Health and social care cost savings

Retirement homes offer benefits not just to those who live in them, but to the Government, tax payers and the wider market

.png)

Retirement homes offer benefits not just to those who live in them, but to the Government, tax payers and the wider market

Over the past five years, on average, 7,524 new retirement properties have been completed per annum, according to EAC data. Each year’s housing supply generates an annual NHS and social care saving of £8.4-13.9 million. Capitalised into perpetuity, the retirement housing sector generates significant government cost savings of £186-310 million every year – as well as the benefits generated by simply increasing housing supply.

The cost savings, capitalised in perpetuity, amount to £24,700 to £41,100 per retirement property

Savills Research

How savings are made

This type of housing gives relief to services used by elderly residents. The homes are designed for their needs, reducing the number of falls and taking pressure off the NHS. If residents need hospital care, services within retirement communities mean hospitals are able to discharge elderly patients sooner.

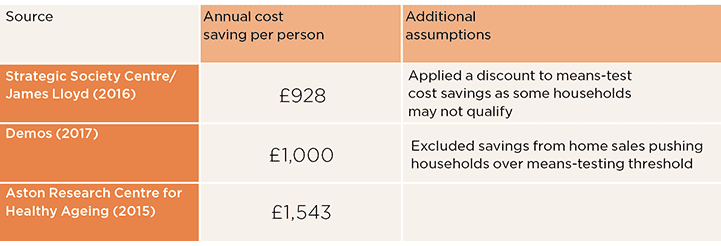

The associated saving varies between £928 and £1,543 per person per year (see table below). Assuming an average occupancy level of 1.2 people per household in retirement accommodation, that is a saving of £1,114-£1,852 per year for each property.

Estimated savings Comparing research into the savings of retirement homes

Source: Savills Research

Looking forward

Planning authorities grant sites permission for retirement development in perpetuity. The savings, capitalised in perpetuity, total £24,747 to £41,147 per retirement property. Even if we assume the homes stay retirement-only for 40 years and receive permission to revert to family homes after that, they still represent a benefit of £20,532 to £34,138 each.

That saving is not currently being reflected in policy.

.png)

Bridging the gap

A 55+ planning consent restricts the market that is able to buy the properties. Generally, restricting your pool of buyers limits the rate at which you can sell, which affects land value. Until now, retirement-housing providers have compensated for this by building higher-specification homes with lots of shared amenities, driving value.

While this premium product meets the needs of a fortunate few affluent households, and sheltered rent meets the needs of those without housing wealth, there’s little choice for households in the middle with limited housing wealth. They find themselves stuck, wanting to move to more suitable housing but unable to find anything that fits their needs.

It doesn’t have to be this way. In the rapidly growing Build to Rent sector, investors agree a covenant with planning authorities to hold the homes in the rental sector in exchange for a deliverable affordable housing contribution.

Retirement-housing developers could off er a similar covenant, restricting the homes to older households and guaranteeing a minimum level of service provision in exchange for land competitive affordable-housing contributions. That will help retirement developers compete with general residential developers on land value while offering homes for the mid-market and adding to overall build-out rates. And the planning authority gets a guarantee that the homes will go to much-needed retirement housing, rather than general sale.

3 other article(s) in this publication