Market potential

An ageing population will increase demand for retirement homes in the next decade, but the market needs to offer a range of options to meet different buyers’ needs

.png)

An ageing population will increase demand for retirement homes in the next decade, but the market needs to offer a range of options to meet different buyers’ needs

There are just under 12 million people over the age of 65 living in the UK, which corresponds to around 8 million households. International benchmarks suggests specialist retirement housing should be provided for 15% of these households.

On that basis, the UK’s retirement housing stock would have to grow to 1.2 million homes: 65% more than exist now. This would require more than 400,000 additional retirement homes in England and Wales alone.

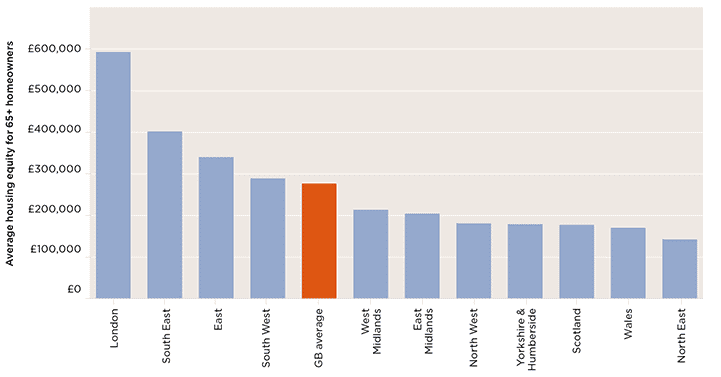

Geographical divide The amount of homeowner housing equity among the over-65s in the UK drops sharply as you move north

Source: Savills Research

The size of the prize

Over-65s own more than 40% of homeowner housing equity in the UK, some £1.6 trillion. Retirement housing has the potential to unlock some of this vast store of wealth.

That distribution of equity varies and tends to be lower as you move further north in the UK. On average, homeowners aged over 65 in London have £593,000 in housing equity. In the North East, the average is only £143,000.

This variation in housing wealth affects the demand for different types of retirement housing. The appropriate tenure mix for a scheme in Barnet, for example, will be very different from a scheme in Barnsley.

Homeowners aged 65+ own £1.6 trillion in housing equity. Retirement housing could unlock some of that wealth

Savills Research

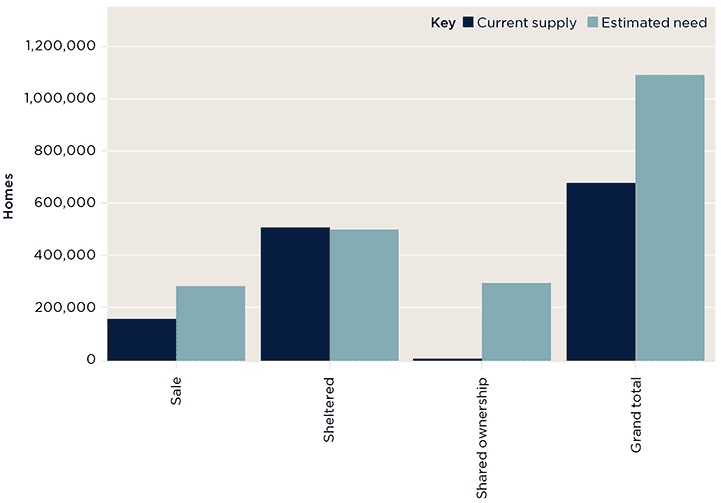

Potential by tenure

Most retirement homes for sale include substantial communal facilities and premium pricing. Assuming new retirement home values sit around the upper quartile of the new build market (ie. more expensive than 75% of other new homes in that area), and that households need to release £50,000 of equity to make moving worthwhile, 37% of homeowners could downsize outright. That’s just over a quarter of all 65+ households.

That demand accounts for 284,000 households in England and Wales. By contrast, there are just 156,000 retirement homes for private ownership.

Many more households have some housing wealth, but not enough to downsize and buy a new home outright. Shared-ownership offers households the opportunity to buy between a 25% and 75% stake in their home, while paying an affordable rent on the remainder. For households able to afford a 75% stake, Older People’s Shared Ownership is an age-targeted scheme that allows older households to buy a three-quarter share and pay no rent at all.

Assuming households buy a 50% stake, and they still require £50,000 equity release to convince them to move, that opens the market up to a further 291,000 households in England and Wales. Current stock stands at fewer than 5,000 shared-ownership homes.

Finally, many older households have no housing wealth at all. Those in the private rented sector often don’t have security of tenure, putting them at risk of eviction. Older households in social housing could free up much-needed general needs accommodation for others if they moved to a sheltered rent scheme. We estimate there’s a need for 493,000 such homes in England and Wales. That’s slightly lower than the 498,000 that exist today, but doesn’t account for the age and state of repair of these homes, many of which were built at least 30 years ago.

Market potential by tenure Comparing supply against need in England and Wales

Source: EAC, Savills Research

Why don’t more people move?

Most people in the UK aged over 65 couldn’t live in specialist housing – the homes simply don’t exist. New retirement housing has been in short supply since the 1980s, with limited government grant and a challenging viability environment for market housing. We explore how changes to planning policy could help boost supply of retirement homes in Measuring the benefits.

In the South, a slower transaction market, high stamp duty, and an inheritance tax regime with generous allowances for property wealth discourage downsizing. In the Midlands and North, low property values mean many don’t have the equity to move.

With that in mind, local authorities face rising health and social care costs with little prospect of more funding from central government. Anything that helps reduce their outgoings should be a welcome development.

As well as reducing costs for government, moving to retirement housing has many benefits for the residents.

.png)

QUALITY OF LIFE

Retirement housing often includes amenities such as gyms, restaurants, hair salons and bars on site. Perhaps most importantly, it brings together like-minded people into a community, reducing loneliness and isolation.

.png)

A CULTURAL SHIFT

Currently, most people only move to retirement housing following a negative event, such as health issues or the death of a spouse. As the retirement living sector develops and its reputation spreads, we might expect to see people moving earlier.

3 other article(s) in this publication