Capacity

Housebuilding levels have increased, but are still below the government’s target to build 300,000 additional homes in England per year by the mid-2020s

.png)

Housebuilding levels have increased, but are still below the government’s target to build 300,000 additional homes in England per year by the mid-2020s

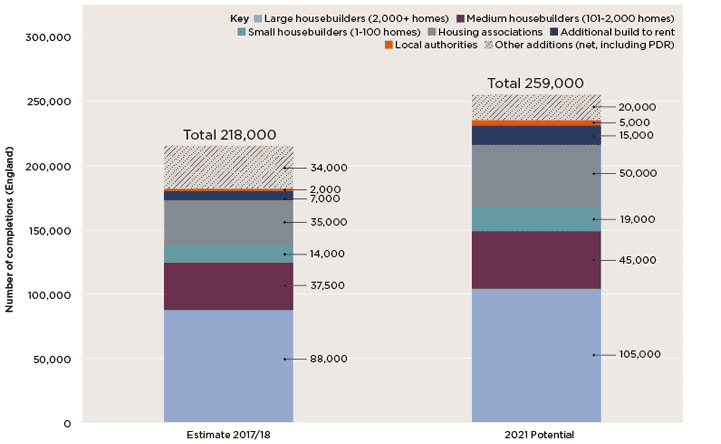

We estimate that 218,000 net additional dwellings have been delivered in England in 2017/18 – similar to the previous year when 217,000 homes were added.

The number of new homes built in England in 2016/17 was 184,000, which, given the plateauing net additional dwellings, is likely to be similar for 2017/18. In the year to March 2018, 6,700 new homes were built in Wales and 17,000 were built in Scotland.

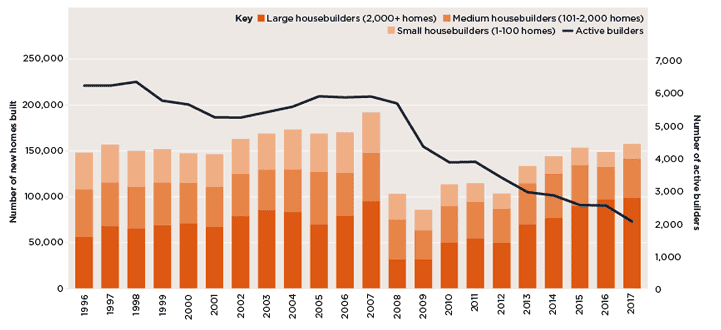

Homes and builders The number of new homes and active builders since 1996 (GB)

Source: NHBC

Large housebuilders

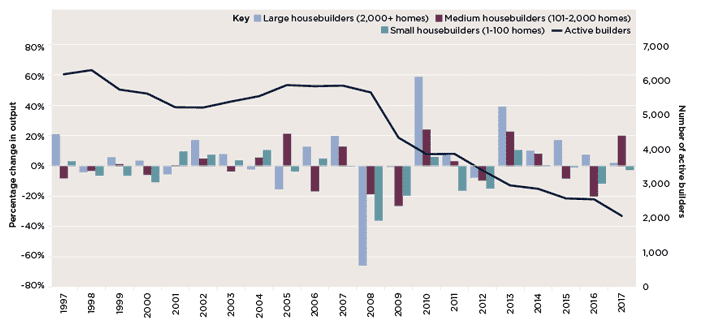

The large housebuilders build the majority of new homes in Great Britain. Those building over 2,000 homes per year built 63% of the new homes built by housebuilders in 2017 according to NHBC. Their output has grown considerably since 2009, exceeding their 2007 levels by 4%. Since 2008, output from this group has grown at an average rate of 9% per year. During the past year, growth has been slightly moderated, averaging 6.1%.

We expect controlled growth, at the current rate of 6% per year on average, to continue for the next three years. We base this on the latest trading updates and annual reports issued by housebuilders.

.png)

Medium housebuilders

Medium-sized housebuilders have recovered more slowly than the large housebuilders and output from this group is still 20% below its 2007 peak. However, they have been building more homes, increasing by 4% per year on average, since 2009, and have also become more active in the land market, suggesting ambition to continue expanding. In 2017, medium-sized housebuilders bought 54% more plots through Savills than in 2015.

While some medium-sized housebuilders may merge or be bought by larger companies, others have been showing significant growth. The smaller ones, in particular, are able to benefit from the Home Building Fund. Therefore, we estimate that their output will continue to grow in line with larger housebuilders at the rate of 6% per year for the next three years.

Small housebuilders

The number of smaller housebuilders has reduced significantly since the global financial crisis. There are 72% fewer of them registered with NHBC and collectively they are building 62% fewer homes than in 2007. Access to finance and relatively higher costs for planning and materials due to a lack of economies of scale have been particular challenges for small housebuilders.

However, the £3 billion Home Building Fund is intended to benefit smaller housebuilders who would otherwise be unable to progress quickly, if at all. The fund has been heavily oversubscribed, however the majority of these funds, as of December 2017, had not yet been fed into the market.

We expect smaller housebuilders to draw down this funding over the next three years, supporting growth over the period of 10% per year. Further support is being directed at this sector with the recent announcement of a £1 billion loan financing fund from Barclays and Homes England.

In 2017, just 13 housebuilders built over 60% of new homes in England. With the Letwin Review calling for a greater number of builders on development sites to help create natural variation in product, we need to see continued support for smaller housebuilders to partner with larger housebuilders on sites.

.png)

Housing associations

Nationally, housing associations built 17% of new homes and have ambitions to increase output. With limited grant, they need to cross subsidise affordable product with development of homes for private sale.

The top 50 housing associations plan to build 43% more homes per year in 2020/21 than they did in 2016/17, reaching 50,000 per year. The eight Strategic Partnerships announced so far by Homes England, with a second wave to come, will help achieve this. The associated increase in scale and flexibility of funding will help this sector meet the demand for affordable housing as well as delivering private homes to cross subsidise the affordable.

The top 50 housing associations plan to build 43% more homes per year in 2020/21 than in 2016/17 – reaching 50,000 per year

Savills Research

The impact of the GFC The percentage change in output for housebuilder type (GB)

Source: Savills Research

Build to rent

The build to rent sector is growing fast, with completions increasing by 50% per year over the last three years. As the sector becomes more established this trend should continue. Around 7,000 new build to rent homes were completed last year and we expect that completions could reach 15,000 by 2021.

.png)

Local authorities

Local authorities built 3,450 new homes in Great Britain last year. In England, the 1,870 new homes built last year by local authorities represented just 1% of supply and has remained at similar levels in the last eight years according to MHCLG. However, in Scotland and Wales, 41% more homes were built by local authorities in 2017/18 than the previous year.

The removal of the HRA borrowing cap in England will enable local authorities to deliver more homes. With prudent long-term planning, we estimate that authorities could release between £10bn and £15bn of extra borrowing capacity. However, many will need to establish a land pipeline and build up construction capacity. We expect local authorities could deliver up to 5,000 homes a year in England by 2021.

Other additions

The total number of homes added to stock each year includes conversions and change of use as well as new build. This other supply has increased by 33% per year over the last three years. Since permitted development rights (PDR) came in, this supply has been equivalent to 24% of the number of new build completions.

Change of use has increased significantly since PDR allowed the conversion of office buildings to residential. However, the supply of this type of home is not unlimited and in many key cities the majority of viable conversions have been made.

Applications for prior approval for permitted development of office to residential in the year to March 2018 have fallen to 60% of what they were three years ago. We expect the decline to feed through in the number of homes completed through change of use over the next three years.

How completions stack up New home completions in 2018 against the potential for 2021

Source: Savills Research

On track to reach 300,000?

In 2017/18, the number of additional homes built in England plateaued, after five years of strong growth since 2013. However, we think that housebuilding will increase to 260,000 a year by 2021, progressing towards the 300,000 goal.

The target should be achievable by the mid-2020s. However, it will require ongoing government support and collaboration to bring together public land and capital and private sector expertise to boost delivery.

2 other article(s) in this publication