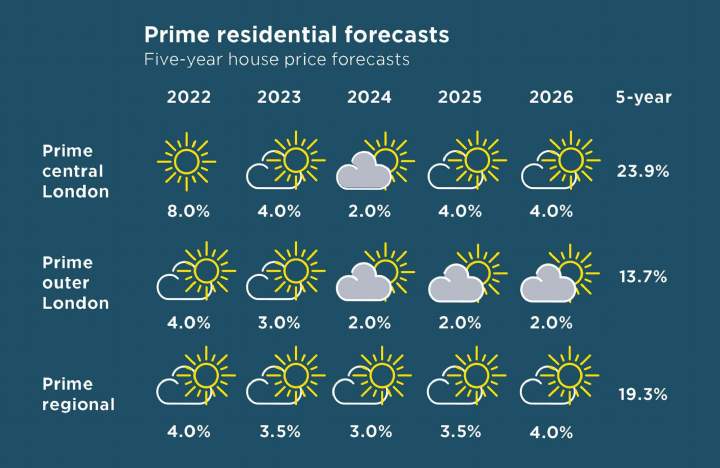

Prime Markets

The rarefied prime housing market of central London continues to look good value in a historical context and is expected to benefit from an increase in overseas demand as international travel picks up. That presents the prospect of a strong burst of house price growth next year, though a general election in 2024 could interrupt a more sustained recovery.

More generally, the equity-rich prime housing markets are less dependent on mortgage affordability and interest rates. But the prospect of an increased tax burden for wealthier households tempers our view on the levels of growth in the more domestic part of the market.

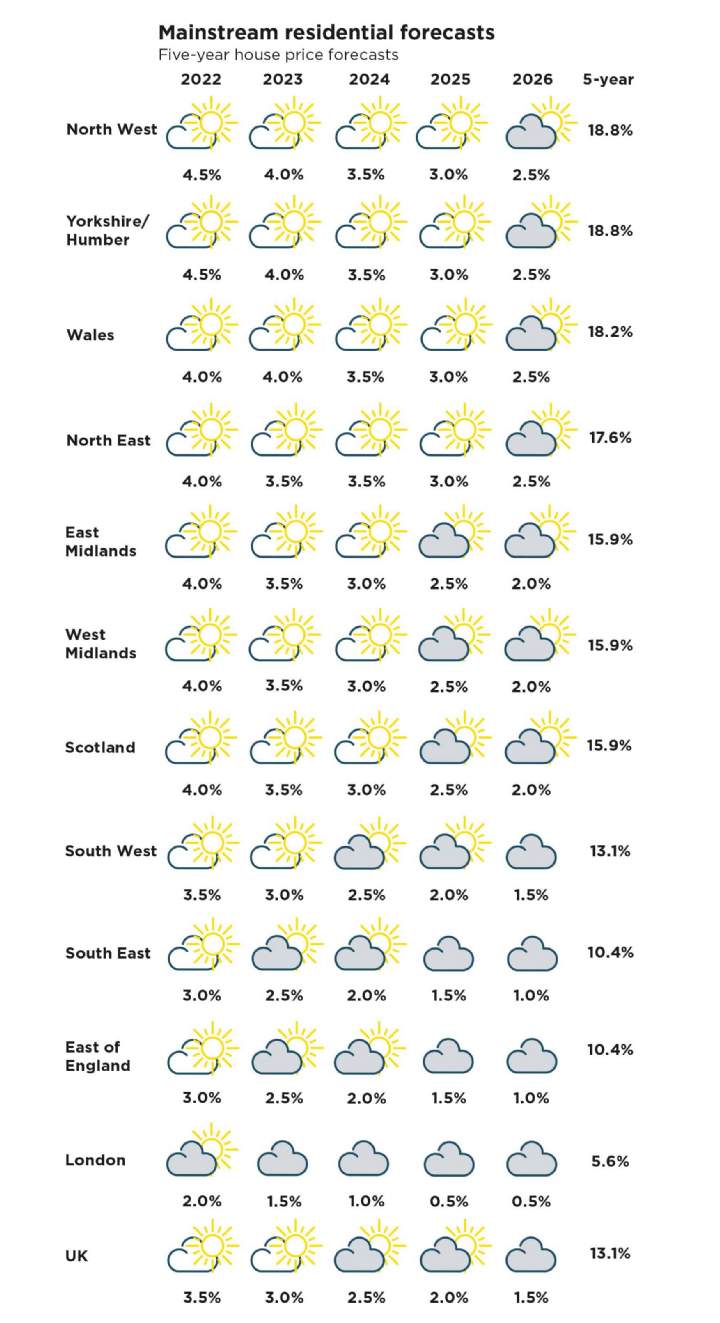

Across all markets we expect to see the change in working patterns underpin demand in suburban and more rural areas further away from major employment centres, albeit to a lesser degree than we have seen in the past year and a half.

You can read more about the prospects for the prime housing market in Prime Residential Property Forecasts.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)