Resilient and ready to make a recovery

It won’t come as a surprise that the past 18 months have been somewhat quieter in London’s most exclusive postcodes. But as streets start to bustle once more, and confidence in the vaccine programme grows greater, London’s luxury property market also breathes signs of life again.

So, how is the residential property market here performing? Prime central London has recorded its strongest half year in both volume and value terms since the rush to beat the introduction of the new stamp duty rates seven years ago. Although encouraging, this activity is yet to translate into meaningful price growth with prices rising by only 0.2% on average.

London remains one of the world’s truly international cities, and has always enjoyed welcoming international buyers through its doors

Jonathan Hewlett, Head of London Residential

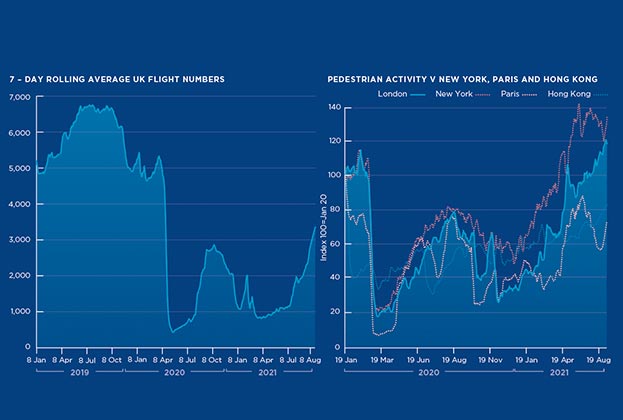

The ongoing delay in the much-anticipated price recovery reflects the continued restrictions on international travel, and has affected Belgravia, Knightsbridge and Mayfair most strongly. The likes of Notting Hill, Bayswater and Holland Park have captured the greatest levels of demand, given their appeal to those long-term residents in the UK who are looking for a family home.

London remains one of the world’s truly international cities, and has always enjoyed welcoming international buyers through its doors. From its restaurant and retail scene, to its rich history and culture, these qualities make central London one of the few places globally that international buyers understand, and feel secure to invest in.

As the world begins to open, so too will prime central London. We explore the resilience of the capital’s prime property markets through detailed research and our own agents’ voices. If you’re thinking of buying, selling, letting, renting or investing we’d love to talk to you.

Read each section below...