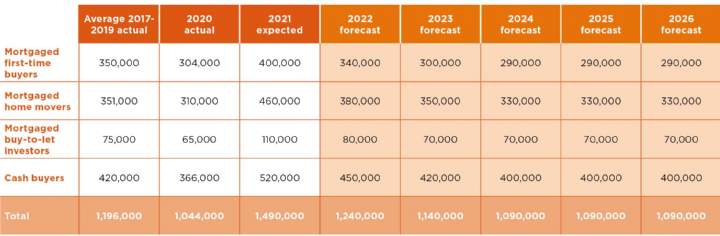

Overall transactions averaged 1,196,000 a year between 2017 and 2019. They rose to 1,552,000 in the year to September 2021, fuelled by three significant monthly spikes as buyers sought to complete purchases prior to various stamp duty holiday deadlines. As has been well documented, upsizers drove much of that boost in activity, as they looked for more space inside and outside the home.

However, we have seen an increase in activity across all buyer types. That includes first-time buyers, despite the growing challenge of raising a deposit to let them access competitive mortgage finance. It also includes buy-to-let investors who face an ever-increasing regulatory burden.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)