High levels of transactional activity, a leap in the number of global ultra-high net worth individuals and the point at which prices sit in a historical context all point to a price recovery in London’s most exclusive residential neighbourhoods. The question is: when?

- Piecing together the central London jigsaw – words by Lucian Cook

- The lure of the country house – words by Frances Clacy

In the second quarter of 2020 – as the first wave of the pandemic hit the UK – 300 new Aston Martins, Bentleys and Rolls-Royces were registered for the first time in the UK. They were joined by 353 new Ferraris, Lamborghinis, Maseratis and McLarens.

However, during the same period a year earlier, 2,044 such supercars – more than three times as many – had been registered. Proof, if proof was needed, of a Covid-led disruption to the spending patterns of the world’s ultra-high net worth individuals (UHNWIs), a community so important to the prime central London (PCL) property markets.

Initially, transaction levels in the PCL residential market followed a similar path, though a 50% fall in sales volumes, however dramatic, was less than the one experienced in the luxury car showrooms.

A remarkable turn of speed

With the impact of the pandemic far more prolonged than initially expected, the turnaround in activity in both markets has been remarkable. By the end of the first quarter of 2021, new car registrations across these seven uber-luxury brands had returned to 1,487.

Not too shabby given the continued constraints on international travel that will have undoubtedly limited the footfall in the showrooms of the supercar retailers of Berkeley Square (not to mention the effect on automotive supply chains).

In the PCL housing markets, the recovery in activity has been even greater. This is despite being increasingly dependent on demand from domestic buyers and resident non-doms more regularly buying a home for use as their main residence.

Exacerbated by a surge in transactions in the second quarter of this year, buying activity in the past year has been 28% above levels seen pre-pandemic, according to data from LonRes. Our own data reveals that some £4.4 billion was deployed in the rarefied market above £5 million – more than £700 million above the average spent from 2017 to 2019.

Without the super-chargers

While activity levels have rebounded strongly, this has not yet translated into sustained price growth. Though annual price growth returned to the PCL market in June, at just 0.5% it was hardly at the level to set pulses racing. That means prices remain on average 20.3% below their 2014 peak in nominal terms and 28.1% on an inflation-adjusted basis. As we have been saying for more than three years, the market looks good value on a historical basis, even if a little of the currency play has been lost recently through an appreciation of sterling.

Drivers of demand

The value on offer sits against the context of a strong rise in those considered to be UHNWIs across the globe, namely those with wealth exceeding US$50 million. Despite the social and economic turmoil of 2020, their numbers increased by more than 40,000, or 24%, in the past year, according to Credit Suisse. That, fuelled by strong growth in the technology and life sciences sectors, represents the biggest percentage increase since 2003. The UK is home to the fourth highest number of UHNWIs, behind the USA, China and Germany (although India is catching up fast).

Primed for a price recovery

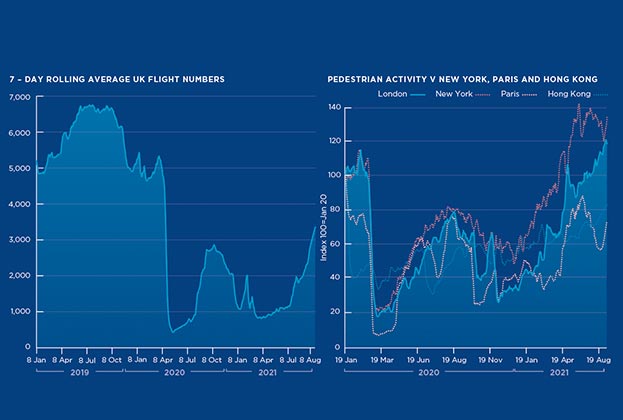

This suggests values in PCL remain poised for recovery, as and when international travel restrictions ease. Timing remains the most difficult thing to predict, with much depending on the progress of Covid vaccination programmes outside of the UK and the experience of transmission rates as social-distancing measures are relaxed in response to the UK’s own vaccination programme.

As things stand, we are forecasting values across PCL to increase by an average of 2.0% during 2021 before a more significant recovery next year, with forecast growth of 8.0%.

Piecing together the central London jigsaw

Average price movements only give part of the picture of what is going on in the PCL property market. Our index suggests that across the best-performing 10% of the PCL market, prices are only 1.0% below their 2014 peak. However, in the worst-performing 10%, prices are close to 37% below that benchmark.

Much of that variation in performance comes down to the specific attributes of individual properties, meaning it is hard to generalise about the top and bottom performers over that period. However, larger family homes in slightly more domestic areas of central London, such as Holland Park and Notting Hill, have held or recovered their value more readily than other properties.

That reflects a market more driven by those looking to buy a family home as their main residence and a requirement for more space, both inside and outside the home, given the recent experience of the pandemic. So while prices are on average 0.7% below where they were prior to the first lockdown, those with a medium or large garden have risen in value by 1.8%, while homes of five bedrooms or more in Notting Hill, Holland Park, Bayswater and Kensington have increased in value by 4.0% over the same period.

But as office-based workers return to their desks and international buyers are able to visit the capital more easily again, we expect a rebalancing of demand across different property types.

Marlborough, Wiltshire

Since mid-2020, the standout performers of the prime residential housing markets have been ultimate lifestyle and second home locations. These include properties in the £2 million+ country house market. After many years of underperforming the wider prime regional markets, this rarefied sector saw annual growth of 12.9%, its strongest performance since 2007.

Despite this recent surge in growth, values still remain on average 11.3% lower than their previous 2007 peak, suggesting there is still room for further growth. After the credit crunch, most people wanted to be in the thick of city life, so country houses went slightly out of fashion. The numerous stamp duty increases also hit these higher value, discretionary markets harder.

The general election result in late 2019 improved confidence across the country house market and there was already increased interest before the pandemic hit. The various Covid-19 lockdowns then caused many to move out of towns and cities into the countryside, and this compounded demand levels. Some were buying second homes whilst others decided to swap how they use their city and country bases.

Looking ahead, we expect there to be more focus on town and city markets now that social distancing measures have been relaxed

Frances Clacy, Associate Director, Residential Research

Scotland (where a 33.5% price gap compared with 2007 acts as an additional driver), the Cotswolds and the South West of England were the strongest performing submarkets. The Cotswolds in particular has seen an increase in demand from London buyers who have been attracted to areas around Stow-on-the-Wold, Chipping Norton and Burford.

The private estates of the Home Counties have also seen a resurgence. Of these, St George’s Hill and Wentworth remain the most exclusive and highly valued. Here, annual growth is sitting at 11.4%, following a flurry of activity driven by domestic buyers. There were 13 transactions on the estate of St George’s Hill during the first six months of 2021, the highest number recorded in the first half of any year since 2013, before the stamp duty changes.

Looking ahead, we expect there to be more focus on town and city markets now that social distancing measures have been relaxed. However, there remains a core of unmet demand from people looking to upsize or relocate, particularly with the lack of available properties across the country house market.

The lifting of restrictions and rollout of the vaccine means more stock is likely to come to the market. When this happens, a readjustment in buyer and seller expectations will be crucial to maintain current momentum. The value on offer across the country house markets will also act as an additional driver of demand.

To read more of our Residential Research please visit our Residential Hub

Read the articles within In Focus: Prime Central London – Autumn 2021 below

.jpg)